Most companies and organizations have a plan for financial savings. However, most don’t bother to use it because they don’t even think about how to put it into a financial savings plan spreadsheet. It’s very important for every company to set up a spreadsheet so they can make the most of their savings.

Having a financial savings plan is one of the best ways to get your company on the right track. It’s hard to succeed with your business when you don’t know where you are going. If you have a savings plan, your company will be able to see where it needs to go in order to be successful.

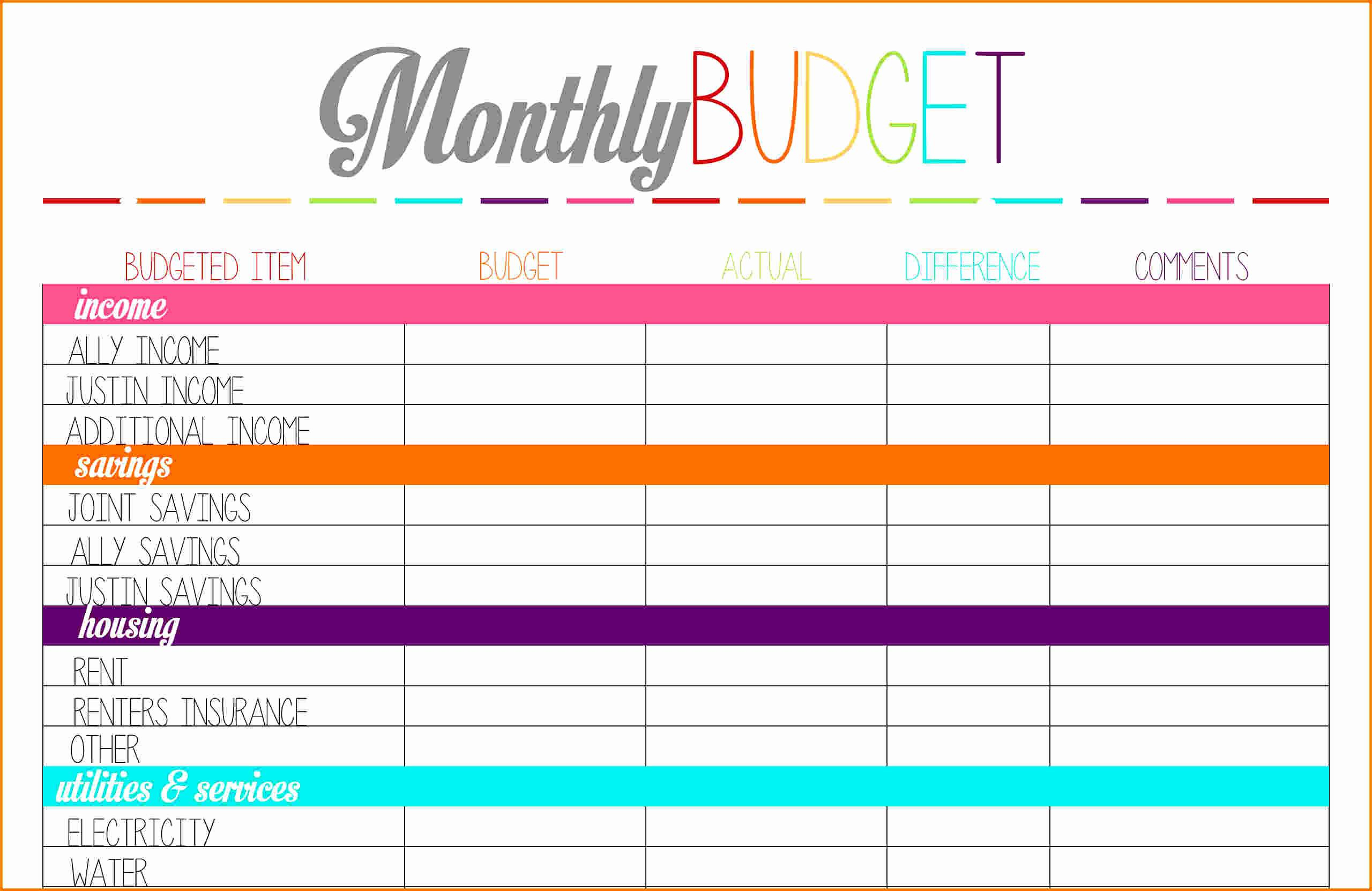

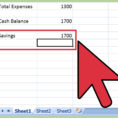

When you have financial savings plan spreadsheet, you’ll be able to see where your money is going. You’ll be able to see how much of your money you’re spending on things that are considered “essential” and how much you’re spending on luxuries. With this information, you’ll be able to make changes to your business so that you can get more profits out of it.

What Do You Need To Do To Use A Financial Savings Plan Spreadsheet?

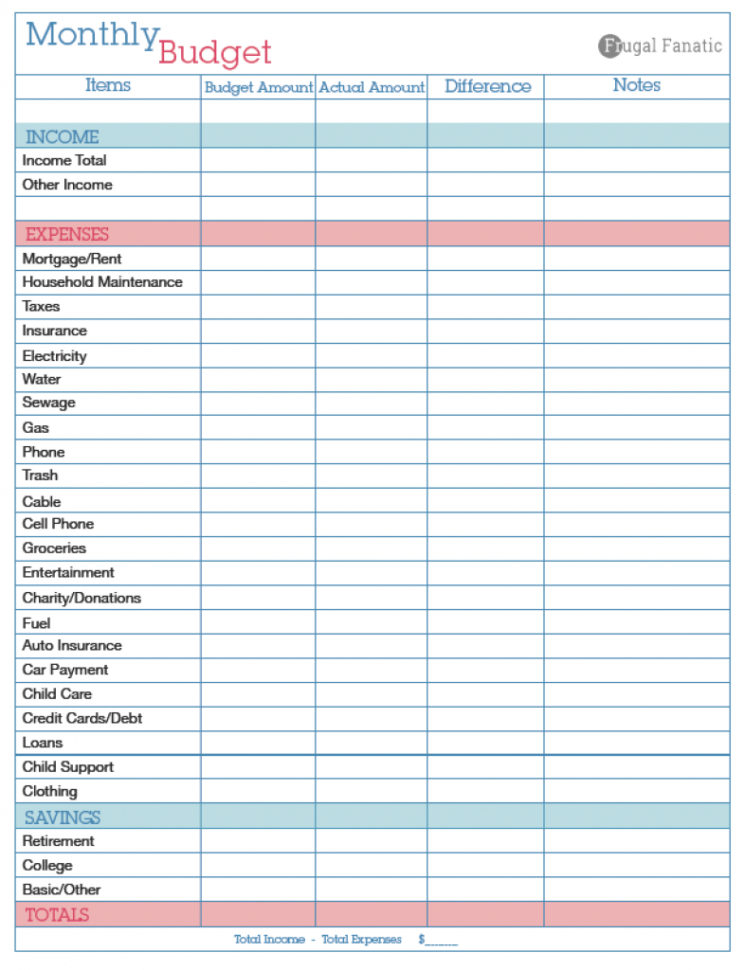

Before you start your own financial plan spreadsheet, you need to make sure that you have all of the information that you need. The first thing that you should do is take a look at your budget. This is a very important part of your spreadsheet and you should make sure that you do it right.

Your budget should include everything that you spend money on. There should be a line for your employees as well as an amount for marketing and there should be a line for your financial expenses. Make sure that you consider each one of these items when creating your budget.

Payroll is something that you may not think about when you’re creating your budget. However, you should always include payroll in your financial plan spreadsheet. It’s important that your employees get their pay from you. They should get paid on time and in full.

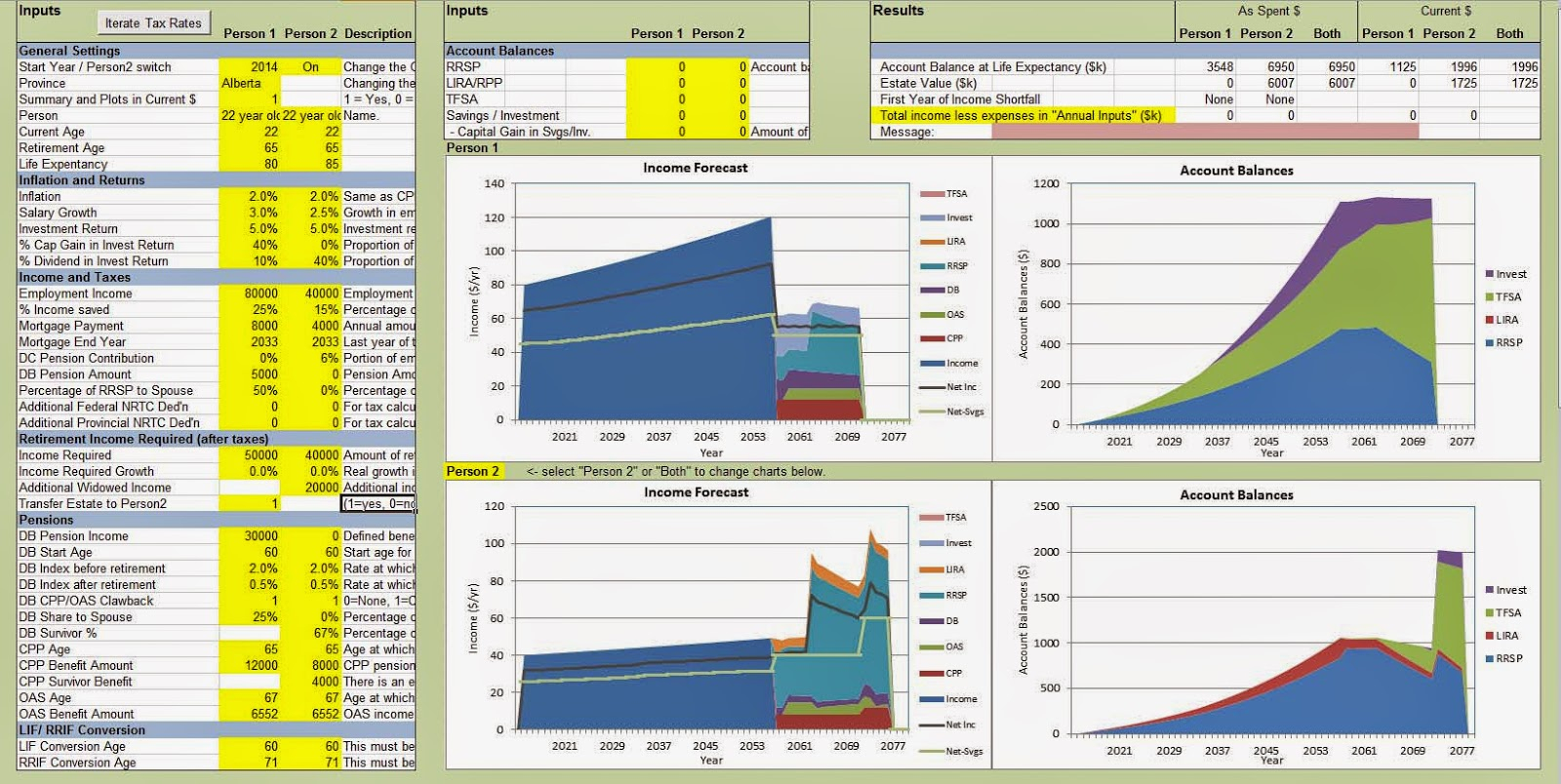

After your employee’s budget, your next step is to set up your company. With a financial plan spreadsheet, you’ll be able to set up your business in order to get your profits to increase. With a great company, it can bring you many benefits.

To create a financial savings plan spreadsheet, you’ll first need to get a good accounting program. Once you get a good program, you can create a business plan and set up your company. Your financial plan spreadsheet will then show you what you should do with your money.

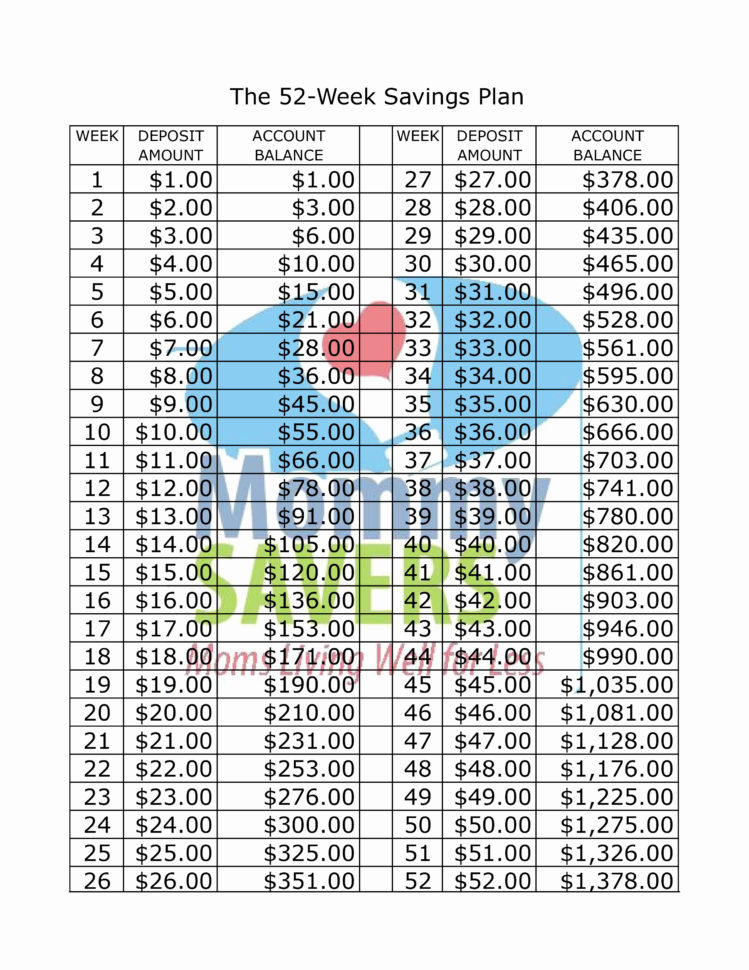

However, it’s important that you don’t just do anything with your money and create a financial plan spreadsheet. First, your spreadsheet should give you a goal and a schedule. This means that you won’t use your money unwisely.

It’s important that you keep your goals realistic and that you stick to your schedule. Even if you’ve set up a financial plan spreadsheet, you’ll need to stick to your schedule and not waste any money. You’ll also need to make sure that you don’t spend too much money on your company and that you’re setting up a system that can easily be managed.

Setting up a company can be easy once you do it right. It’s important that you don’t use your company as a money pit. Once you set up a company, you should be sure that you continue to use it as it should.

It’s very important that you use a financial savings plan spreadsheet so that you can see where your money is going. You should keep your goals realistic and stick to your schedule. This way, you can see how your company will grow, as well as what you’ll need to do with the money that you get from it. LOOK ALSO : financial reporting problem apple inc excel spreadsheet

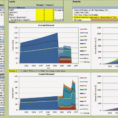

Sample for Financial Savings Plan Spreadsheet