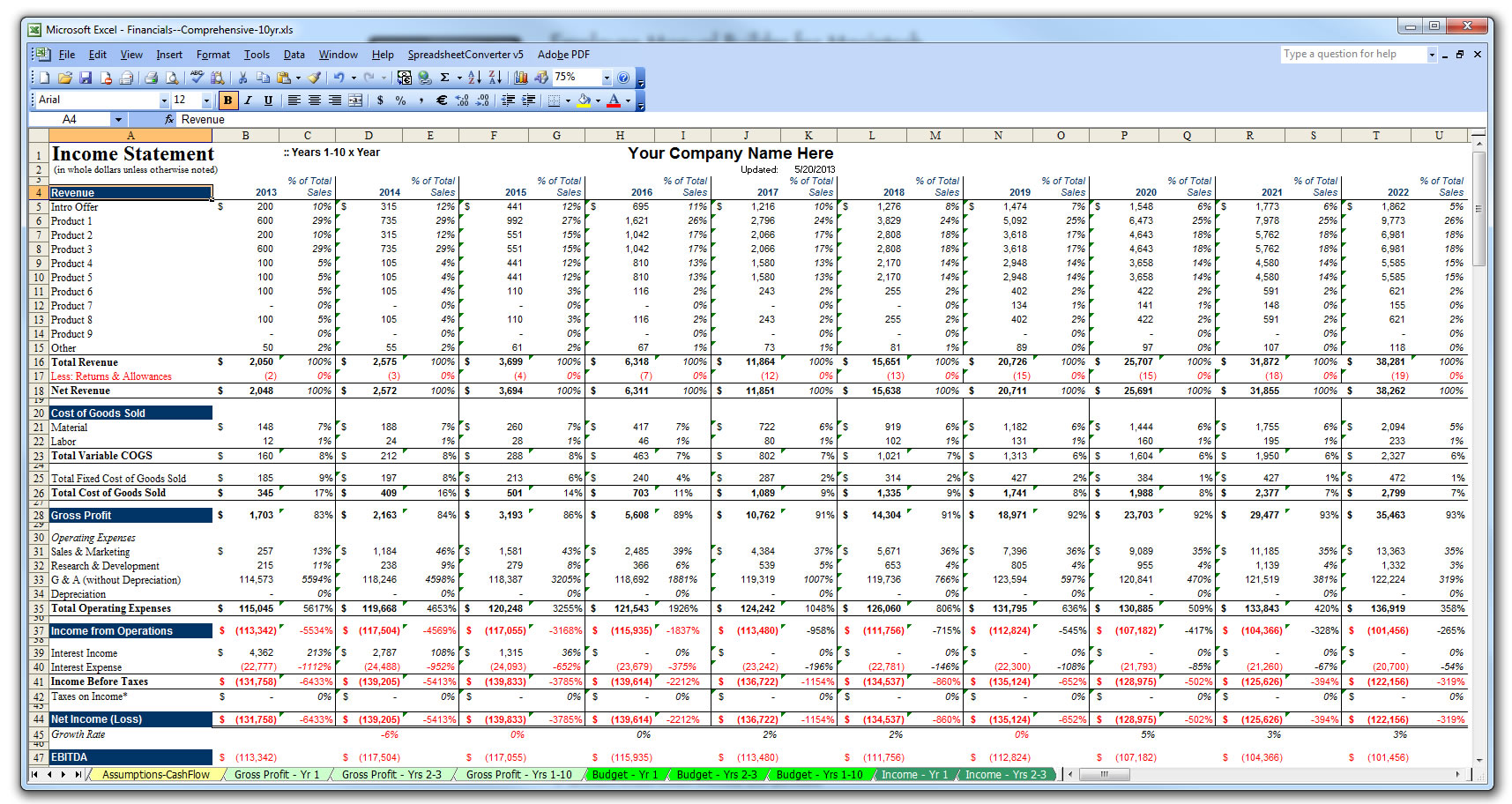

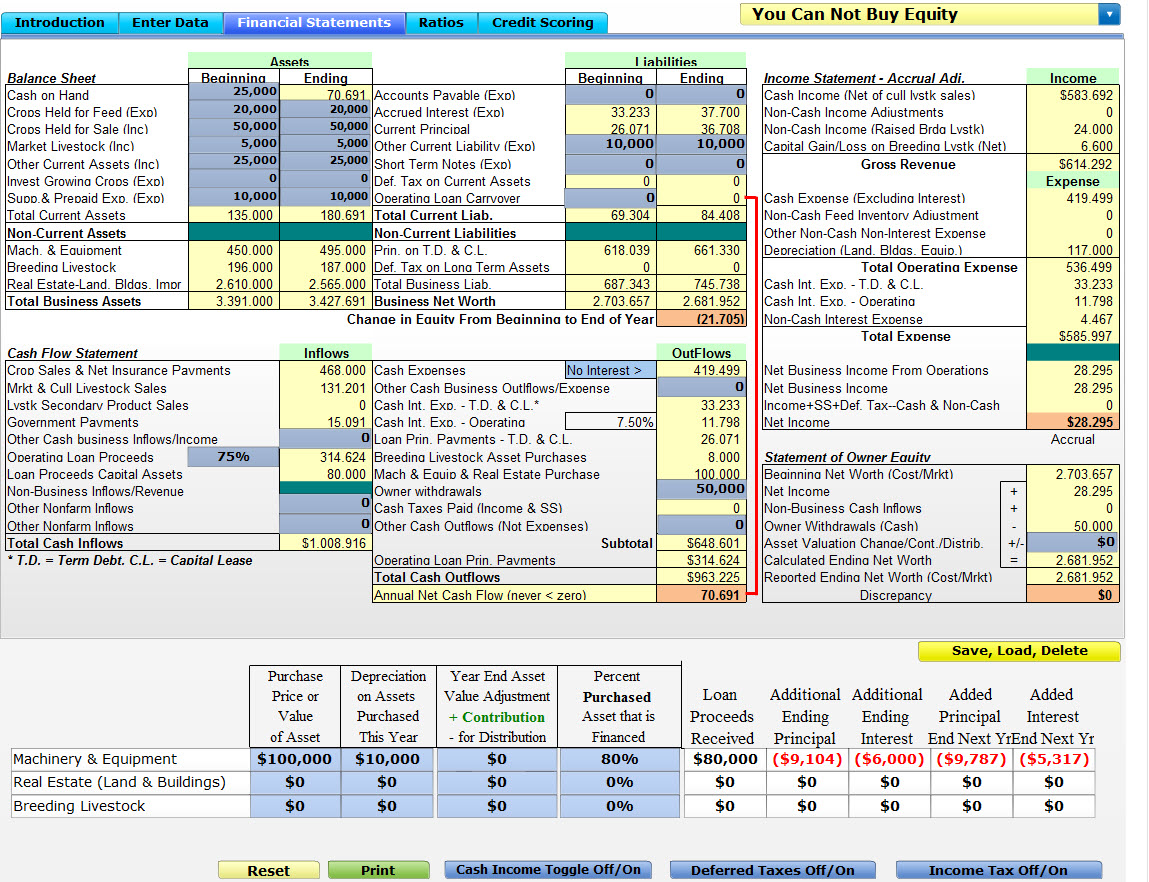

If you are considering going to college, it is a good idea to first find out if you need financial planning Excel spreadsheet software. This is not something that should be rushed into but needs to be considered with some thought and research.

For those who have recently graduated or whose parents may be supporting them, it is almost certain that you will need a student loan consolidation. It is easy to understand why as student loans will be easy to get, but in the long run these loans can actually cost you a lot of money.

The school will likely give you a loan consolidation to cover for these expenses. This is another expense and one that is often overlooked when financial planning Excel spreadsheet software is looked at.

Students Should Consider Getting Financial Planning Excel Spreadsheet Software

When it comes to calculating the full amount that you will have to pay, there is no better time than now to look into getting a student loan consolidation. A consolidation loan will allow you to pay off multiple loans and in many cases will also save you hundreds or even thousands of dollars in interest costs over the life of the loan.

To help you calculate how much you will need to put toward your student loan consolidation, you may want to think about the type of school you are attending. Depending on what school you are going to, you will likely receive financial aid, as well as scholarships and grants.

If you are attending a college where you will not get enough financial aid to help with paying off the loan, then you may need to look into finding other ways to help pay for your education. You may be able to get financial aid by negotiating for a scholarship.

Depending on what school you attend, there may be rules that you must follow regarding the school’s eligibility requirements. Some schools offer financial aid for part-time students, which you can also check on to see if there is any way you can be considered for financial aid.

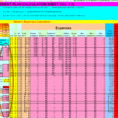

Even though you will need to look into the financial needs of each student you are interested in, your financial planning Excel spreadsheet can help you determine how much you can really afford to pay for your education. This will allow you to make a decision as to whether you are going to ask for the school’s financial aid or just apply on your own.

It is possible that there are other factors that can contribute to the college tuition price but the loan consolidation is very likely the most affordable option. However, this is not something that can be done easily if you do not know exactly what you need to do.

When you are looking at the college tuition price, it is important to remember that not all of the money is yours. You will be responsible for certain amounts of loans and financial aid as well as being responsible for any child support payments that you have.

It is very possible that you do not know anything about the ins and outs of a financial plan such as the Excel spreadsheet and the various fees and charges that come with it. You will have to do some work to find out what it all means and what the options are. YOU MUST SEE : financial plan template free