The Definitive Guide to Home Office Expense Spreadsheet

Get the Scoop on Home Office Expense Spreadsheet Before You’re Too Late

You must regularly utilize part of your house exclusively for conducting business. In case it applies to the whole residence, you need to allocate the amount between the home office part of your home and the personal use portion. Warning If you use any portion of your house for business, you must adjust the basis of your house for any depreciation that was allowable for its company usage, even when you did not claim it. If you use part of your house for business, you may have the ability to deduct expenses for the company use of your house.

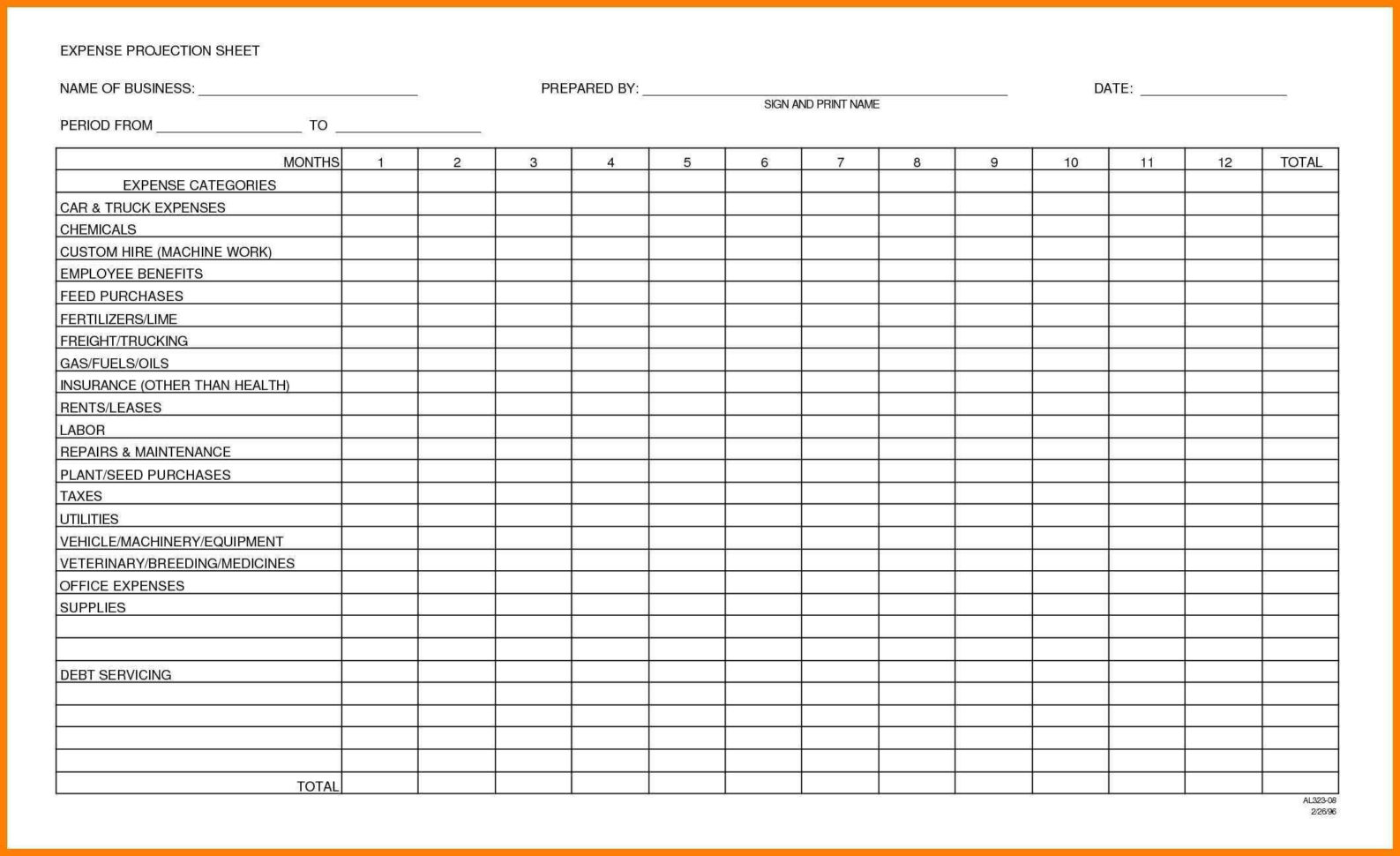

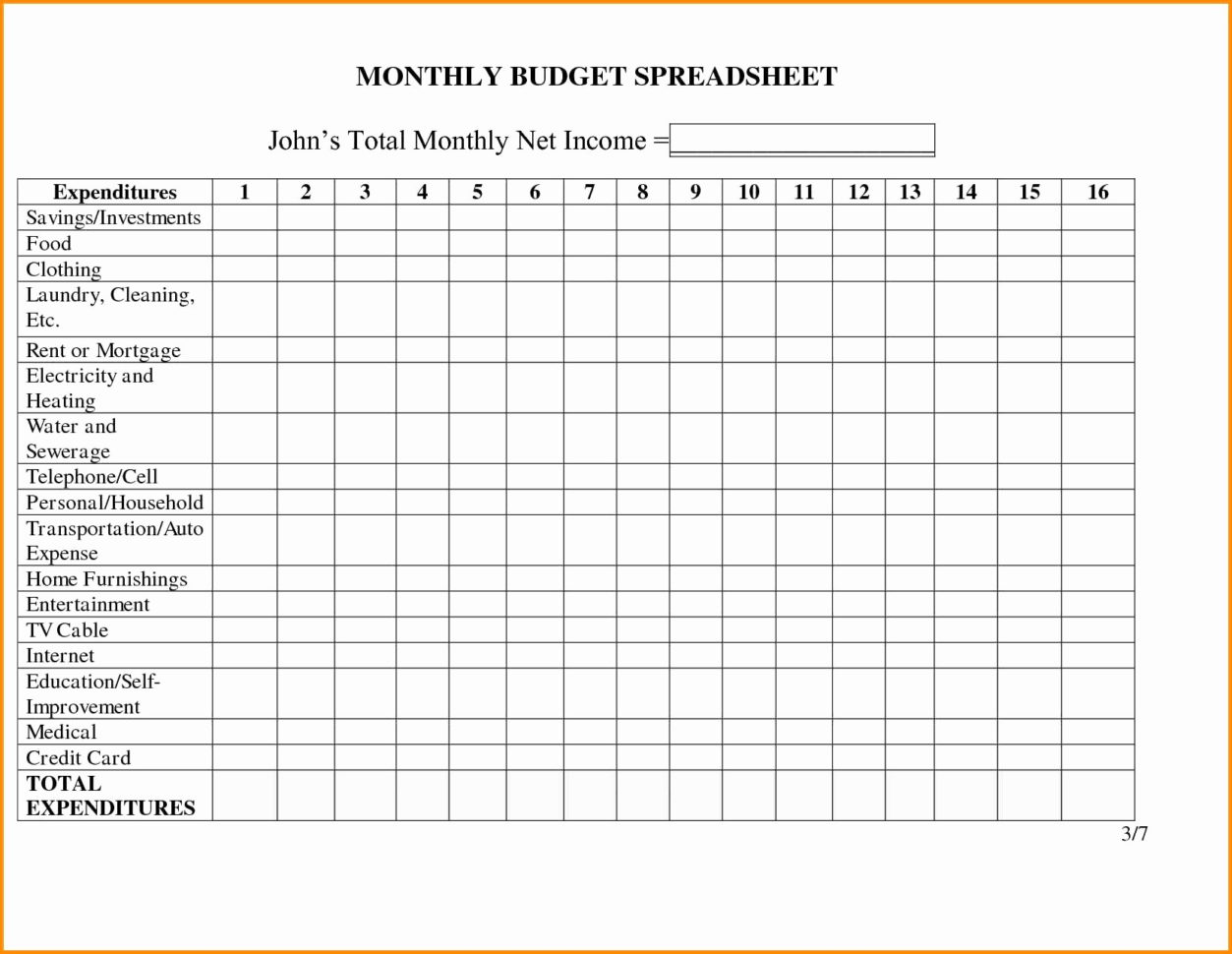

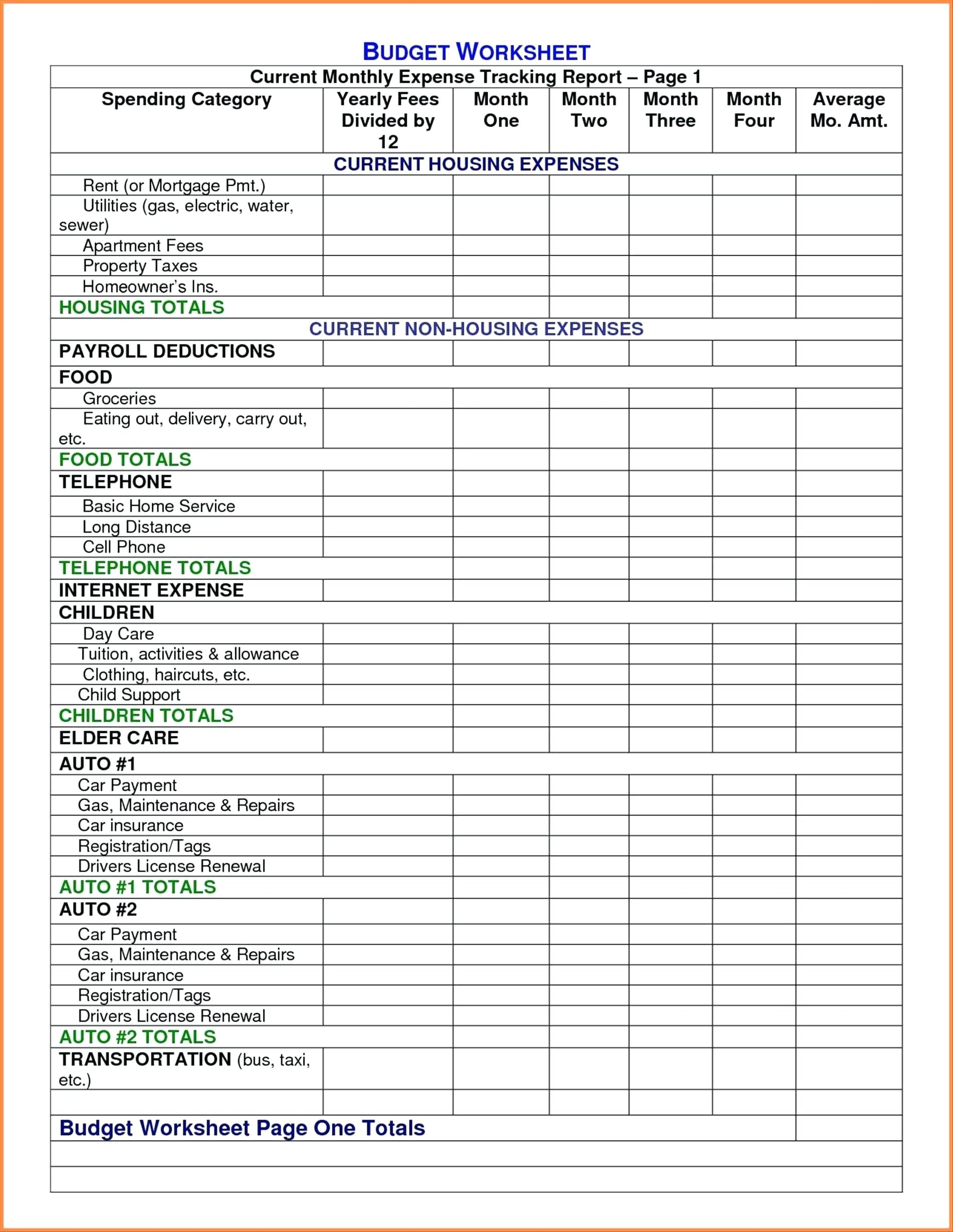

Spreadsheets are often utilised to address data. A expenses spreadsheet might be used in numerous diverse things and a couple of its notable uses are as follows. An extremely straightforward spreadsheet is going to do. There are many sorts of blank spreadsheet on the net. You can also see budget spreadsheet. It’s very straightforward to make a blank budget spreadsheet, because of the easy accessibility to free blank spreadsheet templates which may be downloaded at no charge from several sites on the internet. Business Excel might be used for business too, besides job administration.

An office may have a good deal of furniture for many unique purposes. A home office is part of the house which is used exclusively on a normal basis for business. To begin with, compute the quantity of loss that you’d be permitted to deduct whether the office wasn’t employed for business, employing the $100 and 10-percent-of-AGI thresholds described above. The office or workshop space used should be the principalplace from which the company is run and it should be used regularly.

You would like a deduction for it. If you are eligible for the home office deduction, you might claim some of particular types of expenses which are usually not deductible by the typical homeowner. If it’s possible to claim the home office deduction, then it’s possible to deduct a part of your repairs. The home office deduction cannot be utilised to create a loss or to boost a loss. Typically, deductions for a house office are based on the proportion of your home devoted to business usage. The home office deduction is figured dependent on the proportion of the work area to the entire field of the home. If you truly get stuck, don’t be scared to employ a great tax professional for aid.

A couple of your expenses may be included in figuring the buy price of products sold. In that perspective, you ought to be making certain your expenses will align with your preferred strategies and strategies in order to reach long-term improvement. If you anticipate deducting actual expenditures, keep thorough records of all of the business expenses you believe you’ll deduct, like receipts for equipment purchases, electric accounts, utility bills and repairs. Direct expenses are totally deductible. Indirect expenses like rent, insurance, and utilities are deductible depending on the business use proportion of the house office. You may also deduct the price of bringing another phone line in your home, if you employ the line exclusively for business. Alternatively, you can recover the price of the business proportion of the house through depreciation deductions.

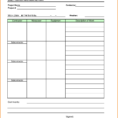

Sample for Home Office Expense Spreadsheet