If you want to get a family monthly expenses spreadsheet and a family’s expenses each month, the first thing that you will need to do is take an inventory of your household’s belongings. As you inventory, the expenses you already know; like insurance, gasoline, cable, phone, cell phone, cable, internet, and groceries. But what about the uninvited expenses such as entertainment, clothing, and gasoline.

You might have a basic income of five hundred dollars a month and then three kids. You still have an uninvited expense from your friends’ places for gasoline, or entertainment, and maybe a small business expense for clothes, school, and childcare. Or perhaps you have a family that needs to take the kids to daycare.

In addition to your current year expenses you will need to find out what your budget is for next year. This might be different from your budget for this year, because you might need to adjust what you owe on loans or credit cards, or who you owe. After you have finalized your budget you will need to find an accountant to help you tally your expenses. You can use your computer to generate a detailed list of your expenses so you can compare them to your monthly budget to make sure they are all considered.

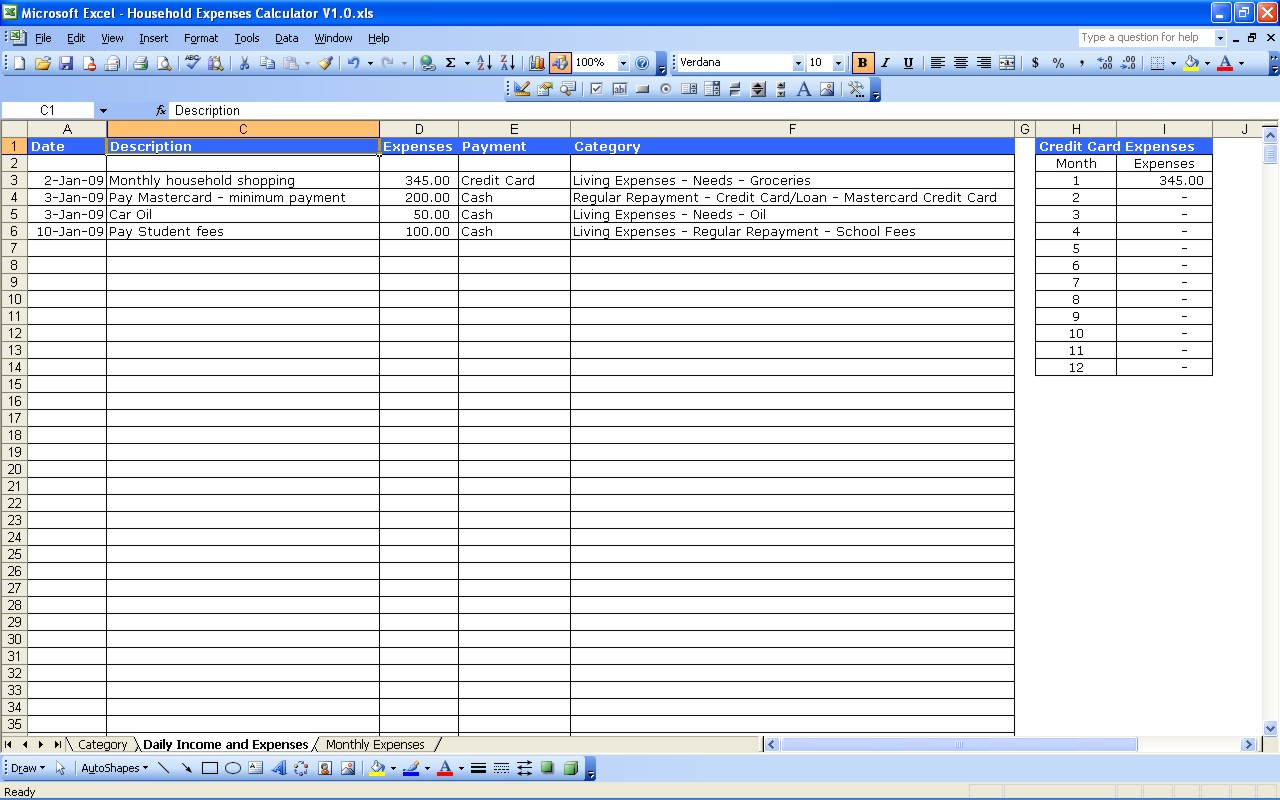

Family Monthly Expenses Spreadsheet

The accountant needs to know how much money you are bringing in each month. They will also need to know how much money you are paying out. Then he or she will need to know if you have some money for uninvited expenses.

Your family monthly expenses spreadsheet will be a living document that tells the accountant how much money you are spending every month. So when it comes time to file your taxes, it will be easy for the accountant to tally the expenses and figure out how much you owe.

In order to be a good accountant, your first goal should be to obtain the education required to be certified. Get an online degree or a degree from a reputable school and then take the accounting classes required by the state.

Next, you should take the classes to learn how to write a calendar that records your financial information based on your current income and expenses. It will be important to provide receipts for every purchase because the accountant will not be able to determine how much money you owe until you provide your receipts.

You will also need to know how to use tax forms such as W-2s and IRS 1099. Many people are not comfortable typing up these forms and will prefer the help of a professional.

Your accountant will need to review your taxes with you to ensure that they are correct. This will be a time when he or she will ask you questions about your financial information and needs.

The accountant may be able to get your taxes for free if you sign up for tax services with them. You can then provide them with all of your financial information, your receipts, and other forms that they require.

When you have finished preparing your family monthly expenses spreadsheet, make sure you keep a copy for yourself. Then it will be easy to keep track of the expenses you have for your entire family.

You will also need to have a checkbook where you can deposit and withdraw money for your bills. A checkbook is a reliable way to track your finances and learn to make wise financial decisions. PLEASE READ : family cash flow spreadsheet

Sample for Family Monthly Expenses Spreadsheet