Know What Gurus are Saying About Heloc Spreadsheet

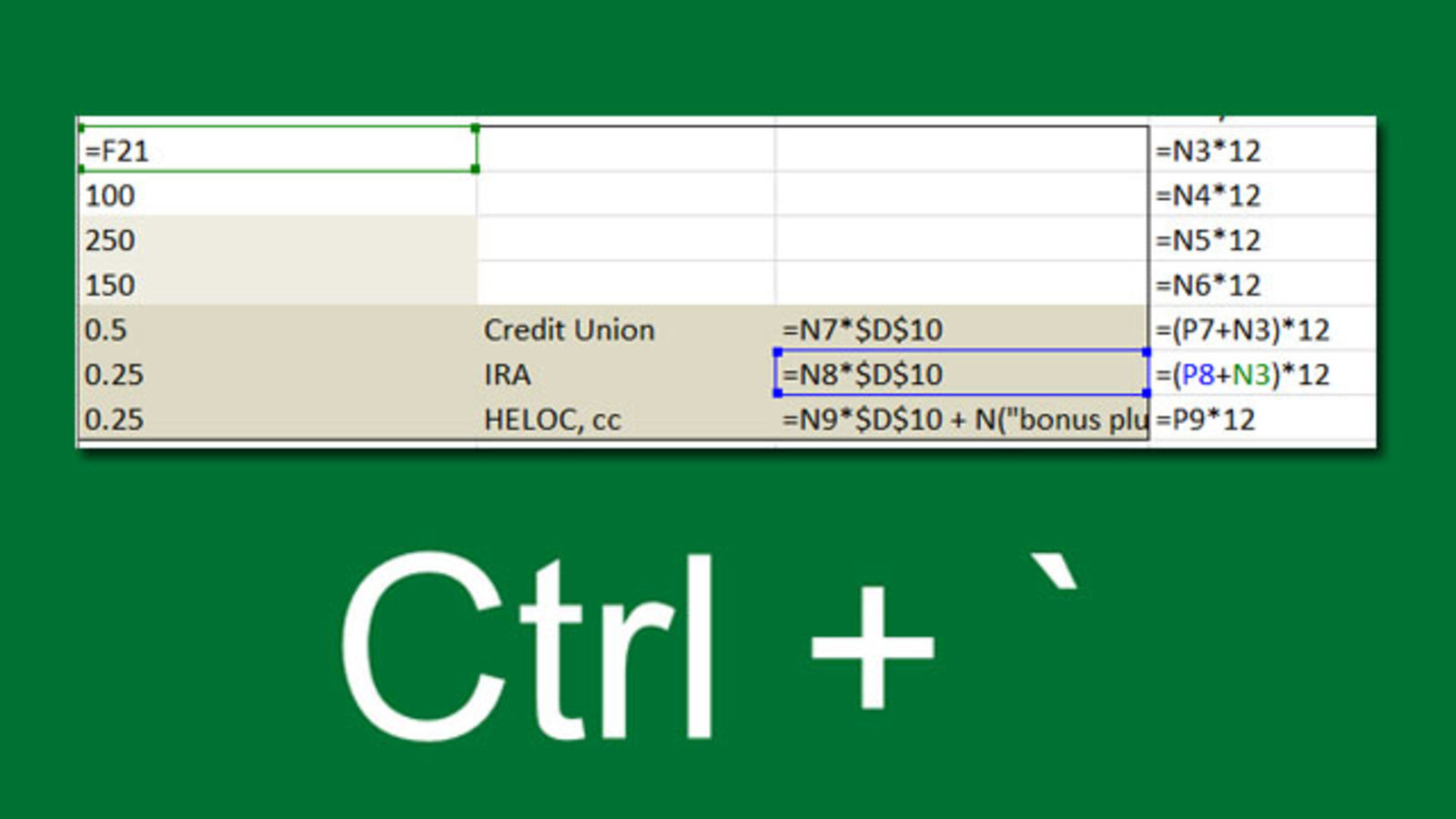

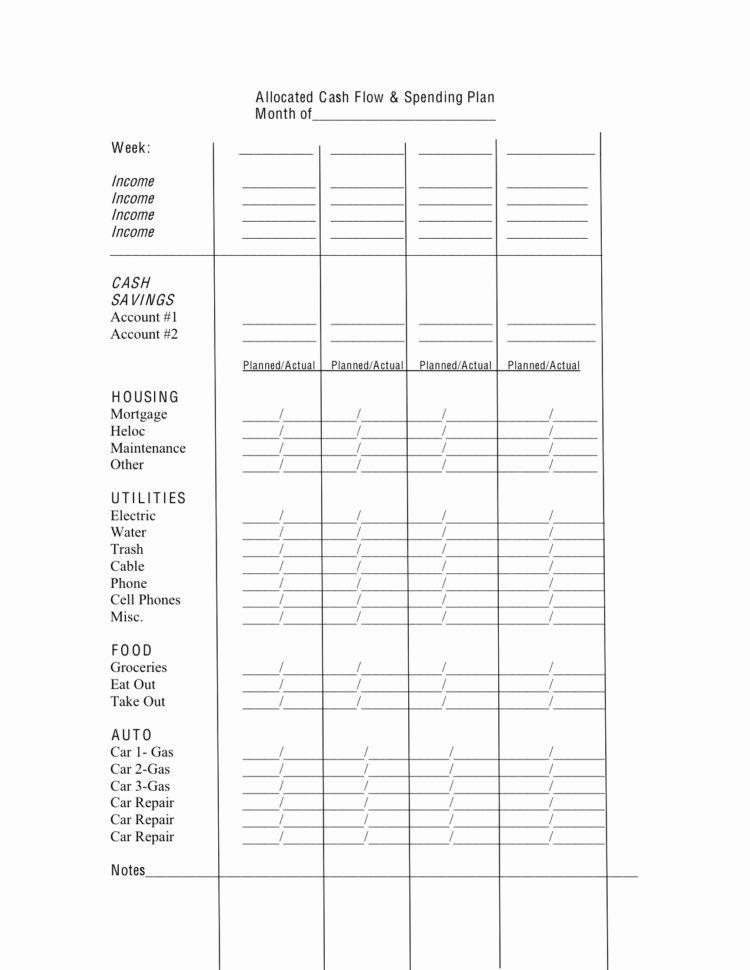

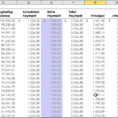

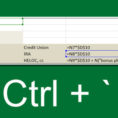

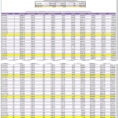

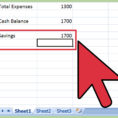

If you prefer to use the spreadsheet, then you will have to click enable content. The spreadsheet includes several worksheets. Additionally, a downloadable… Spreadsheets might even be employed to make tournament brackets. Excel spreadsheets and Access tables enable you to customize the way… If you’re utilized to Excel, the cell editing system may look somewhat slow and much less intuitive because you need to use the mouse as a means to get to… Two spreadsheets are easily offered.

Whenever you choose to borrow money whether it’s to pay the bills or purchase a luxury item make sure that you fully grasp the agreement fully. With a VA-backed mortgage, money does not arrive straight from the administration. It’s most likely you will receive a tiny money back from the excess interest you paid.

Heloc Spreadsheet – the Conspiracy

The more you may put toward your debts every month, the faster you’re likely to be in a position to pay all of them off. Having too much debt seems to be an issue a good deal of… An awesome strategy will provide an exceptional road map for success. Utilizing debt as a portion of any strategy is similar to playing with fire.

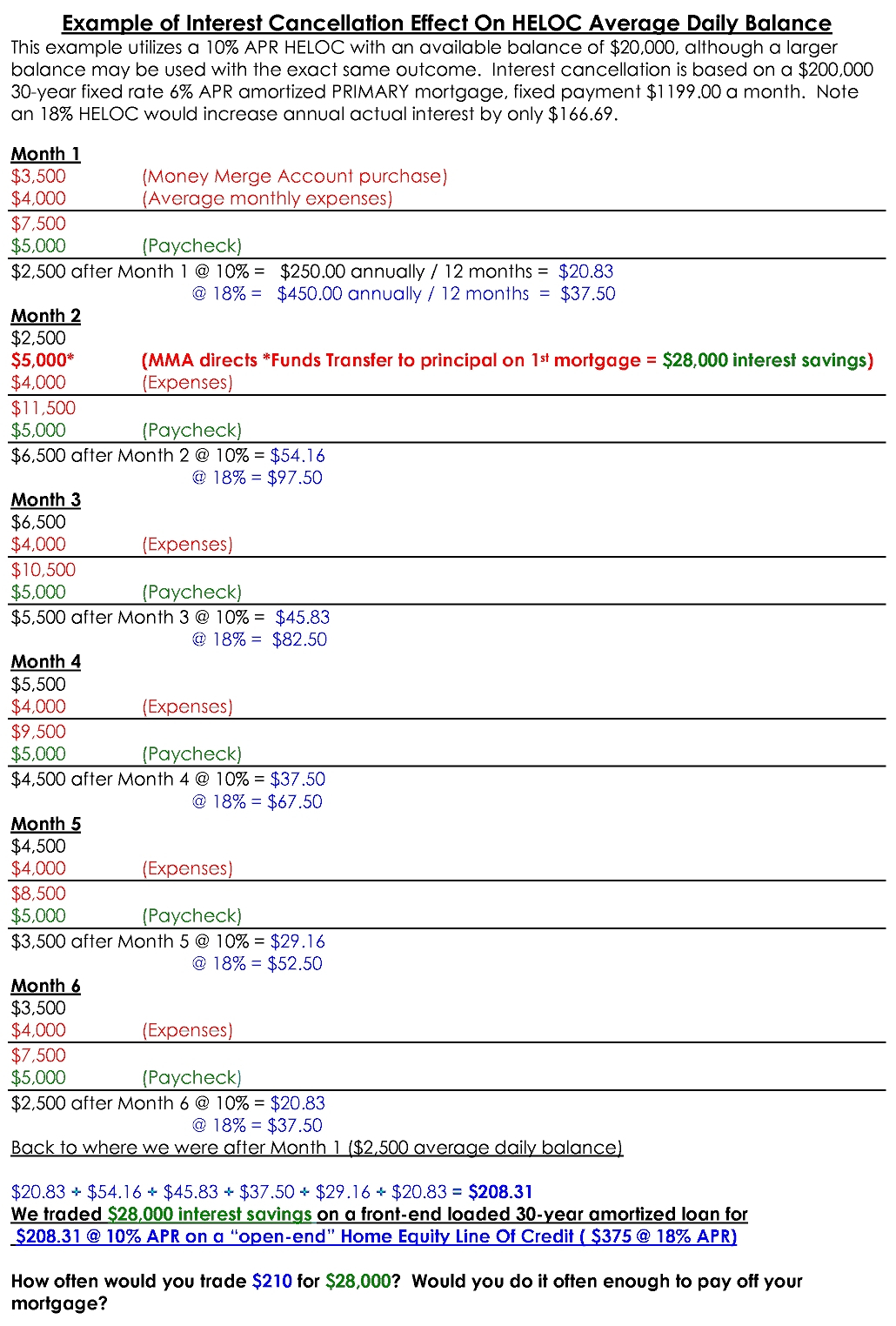

If you’re a lender looking for a means to track a credit line, you can try out the Line of Credit Tracker. Although meant mainly for use for a HELOC calculator, it was created to simulate a general revolving credit line. A home equity credit line (HELOC) enables you to pull funds out as needed.

Ideas, Formulas and Shortcuts for Heloc Spreadsheet

The price of flipping can’t be separated by a very simple formula, nor is there a universal equation that will address all your expense difficulties. The great thing is that you aren’t going to be burdened with the extra expenses of hiring someone that will help you out. It’s well worth noting, however, that while the individual costs might be tough to account for, there are broader expenses that could produce the job of estimating a rehab deal a great deal more manageable. There are in reality several costs investors must take into account if buying a house.

The Key to Successful Heloc Spreadsheet

If you by chance have an interest-only loan or a different form of non-amortizing loan, you don’t build equity in exactly the same way. Federally funded financial loans are better, as they typically arrive with lower rates of interest and more borrower-friendly repayment stipulations. A consolidated loan is intended to simplify your finances. Consolidated loans are usually in the shape of second mortgages or private loans.

What Is So Fascinating About Heloc Spreadsheet?

A whole lot of folks recommend never repaying your mortgage, especially your main mortgage, as you can produce more money investing in the stock exchange or other investments. The way of repaying your mortgage early employing a HELOC is more than a small complicated. Now that the mortgage is repaid, I plan on aggressively raising cash for the remainder of the year. A conventional mortgage is where you get a 30-year amortization schedule in which you make payments in the exact same amount for 30 decades and all the interest is paid upfront. Refinancing a present mortgage to a lower rate of interest rate can spare a bundle.

Sample for Heloc Spreadsheet