A home mortgage amortization spreadsheet is used by many financial institutions, banks and credit unions to determine how much of a loan the mortgagor will have to pay. Amortization is the process of paying off a mortgage loan over a period of time, generally 10 years or more. By subtracting the principal from the amount owed, a monthly payment is calculated.

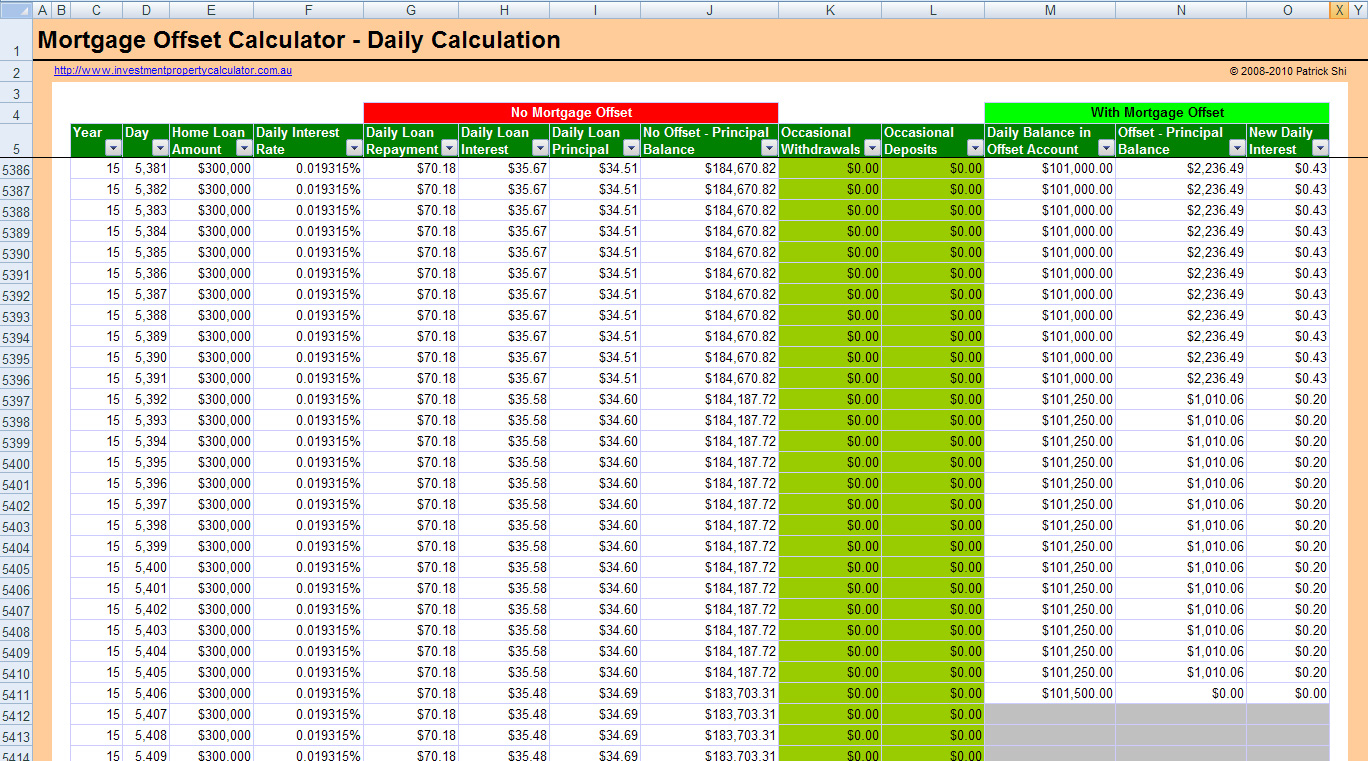

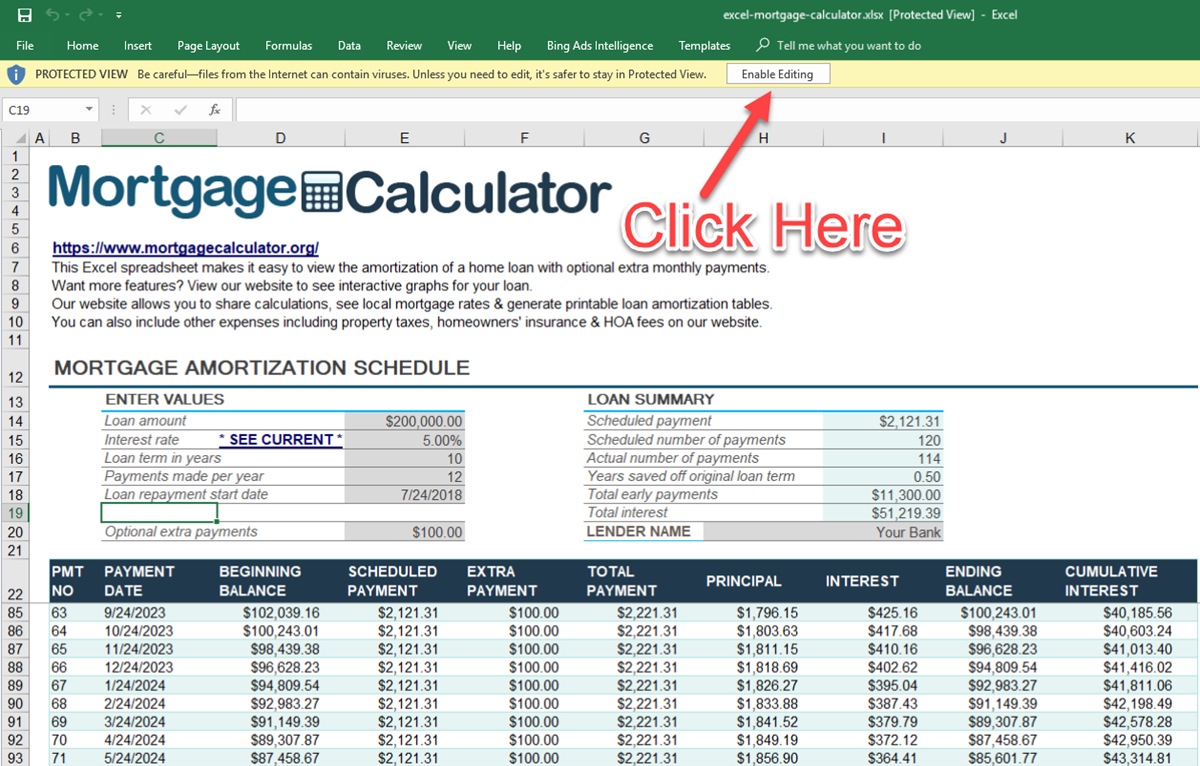

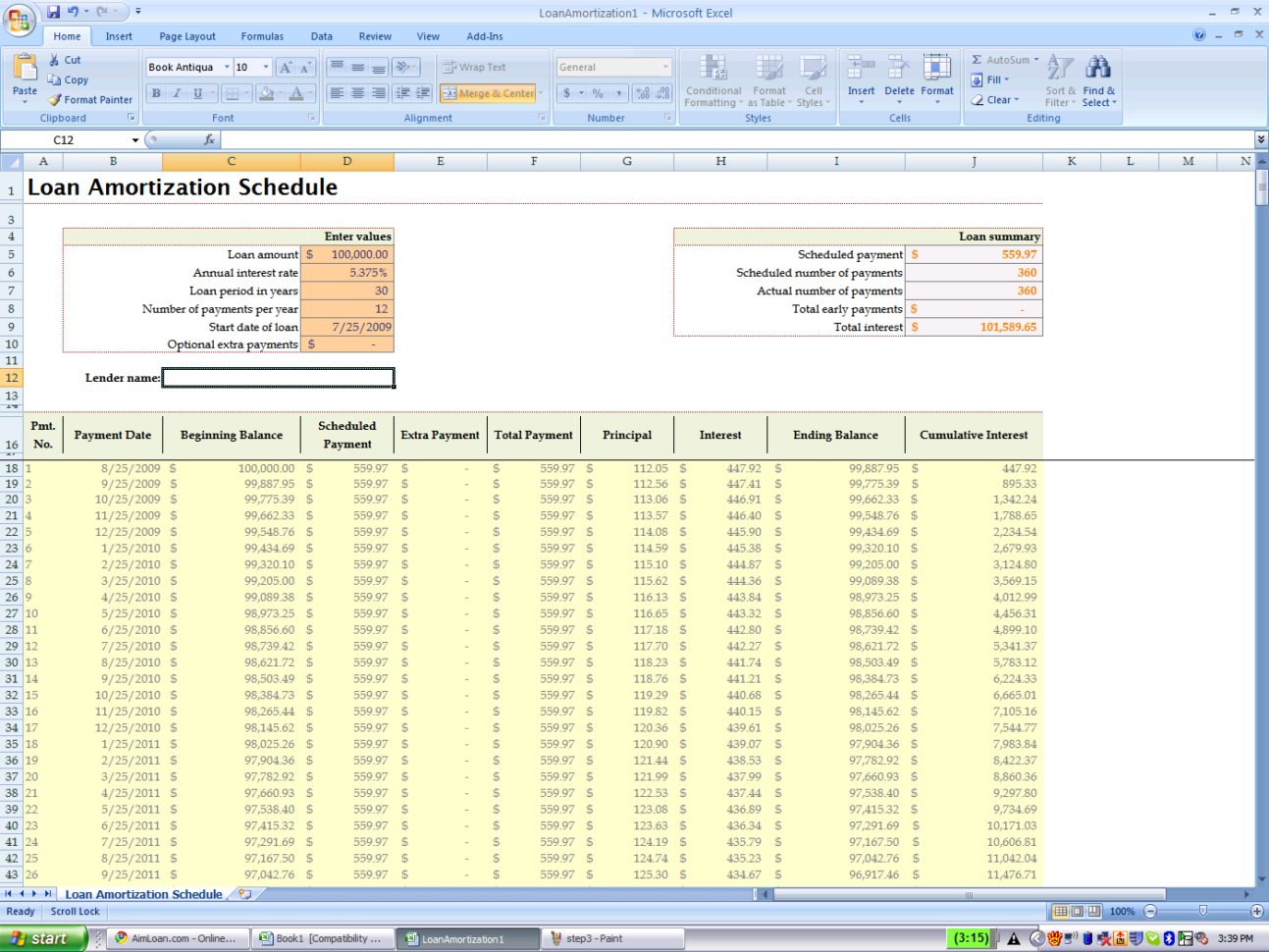

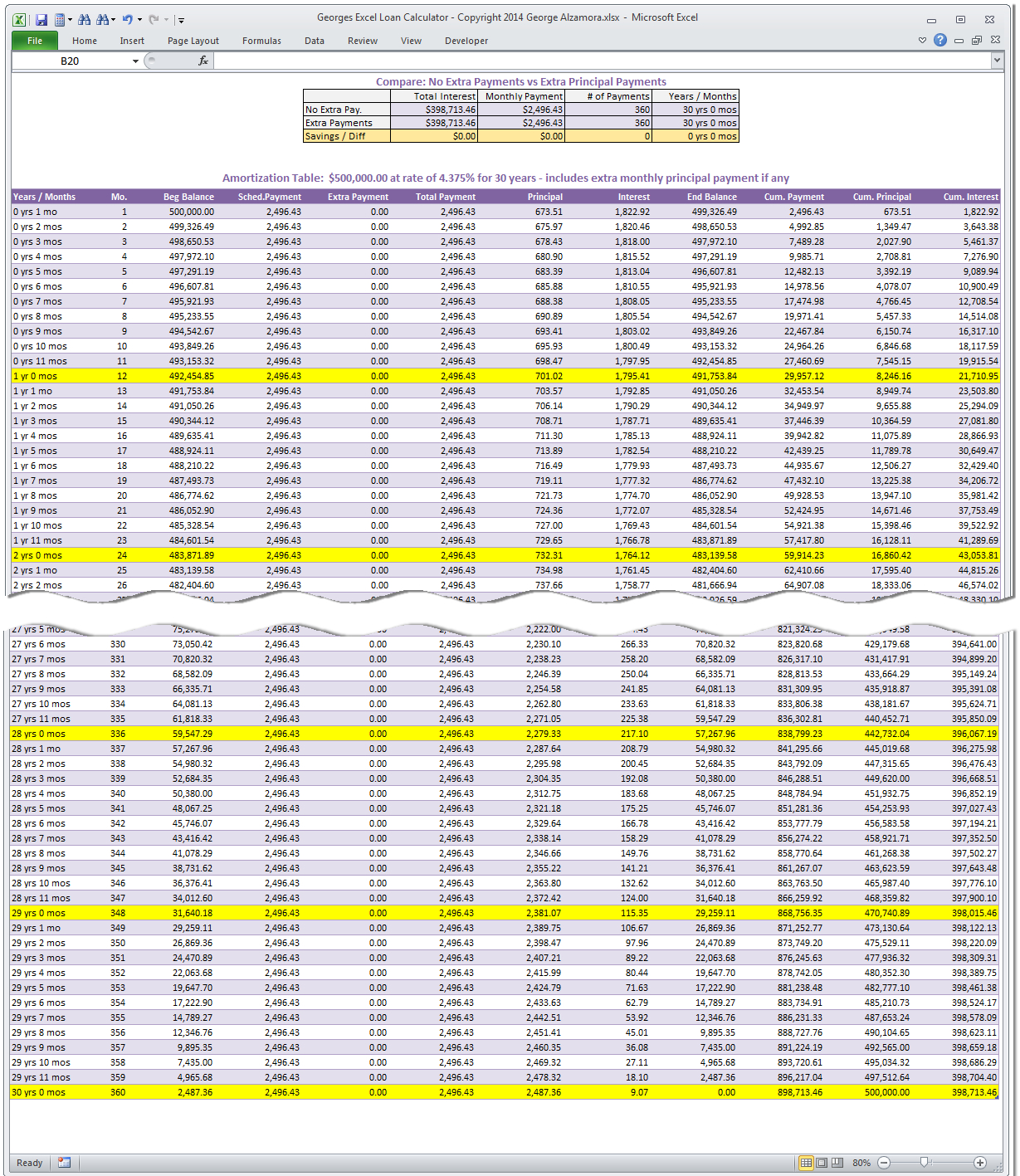

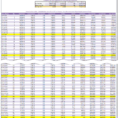

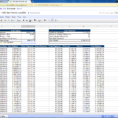

A home mortgage amortization spreadsheet works the same way as an ordinary spreadsheet, except it only needs the financial information from the first loan. The use of a mortgage amortization spreadsheet makes it easier for anyone to see the bigger picture. To help you understand the math involved in the amortization process, the spreadsheet includes columns for the loan amount, amortization periods, interest rates, discount rates and monthly payments.

The mortgage amortization spreadsheet starts with the beginning of the amortization. The amortization period begins once the borrower’s obligation is secured. The most common example of this would be purchasing a home.

Home Mortgage Amortization Sheets

A mortgage amortization sheet displays monthly payments in relation to the total amount owed on the mortgage. The size of the payment is relative to the total debt owed. A spreadsheet can also be used to calculate the amortization period based on the amount of interest paid.

The beginning of the amortization stage is when the monthly payments are computed and totaled. This results in a basic amortization sheet with the beginning of each payment. After this stage is complete, it is important to know what type of amortization is being used and the reason for the conversion.

The simplest and most common amortization process uses a simple amortization formula. This spreadsheet shows the income of the borrower and subtracts it from the remaining payment, which is the amount owed. Then, all remaining payments are multiplied by ten. This results in a monthly payment.

A reverse amortization method requires that the sum of the interest payments be subtracted from the loan balance before any additional interest is added. The main advantage of this amortization process is that the monthly payment is less. It also means that the overall debt is reduced over time.

The next stage in the amortization process is the beginning of the amortization period. This stage is shown in a table and is usually referred to as the time period. This period begins after the final payment is made to the bank and is used to figure out how much more money needs to be paid in order to reach the balance owed.

This figure is the total of the interest payments, the lump sum of the principal and any monthly fees. The lump sum is the amount of money that is owed to the bank on the loan.

Interest rates, discount rates and other variables are the factors that affect the amount of money that is needed to pay off the debt. This amortization sheet also contains a column for the name of the borrower and whether or not the debtor is the owner of the property.

Once the amortization process is completed, the next time period is shown in the same spreadsheet. This period is used to show how much more money is needed to pay off the debt.

As you can see, amortization is used extensively by companies and institutions to determine the overall cost of a loan. It is also used to show how much money is actually owed and therefore how much the borrower will be responsible for paying. A mortgage amortization spreadsheet is a useful tool for the financial markets. READ ALSO : home food inventory spreadsheet

Sample for Home Mortgage Amortization Spreadsheet