The Importance of a Financial Budget Spreadsheet

A financial budget spreadsheet is a simple way to track and manage expenses on your own. With the latest spreadsheet program, you will be able to create a budget that will be based on your own criteria. In this article, I’ll discuss why a financial budget spreadsheet is important and how you can use it.

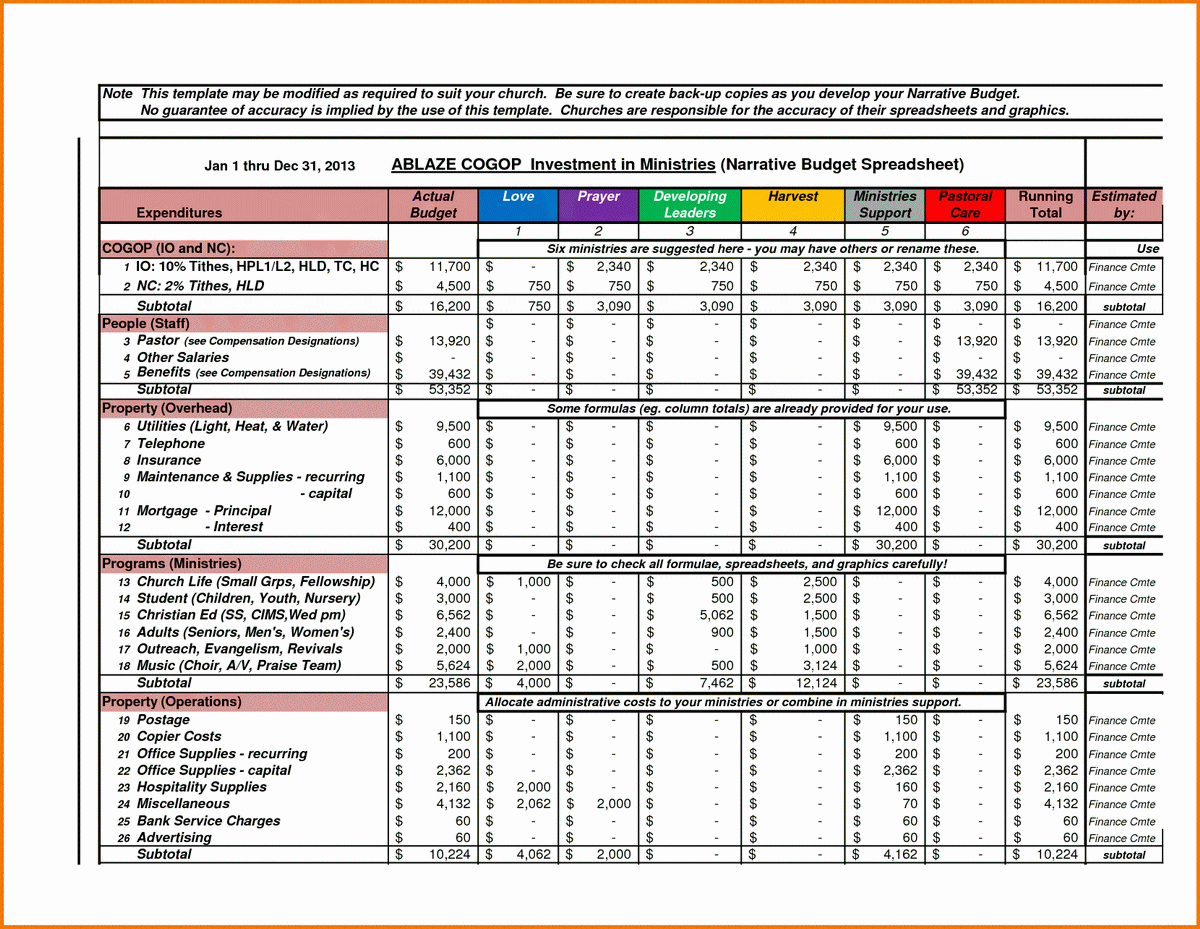

There are many reasons why you might want to create a USP budget or financial budget spreadsheet. Perhaps you have been asked to make a budget by a trusted friend or relative, you are beginning college or are about to move in with your parents. Whatever the reason, you will need to track expenses in order to stay on track. Creating a budget is an important first step in helping you accomplish this goal.

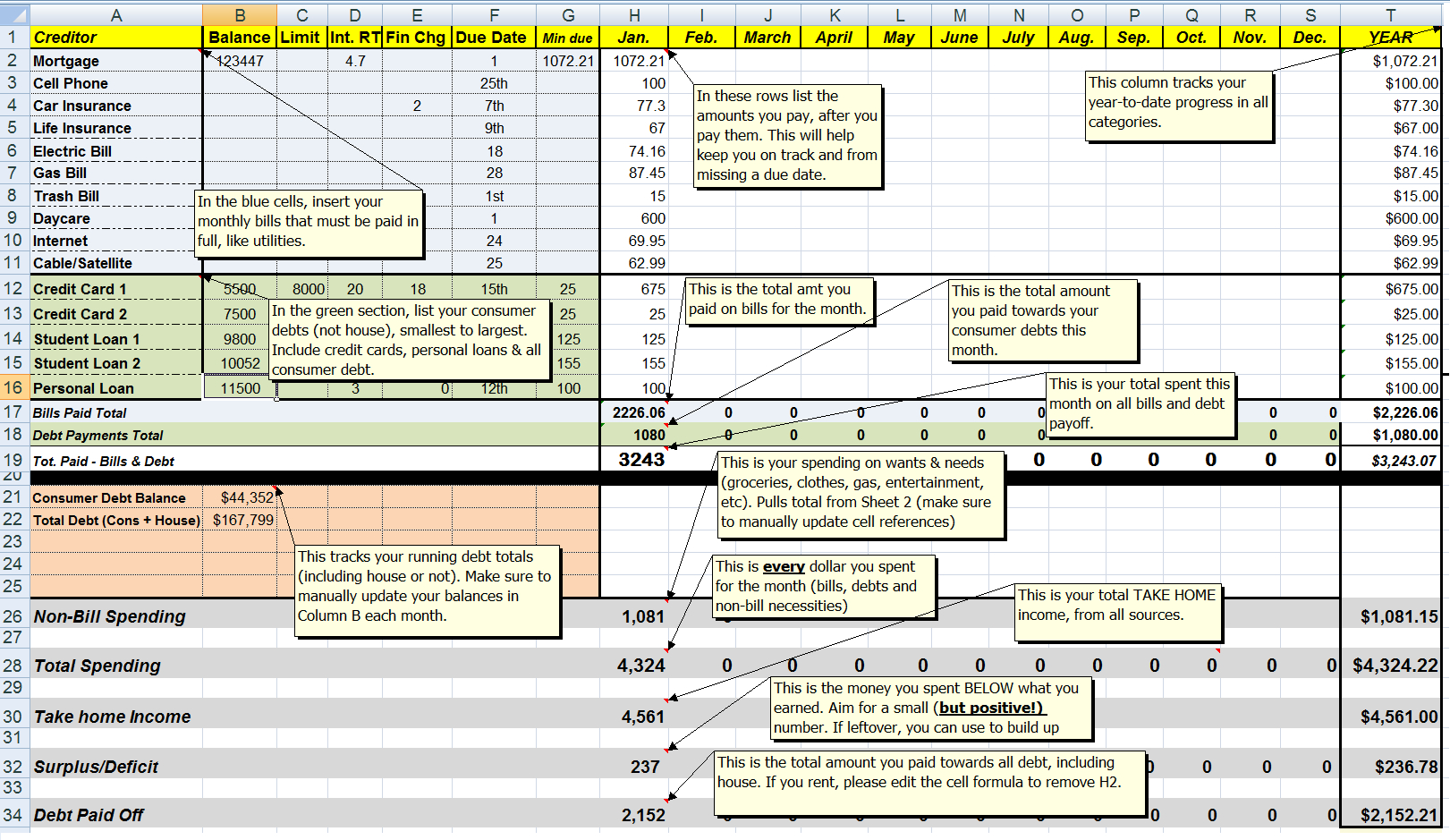

The first reason why a financial budget spreadsheet is important is because of the trust involved in being able to track all of your expenses. You may not be familiar with the term “accounting” and this is where you will get help. There are many free spreadsheet programs that will allow you to add, edit and delete entries as well as calculate prices. You will also find that there are many ways to categorize expenses, whether they are charitable donations, utility bills, business expenditures, miscellaneous expenses, credit card spending, etc.

Once you have your financial budget spreadsheet, you will also want to assign categories for each category. This is important because you will want to track your spending in relation to others’ spending. If you’re paying your bills on time and yet your friends are racking up large credit card bills, then you need to put that on your financial budget spreadsheet. On the other hand, if your friends pay their bills on time but you find yourself in a large financial hole, you may want to try and write down a check for them to pay for it and avoid the financial turmoil. Every situation is different and you need to figure out what works best for you.

The next reason why a financial budget spreadsheet is important is because you will want to set a budget that includes all of your expenses. Having a detailed accounting of your money will allow you to avoid any mismanagement and set realistic spending expectations. After all, everyone has their own spending habits and goals. Establishing realistic spending expectations helps you avoid making financial mistakes and allows you to focus on more important things.

It’s common for people to get frustrated because they don’t have control over their finances and they don’t see any way out. For example, you may get into debt because you take out a larger loan than you can afford to pay back. By setting a monthly budget that includes all of your expenses, you will be able to avoid going into debt because you know exactly how much you need to spend each month.

Another benefit of creating a financial budget spreadsheet is that you can track your monthly income and expenses. If you are trying to save money and still have some left over from the previous month, you can subtract all of your expenses and save the money. Or, if you have a friend that needs to go to a doctor for a check-up, you can tell them to buy a gift card and let them pay it off with that instead of taking out a loan to pay for it.

When you are starting to implement a financial budget spreadsheet, you will want to learn some basic spreadsheet terminology and how to create new entries. For example, a debt entry is an amount you owe that you haven’t paid yet, a car title, or a lease agreement. As you learn more about these entries, you will be able to create more complex entries, such as one that accounts for income, expense and tax.

You can track how your income, expenses, and tax rates change over time with a financial budget spreadsheet. And, you will know which expenses you can save with a gift card, which will keep the list of expenses and income on a monthly basis.

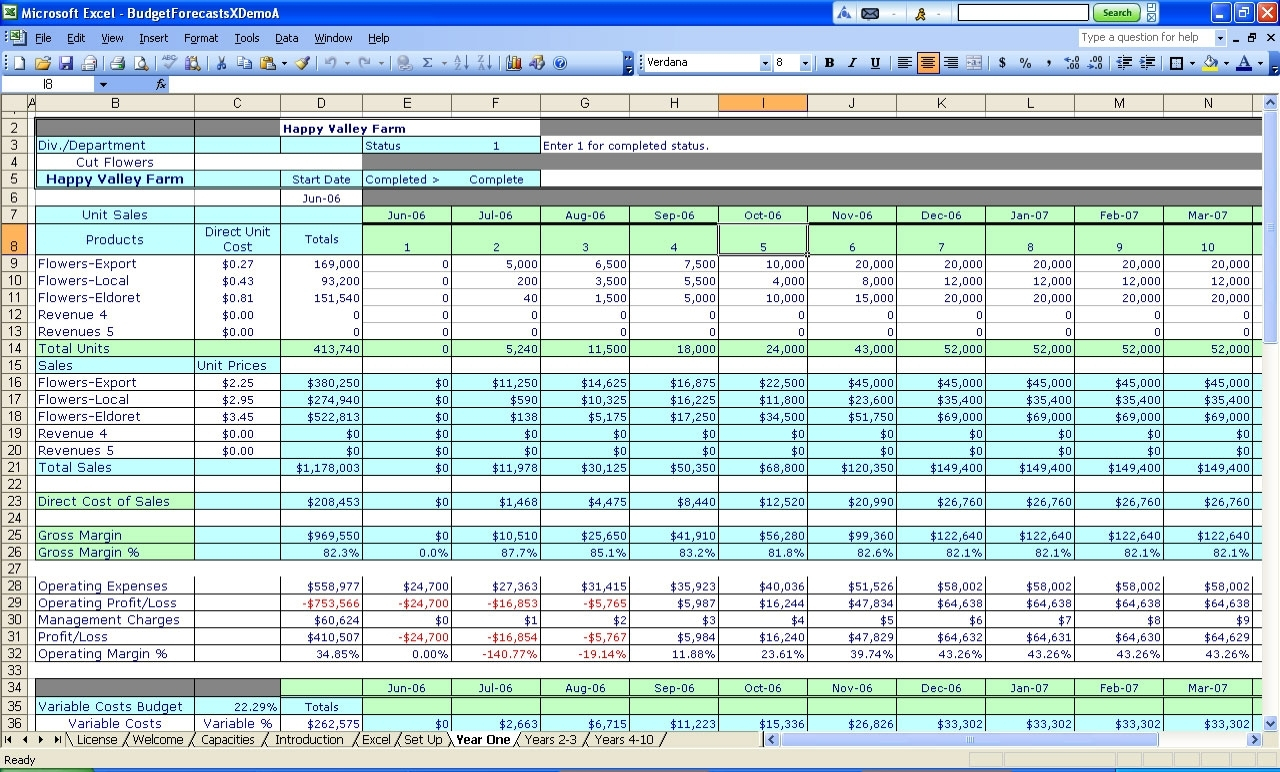

If you have never had a budget before, creating a financial budget spreadsheet and learning how to edit and create entries is a good place to start. You can also learn more about budgeting and spending with new software available today. YOU MUST SEE : farm record keeping spreadsheets

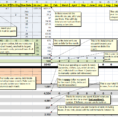

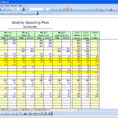

Sample for Financial Budget Spreadsheet