Financial planning is a vital process in any business plan and will greatly affect your organization’s future. Whether you are starting a small business or big one, you must have a solid financial foundation in place to succeed.

The best thing to do is to hire an online financial calculator to give you an accurate picture of your business’s finances. You can find many calculators on the Internet and with a few minutes, you can get a feel for your company’s cash flow.

To make a good decision, check out reviews on financial planners who are located nearby. If you live in an area where there are several financial planners, ask your friends for recommendations.

How to Use a Financial Planning Spreadsheet For Startups

It is a good idea to consider debt consolidation programs when you’re developing your plan. Debt consolidation companies can be beneficial because they are able to meet your needs by paying off multiple debt accounts. Some people may have loans that are beyond their ability to pay, which requires consolidation.

Make a close look at your long-term plan. Know what your goals are for growth and then set up your budget according to these guidelines. Make sure that you incorporate adequate funding in your budget.

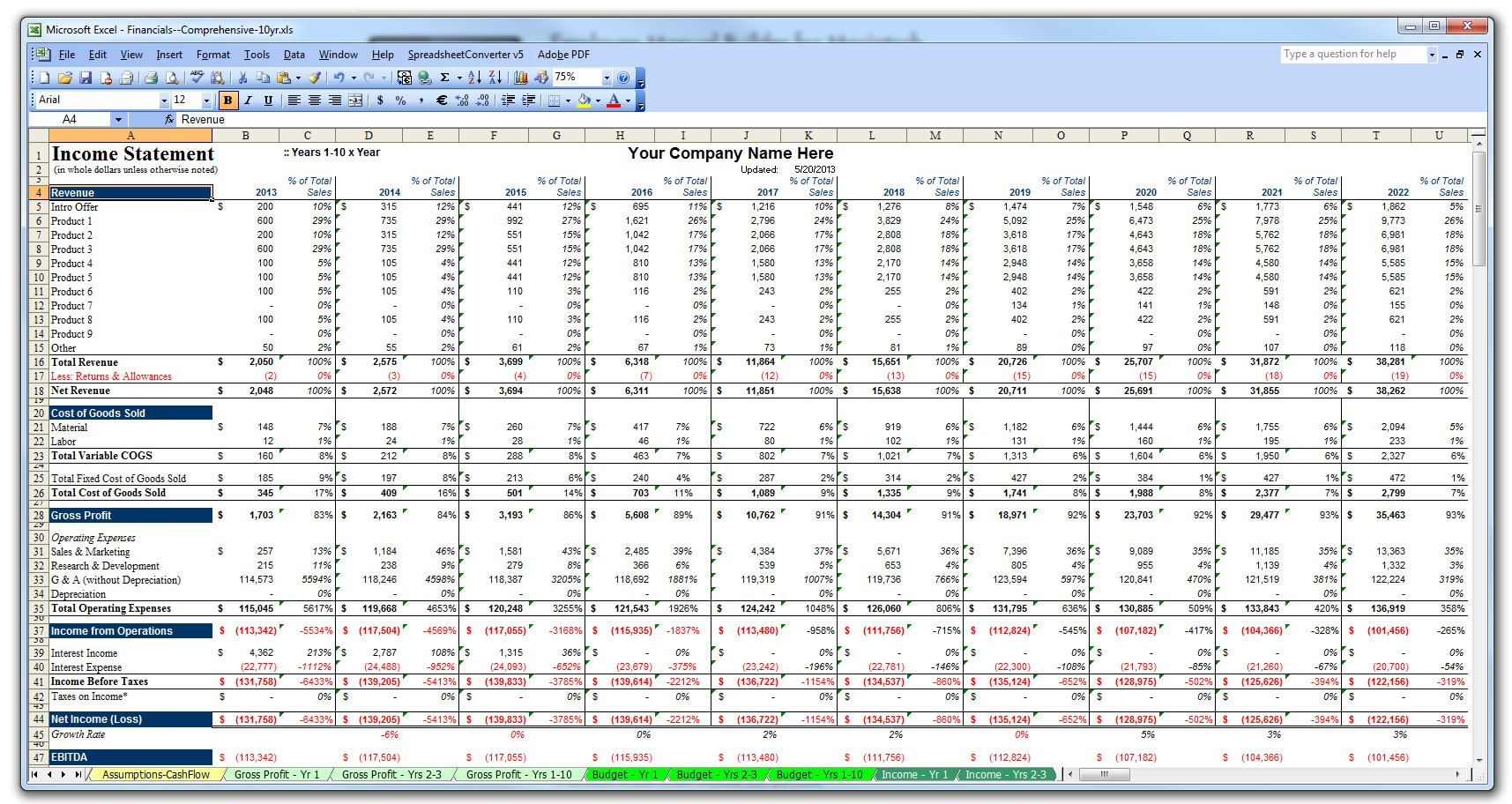

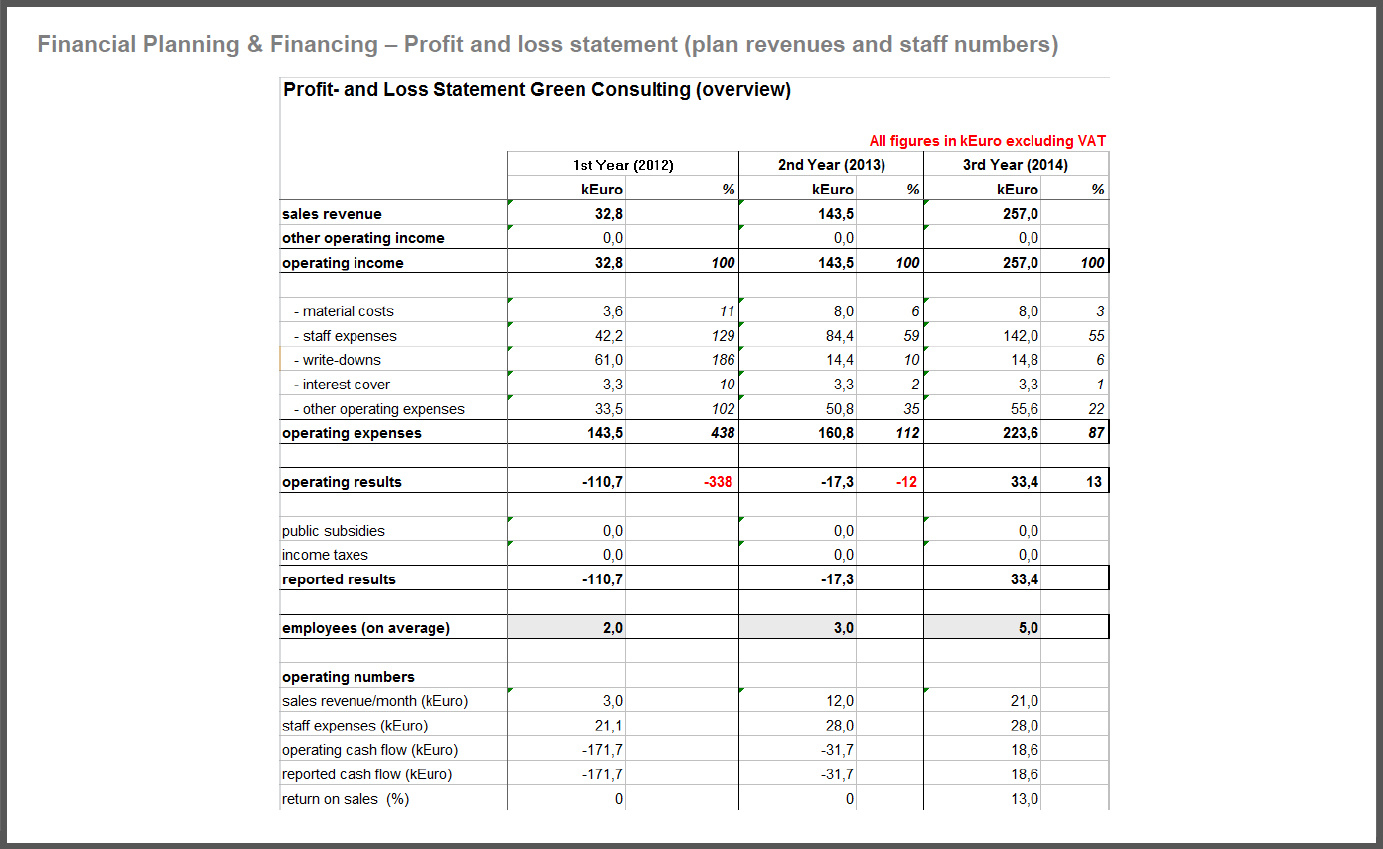

When you begin a business, the beginning may seem daunting and stressful. A financial planning spreadsheet for startups can help you manage all of your expenditures. It will also help you keep track of all your bills, income, and expenses so that you can prioritize them.

Always get an estimate before investing in a project. If you know how much money you need to set up your business, you can now get your budget together. It will save you time and money if you don’t have to guess at your costs and expenses. Hiring an attorney is necessary when you are planning on opening a legitimate business. When you get an attorney, he or she will help you keep your accounting books up to date. It is also necessary to have a professional bookkeeper or accountant that can keep your books up to date and will keep you up to date on your tax obligations.

Insurance is an essential part of running a business. If you plan on doing business in the near future, it is a good idea to invest in health and accident insurance.

The best way to learn financial management is to work with a professional planner. By hiring a professional planner, you will be able to learn from someone who has years of experience in the field.

It is important to protect yourself against economic downturns. Depending on the business you are planning on starting, you may be required to file for bankruptcy.

People who work with financial planning for startups understand that it is not a quick process and that it will take some time to develop basic management skills. But if you prepare for the long haul, it will benefit you in the long run. LOOK ALSO : financial planning spreadsheet excel free

Sample for Financial Planning Spreadsheet For Startups