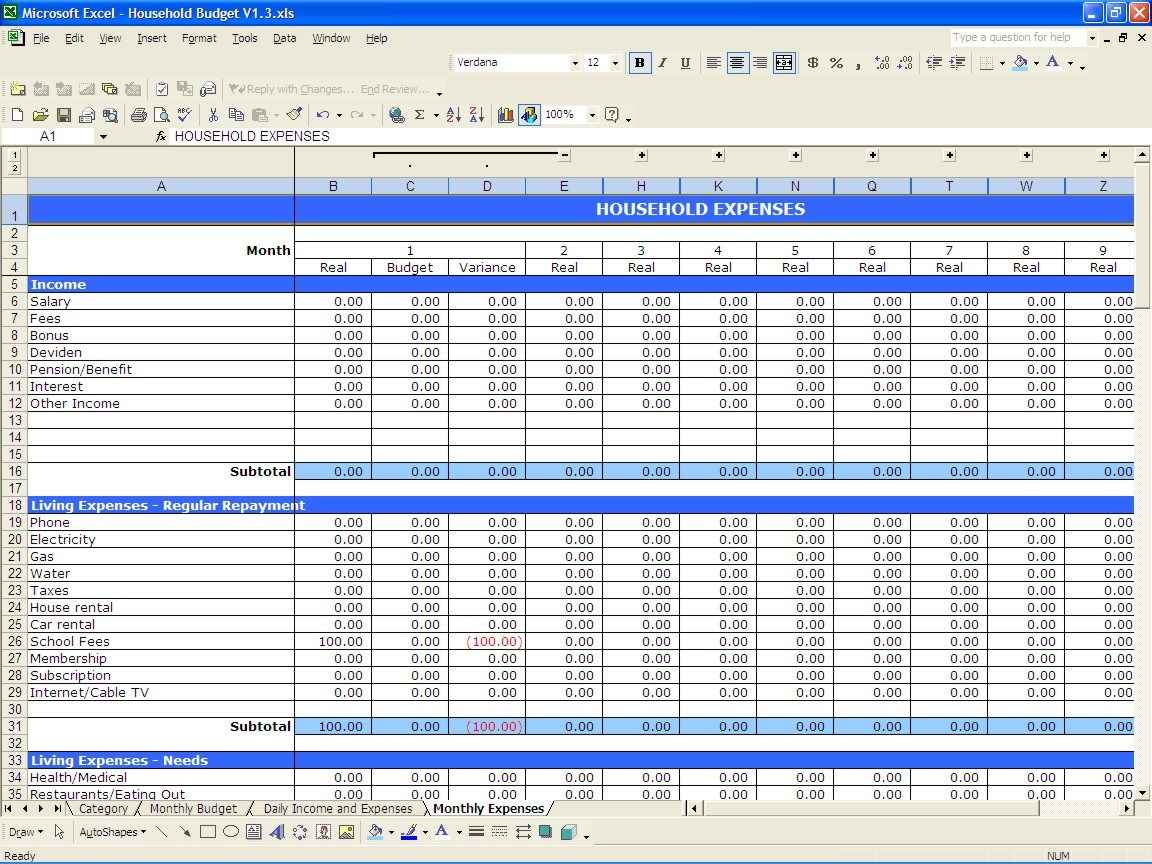

Doing the fundamental course in excel will not offer you any good if you’re not an absolute beginner. You might also amend knowledge once a while if needed. If your company grows, and if you opt to let it grow, you may want to seek the assistance of other people to assist, particularly with earnings. If you are running a business, if this is a home woodworking company or another sort of company, you have to learn how to calculate all your operating expenses. Up until then utilizing a very simple spreadsheet template served my organization accounting needs for more than decades.

Free Income And Expense Spreadsheet With Regard To Free Income And Expenses Spreadsheet Small Business Uploaded by Adam A. Kline on Wednesday, January 23rd, 2019 in category 1 Update, Download.

See also Free Income And Expense Spreadsheet Pertaining To Free Rental Income And Expense Spreadsheet Template Monthly Simple from 1 Update, Download Topic.

Here we have another image Free Income And Expense Spreadsheet With Regard To Free Business Expense Spreadsheet Invoice Template Excel For Small featured under Free Income And Expense Spreadsheet With Regard To Free Income And Expenses Spreadsheet Small Business. We hope you enjoyed it and if you want to download the pictures in high quality, simply right click the image and choose "Save As". Thanks for reading Free Income And Expense Spreadsheet With Regard To Free Income And Expenses Spreadsheet Small Business.