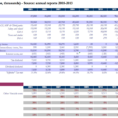

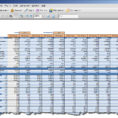

Using Excel spreadsheet to support financial analysis is a significant step forward in developing financial business solutions for the small and medium size enterprises. It helps you cut your analysis down to a single sheet, thereby eliminating certain complexities that might have arisen during the process of analysis. Financial analysis is required when planning for future changes, analyzing the current performance and assessing the future prospects.

Corporations often launch huge research activities with the ultimate aim of coming up with new products and services that can save them time and money. This would help to bring about a drastic change in the organisation’s business strategy. A company would also want to know the level of commitment from its employees so that it can be sure that the employees are ready to commit to the business. This means the work force needs to be maintained and cultivated.

Financial analysis helps to achieve this. Through this, it is possible to analyse the present situation to determine the need for some form of improvement. In the same way, the financial information can be used to evaluate the previous year’s performance. By taking such a step, a company can easily put things in a better perspective and also determine the necessary improvements to be made for a better future.

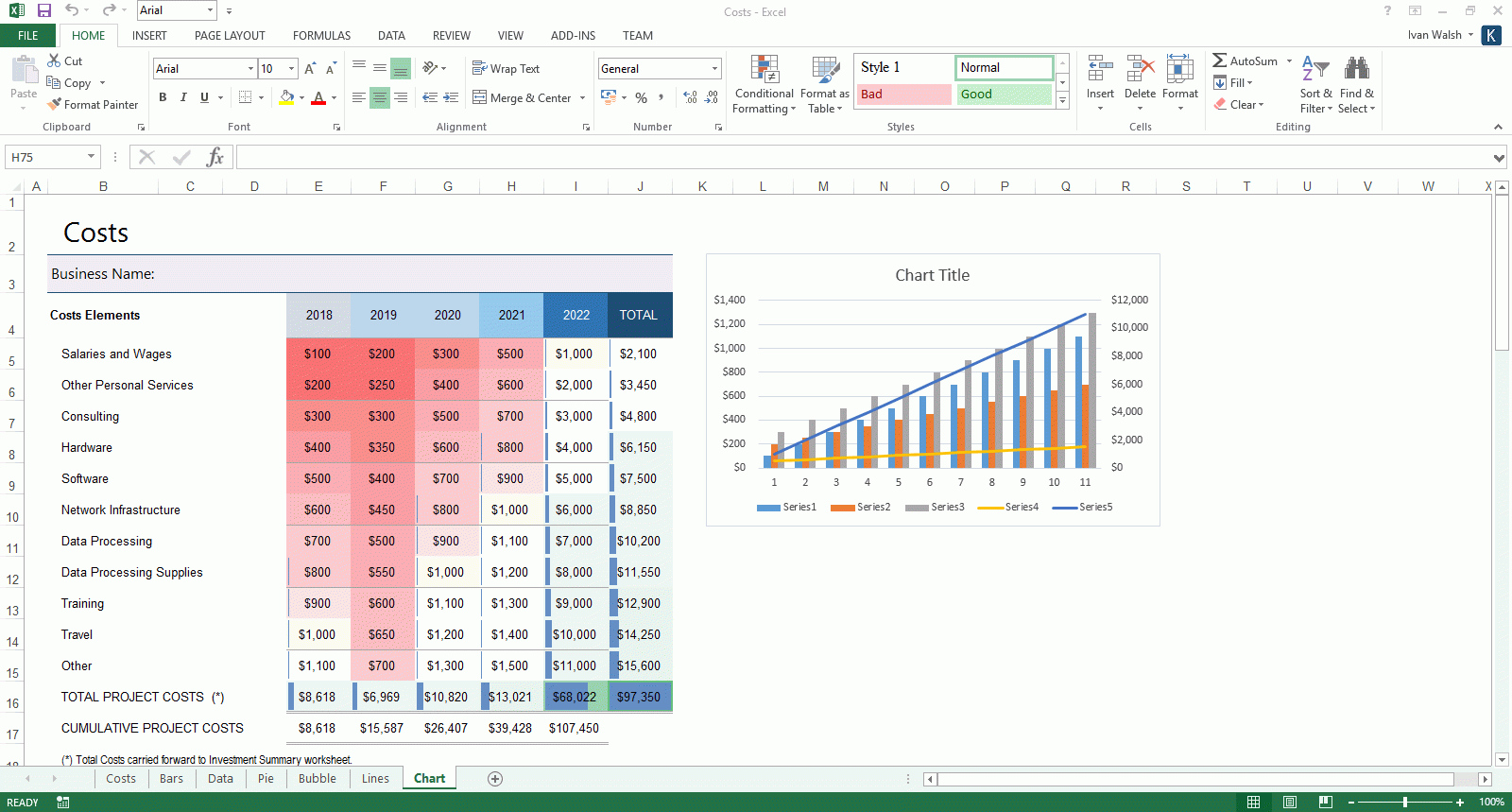

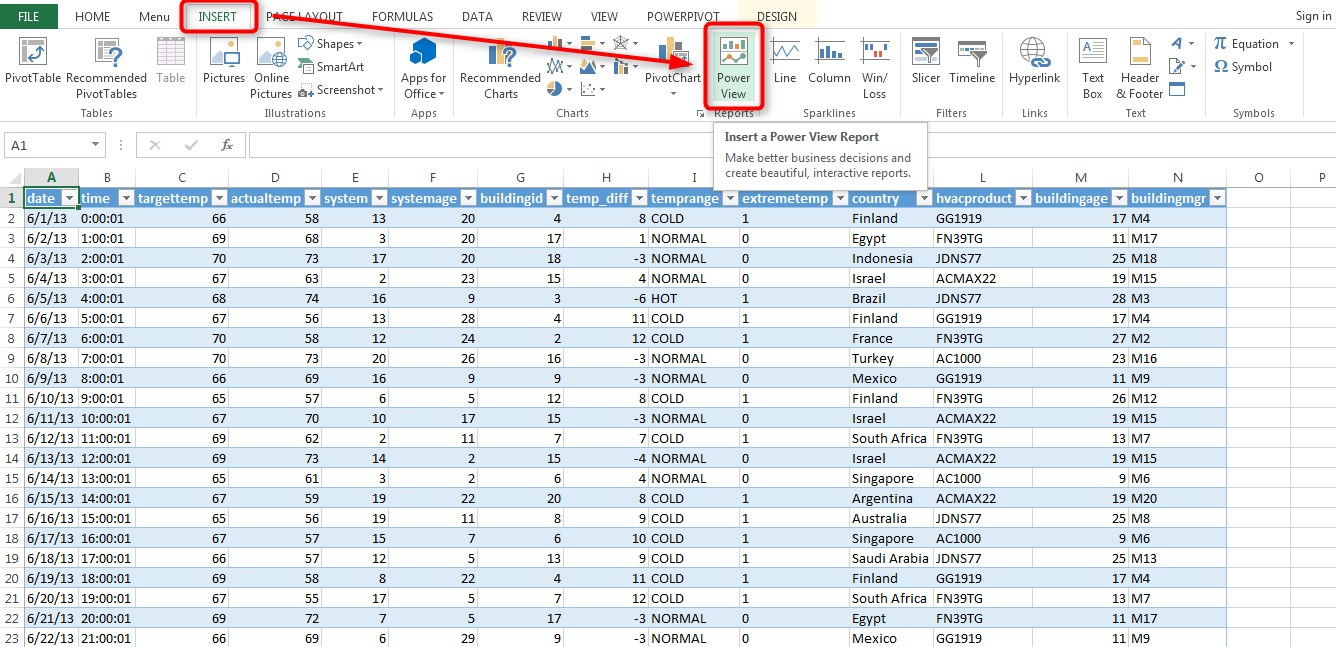

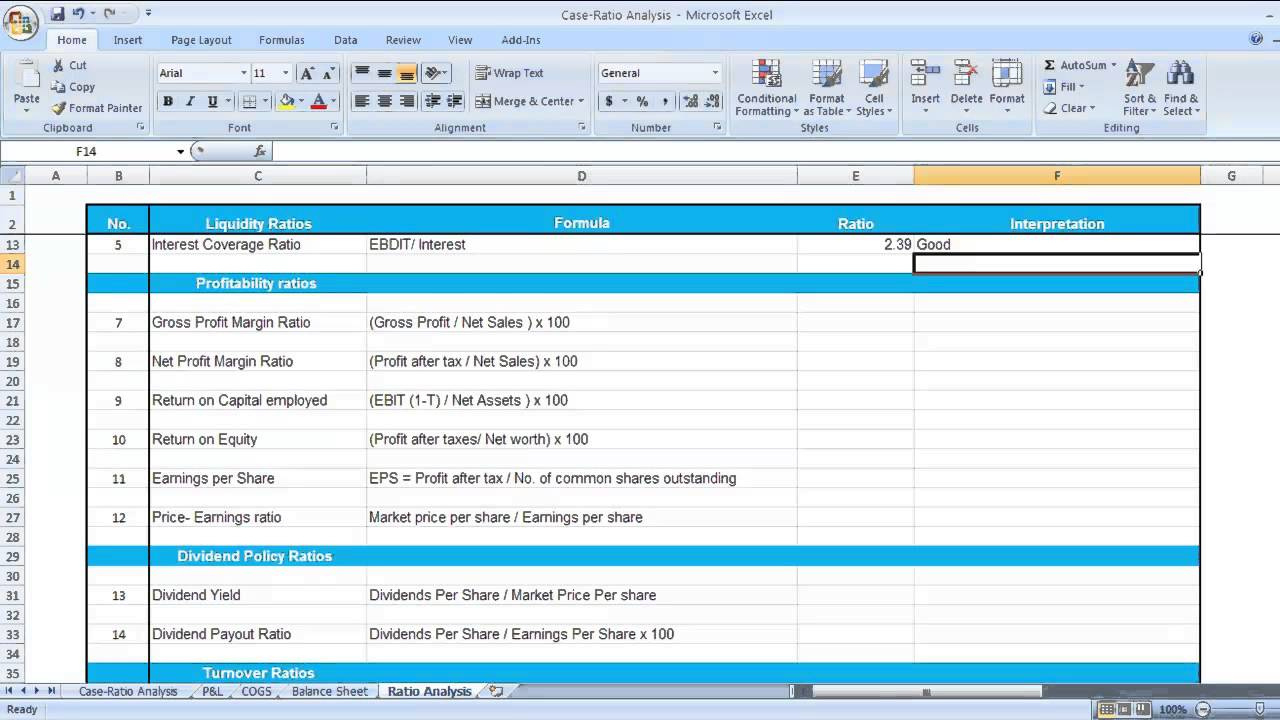

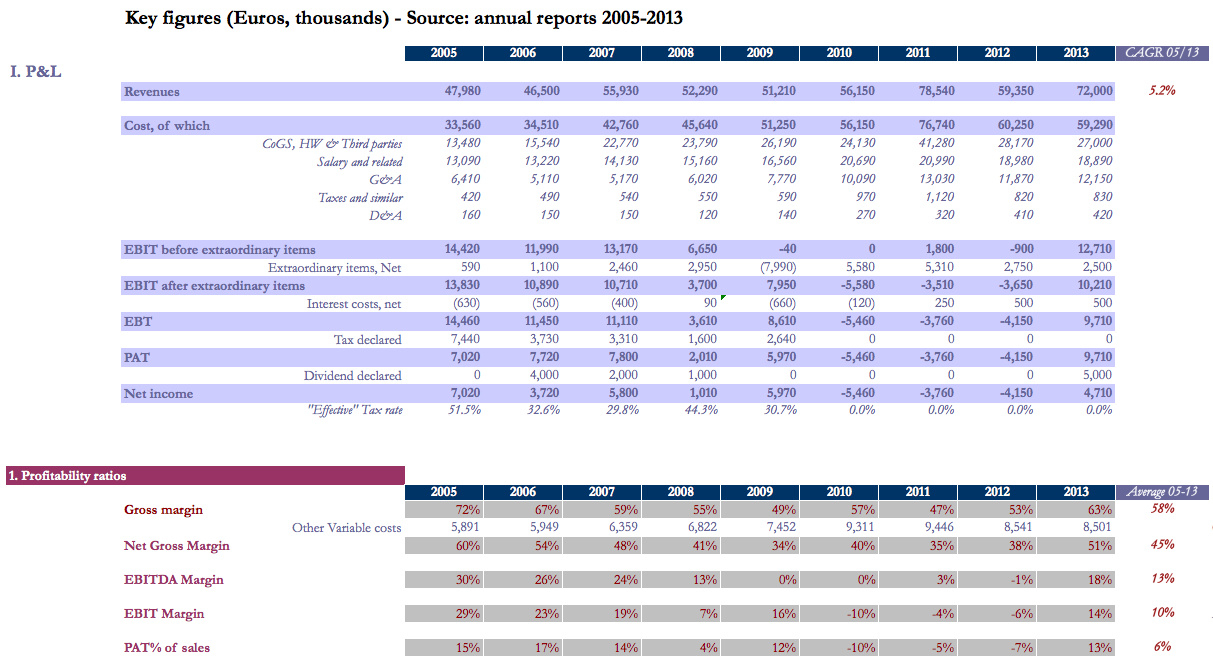

Using Excel Spreadsheet for Financial Analysis

Financial analysis can be applied to help one understand the current status of the organization. This helps to determine whether the organisation is ready to bear the burden of changes that are about to come in the near future or not.

For financial management, excel spreadsheet is the ideal tool. However, before you start using excel spreadsheet in financial analysis, there are a few important factors that need to be considered.

One of the most important factors is the reliability of the financial data. This is because the accuracy of financial data depends on the credibility of the source. One of the possible sources of error is the inaccurate reporting. It is therefore important to be very careful when deciding on which data is reliable.

Another factor that should be considered when considering financial analysis is the scope of analysis. The scope is more important if the financial data contains any numbers that are more detailed than the organization’s knowledge. If the analysis involves a broader scope, it might not be possible to develop an accurate and useful result. It would be better to limit the scope of the analysis to the sections that are required to be covered in the financial analysis.

Financial analysis can be carried out for the purpose of appraisal or setting goals. It is important to know the accuracy of the data. A mistake in the financial data could cause significant discrepancies.

At this point, it is also important to note that financial analysis is only applicable to analysis of current performance. It is not applicable to planning for future changes. It is therefore important to determine what data is relevant to the current analysis.

Financial analysis should be limited to facts and figures. It is important to avoid unnecessary opinions, speculations, interpretations and guesses. This will make the entire financial analysis cumbersome and uninteresting.

One of the most common mistakes that people make when carrying out financial analysis is using some numbers that are outdated. For example, the business performance has declined over the past year but the financial report showed a higher growth. This is a sign of a decline in the growth rate that can be overlooked.

If you want to do an accurate financial analysis, you need to use a spreadsheet that can contain data that is updated every second. Using excel spreadsheet can help you perform this task. There are many organizations offering financial reports and spreadsheets for companies. PLEASE SEE : fax spreadsheet

Sample for Financial Analysis Excel Spreadsheet