A Easy Tip About Get out of Debt Budget Spreadsheet Revealed

For each approach, you can observe how much time it will take to pay off your debt and how much interest you’ll be able to save utilizing each technique. Now, there isn’t one method to escape debt, and the ideal program ought to be tailored to every individual’s individual circumstance. Charge card debt may also be a number of the toughest to pay down.

Most important things in regards to eliminating debt is having or preparing a very good monthly budget template. Paying off debt isn’t an easy undertaking! Now, if you’re wanting to save while you’re paying off the debt, then you’ve got to work out how much you’re comfortable paying toward debt without restricting your capacity to live a joyful life. Being debt free is a significant step towards financial freedom as it ensures that you’re not bugged down by unnecessary periodical repayments. Whenever your first debt is totally paid, the rest of your snowball is subsequently applied to the NEXT debt, and so forth, until all the debts are paid. The very first debt I wish to tackle is my Target Credit Card as it has the maximum rate of interest.

Okay, which means you have your debt together. It’s not enough to just consider why you want to escape debt. Paying off debt is not a simple job! So now you know the 2 most typical techniques to prioritize your debt, I’ll tell you I believe the best method to pay down debt is by employing the Avalanche Method. As everyone probably knows, you won’t ever escape debt if you merely pay the minimum balance each month and you’ll never have the ability to pay extra if you don’t have money remaining at the close of the month. If you would like to eliminate debt, blindly making the minimum payment as you don’t understand where to start is among the worst things you can do. Too many people today aren’t sure about the way to get assistance with credit card debt.

How to Choose Get out of Debt Budget Spreadsheet

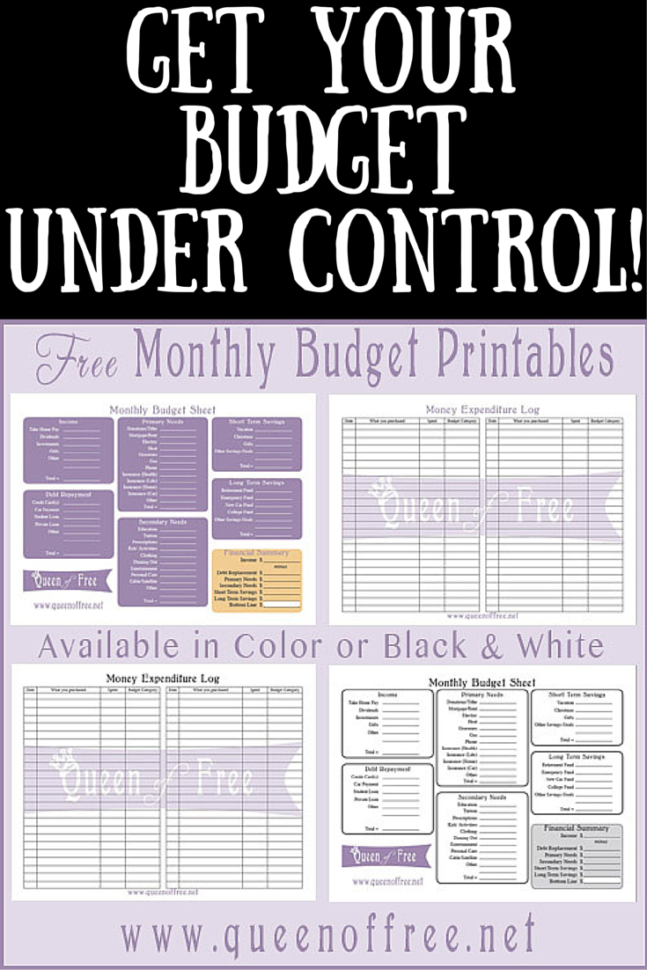

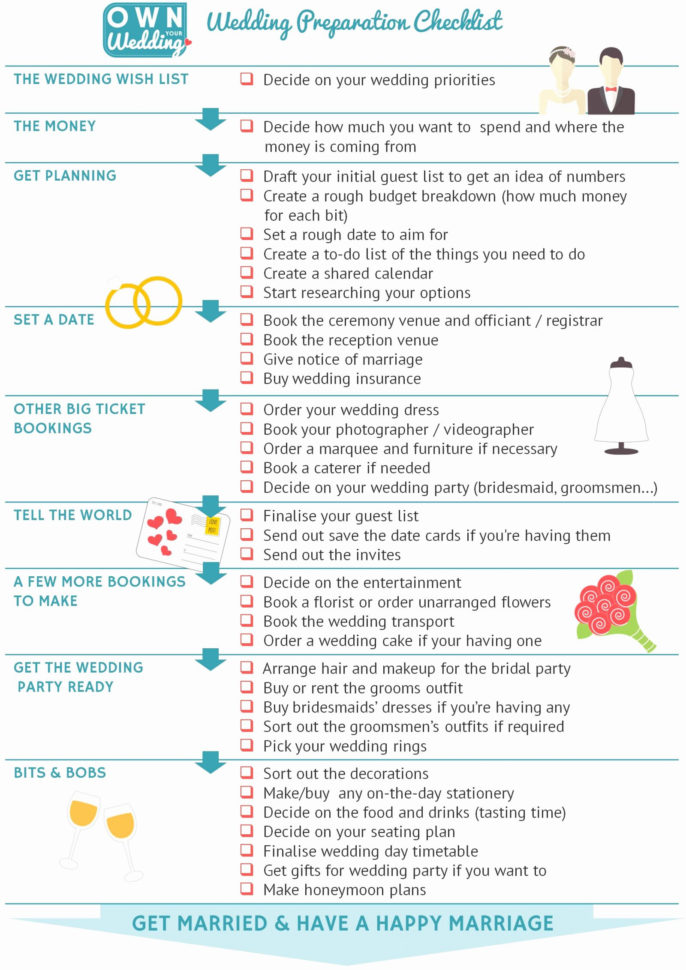

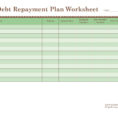

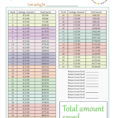

If you’re making a budget for a part of a debt reduction plan to aid you in getting out of debt, then it’s also feasible to download our debt repayment worksheet to aid you to set up debt repayment targets. You know a budget has to be made by you. Developing a family budget isn’t always the simplest thing on the planet to do, but if you are likely to become out of debt or save for your very first home it is needed. Nobody likes to consider downsizing, but if you’d like a true workable family budget, you might have no decision.

The more you’re able to squeeze out of your budget to improve your debt snowball, the faster you are going to achieve your objectives. The budget enables you to make financial decisions in advance, which makes it less difficult to cover all your expenses throughout the year. Everyone is able to establish a personal budget.

When researching private finance and the very best approach to control your cash the very first step is definitely to earn a budget. Preparing a budget is a straightforward practice. You may create a monthly or a yearly budget. Then it can feel as though your budget is off track as you attempt to escape debt. Creating a budget by means of a template will be able to help you to feel in control of your finances and allow you to conserve money for your targets.

The 30-Second Trick for Get out of Debt Budget Spreadsheet

There are two important facts you should understand before you begin to budget properly. One of the absolute most important things associated with financial freedom is the ability to remove debt. One of the absolute most important things connected to financial freedom is the capacity to eradicate debt. A lot of people balk at the notion of budgeting. To get an incredible budget, you are want to procure an accurate idea of precisely how much cash spent to month.

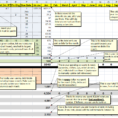

If you were able to effectively identify what many folks want and are eager to pay for, and is able to make your spreadsheet easily accessible, you might be cashing checks for the remainder of your life. The spreadsheet can be found on the FDIC site. A winning spreadsheet could turn you into a fortune. So you’ve got what it requires to create spreadsheets that others would discover useful. It’s possible that you name your spreadsheet whatever you would like. From our example, you can add a few things you might need to finish your spreadsheet. Instead, it supplies pre-built budget spreadsheets that enable users to rapidly organize their finances for certain targets.

The Honest to Goodness Truth on Get out of Debt Budget Spreadsheet

Getting out of debt doesn’t need to be as daunting as you may have thought. It doesn’t need to be as daunting as you could have believed. It is not easy, but with a good plan and firm determination, it is entirely possible.

Sample for Get Out Of Debt Budget Spreadsheet