Health insurance comparison spreadsheet template can be a lifesaver for business owners. When the economic state of the world’s economies is in question, the first thing to go is the price of healthcare. The financial situation that will dictate whether your employees get the healthcare coverage they need will vary from one country to another.

When choosing an insurance company, it would be smart to know the rates and prices of their health insurance policy before getting a quote. Most companies today want their customers to return for a renewal and are willing to offer their customers more for lower prices.

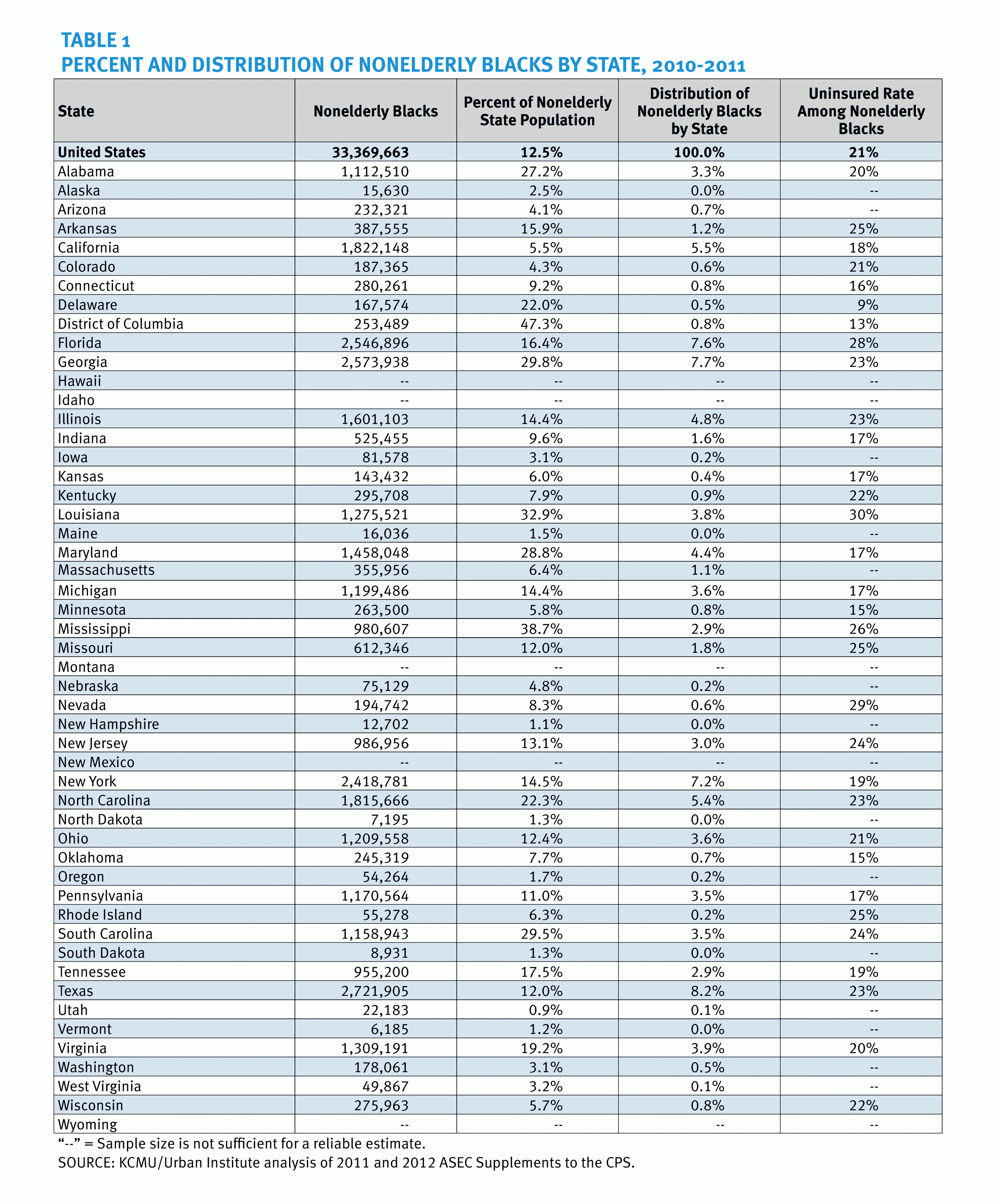

Make sure that you have a general idea of the medical condition of your employees before you approach the insurance company with the request for their quotes. By knowing the medical history of your company, you will be able to distinguish the companies offering the most competitive premiums for the insurance of your employees.

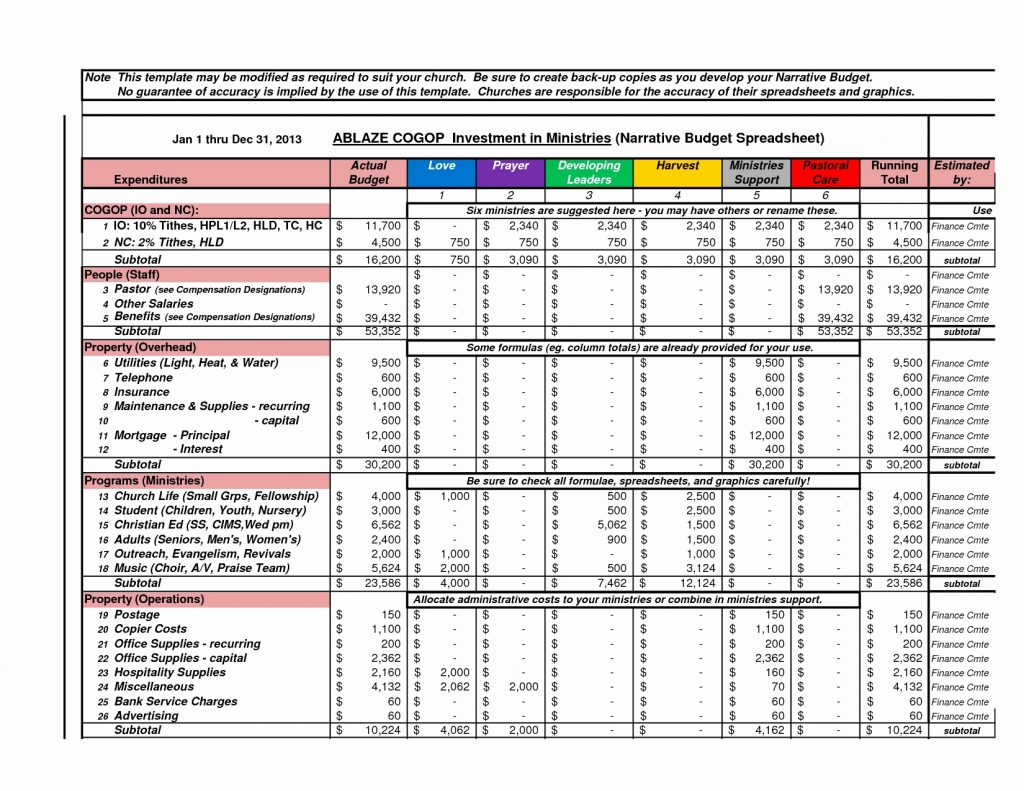

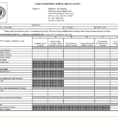

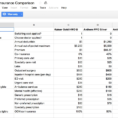

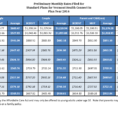

Health Insurance Comparison SpreadsheetTemplate – Your Guide to Getting Lower Rates

When obtaining the quotes, the company should explain the terms and conditions of the health insurance. Most companies would like to include a standard dental coverage and vision coverage in the coverage they provide to employees, however there are some companies that only pay for those benefits if the employees themselves decide to take care of the claims.

The health insurance should also specify what percentage of the premiums should be covered for medical claims made by employees. Some insurance companies may require a medical exam before they will approve the medical claims of their employees, while other companies may require their employees to be examined before they start receiving the medical benefits.

In order to use a health insurance comparison spreadsheet template, you will need to first get in touch with several insurance companies. Make sure that you talk to the professionals who handle your insurance claims to ensure that they will provide you with honest and accurate quotes.

Ifyou do not find the lowest prices at the time you need to apply for the quotes, you can always wait until you have gathered a larger list of insurance companies and then compare the prices of the quotes from each company. You can also use these methods to gather quotes from other companies or even others, if you find a better deal.

There are also quotes that can be used by multiple companies. While you are comparing the quotes, you will want to keep an eye on how many insurance companies are providing quotes for their specific types of insurance, because when you apply for a quote with just one company, it may not be worth your while to change to another company later on down the road.

It may be beneficial to look into the different types of insurance that each company offers, such as health care insurance, dental insurance, and vision insurance. Depending on your needs, you can determine which plan is best for you and then compare the quotes between the insurance companies.

When you are comparing the quotes, it is important to ask about the costs of deductibles for the medical condition, what type of medications are covered by the company, as well as any coverage for emergency treatment. As a business owner, you should also ask about coverage for pre-existing conditions, which some companies may not cover.

What is more important to your business is that you protect your employees from any medical condition that can be life threatening. Of course, a small business owner can insure their staff through their own insurance plan, but if you are a business owner with employees, this is probably not a good option.

By using a health insurance comparison spreadsheet template, you can save yourself a lot of headache when it comes to comparing the insurance quotes. It will take some work and some research to get the best quotes, but it is worth it to protect your employees and your own finances. SEE ALSO : health and safety excel spreadsheet

Sample for Health Insurance Comparison Spreadsheet Template