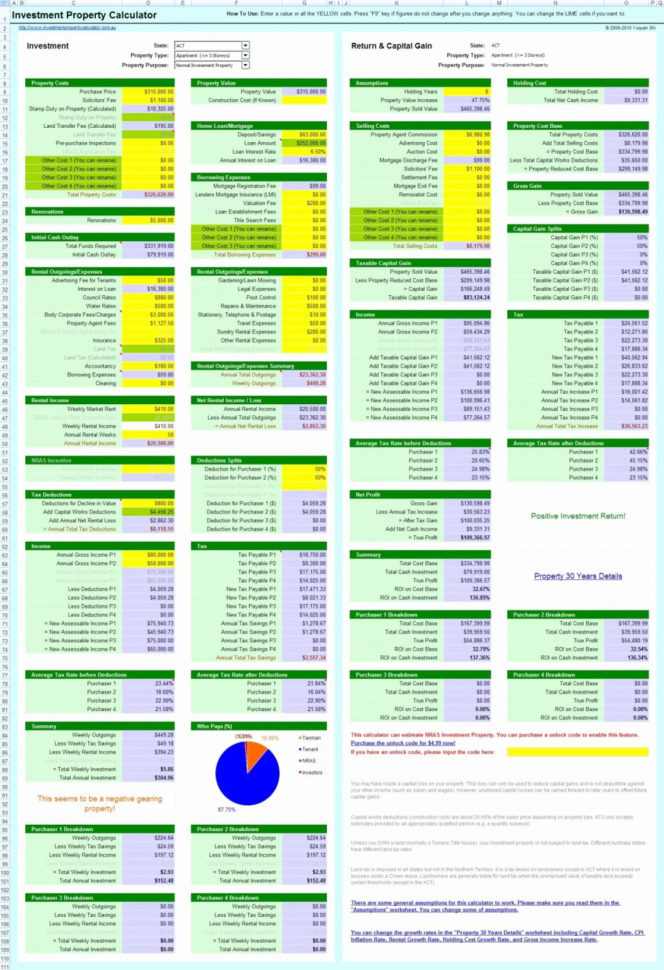

The Forex Risk Management Spreadsheet is just one of the many tools available in the Forex market. These tools can be used to track, chart and strategize all types of market movements.

You can create a spreadsheet that tracks and graphs of your own data. You can also use the spreadsheet to provide an analysis of what’s going on in the market and whether or not it is a good idea to make an investment in a particular commodity.

A spreadsheet can be just as useful at a trade show, as it is when you are holding the piece of paper in front of a stockbroker. There are many people who need this type of analysis before they make a trading decision. If you are new to trading, a spreadsheet can be a great place to start.

Using a Forex Risk Management Spreadsheet

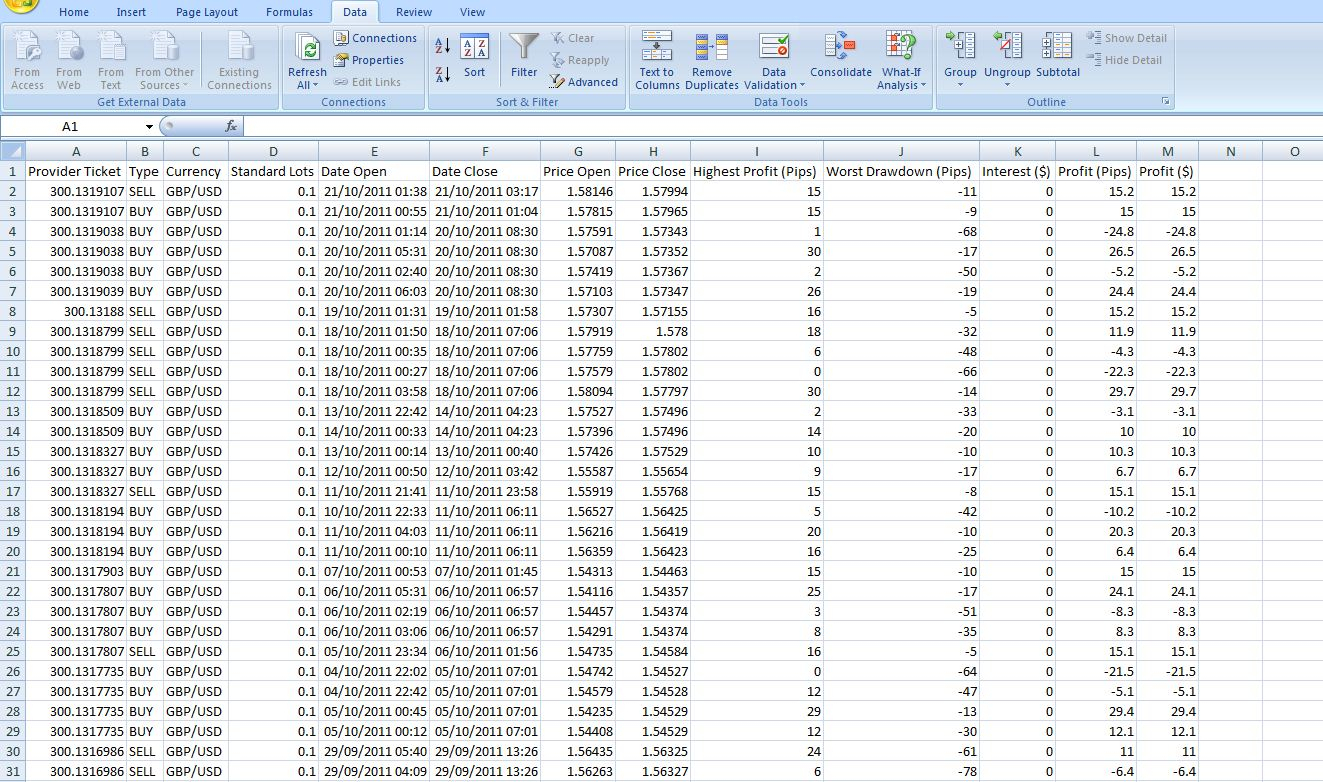

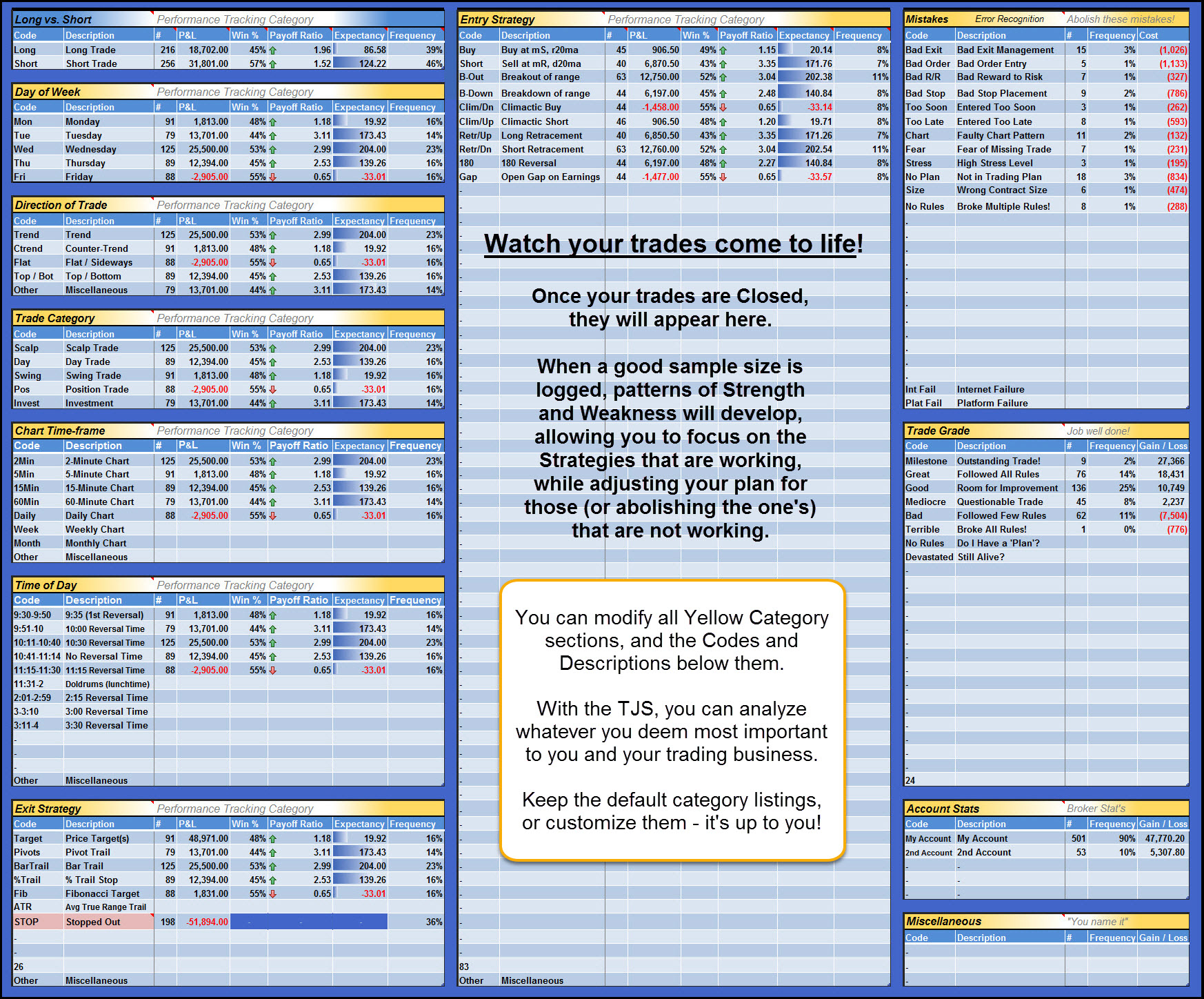

There are many different reasons that a risk management spreadsheet is needed. They can be used in a variety of different ways. The most common use for this type of spreadsheet is tracking the performance of individual traders in a system.

A risk management spreadsheet can provide quick insight into a trader’s behavior and how he or she performs during certain times of the day. It can also be used to track daily performance. Since so much of the Forex market is done online, the computer screen is a great way to track market activities.

Traders now are more analytical than ever before. Because of this, they can use a spreadsheet to track and analyze many different aspects of their business. They can also use a risk management spreadsheet to track their risk levels. It is a proven fact that the more a trader is able to manage his risk the better chance they have of making money.

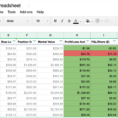

A risk management spreadsheet is not just a type of easy to use tool. They are also great tools to learn a lot about how the Forex market works. With one or two of these tools, a trader will be able to make decisions based on their overall risk levels.

Nowadays, a lot of traders work with systems that are designed to help them determine their position in the market. This can either be based on the current trend, the current market value or a combination of both.

One of the best features of a risk management spreadsheet is that they do not need a trader to manually enter all of the information that needs to be entered. Instead, the system provides a nice user interface and will automatically read the information from the selected columns.

A huge benefit of using a spreadsheet to track market performance is that it allows a trader to keep track of all of the data that he or she needs. This information can include things like historical price action and charts.

An important aspect of managing risk is being able to identify trends. Since so much of the market is done online, a spreadsheet can help a trader to see patterns in price movement. With that information, a trader can then know whether or not a trade is worth taking.

The Forex market is full of a lot of different factors that all need to be managed. If you want to increase your chances of success in this market, a risk management spreadsheet is a great way to start. YOU MUST LOOK : forex money management spreadsheet

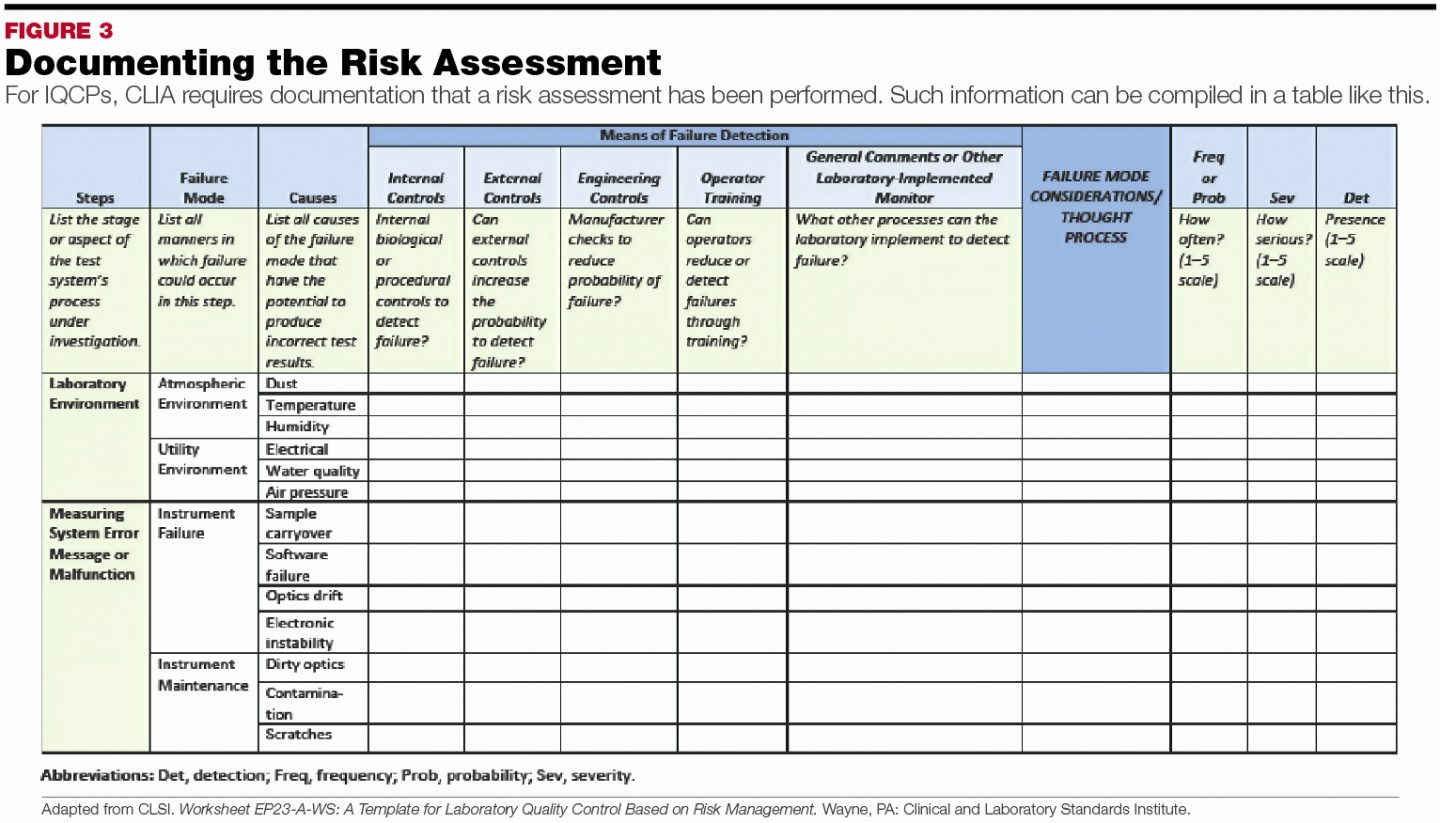

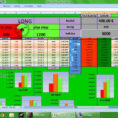

Sample for Forex Risk Management Spreadsheet