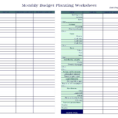

Expense Sheets Help Your Small Business Grow

A small business expense spreadsheet can save your business time and money when preparing financial statements. You must be able to accurately and conveniently gather the necessary data needed to prepare a proper small business expense spreadsheet.

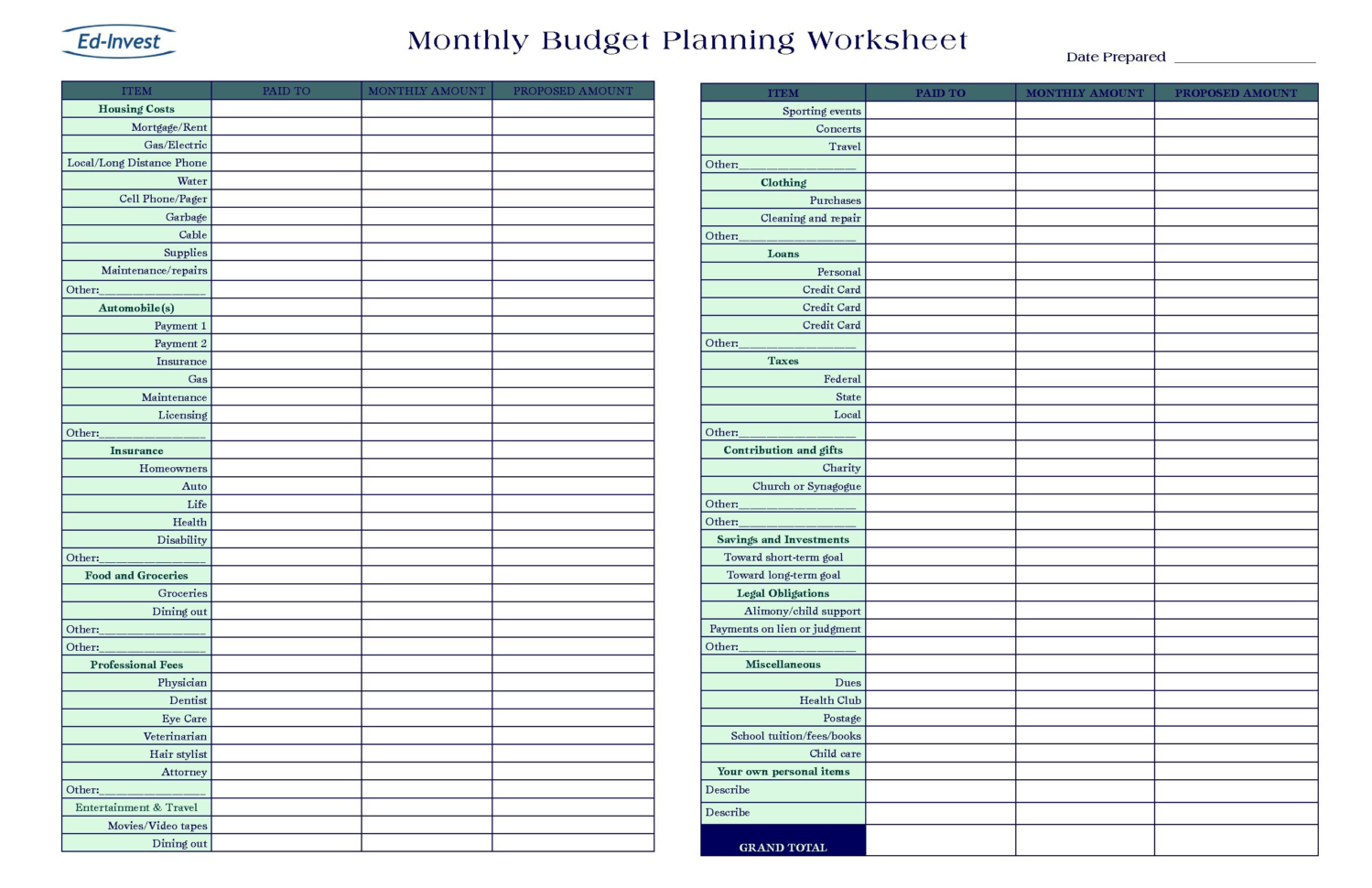

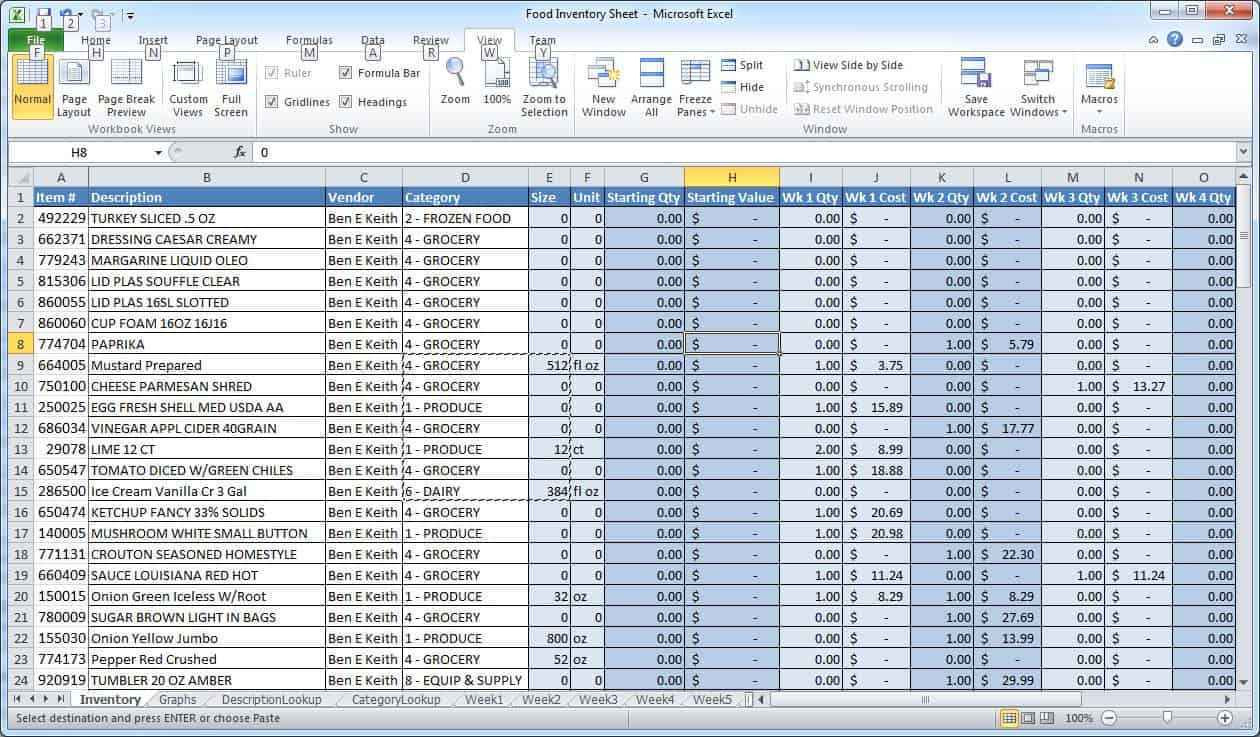

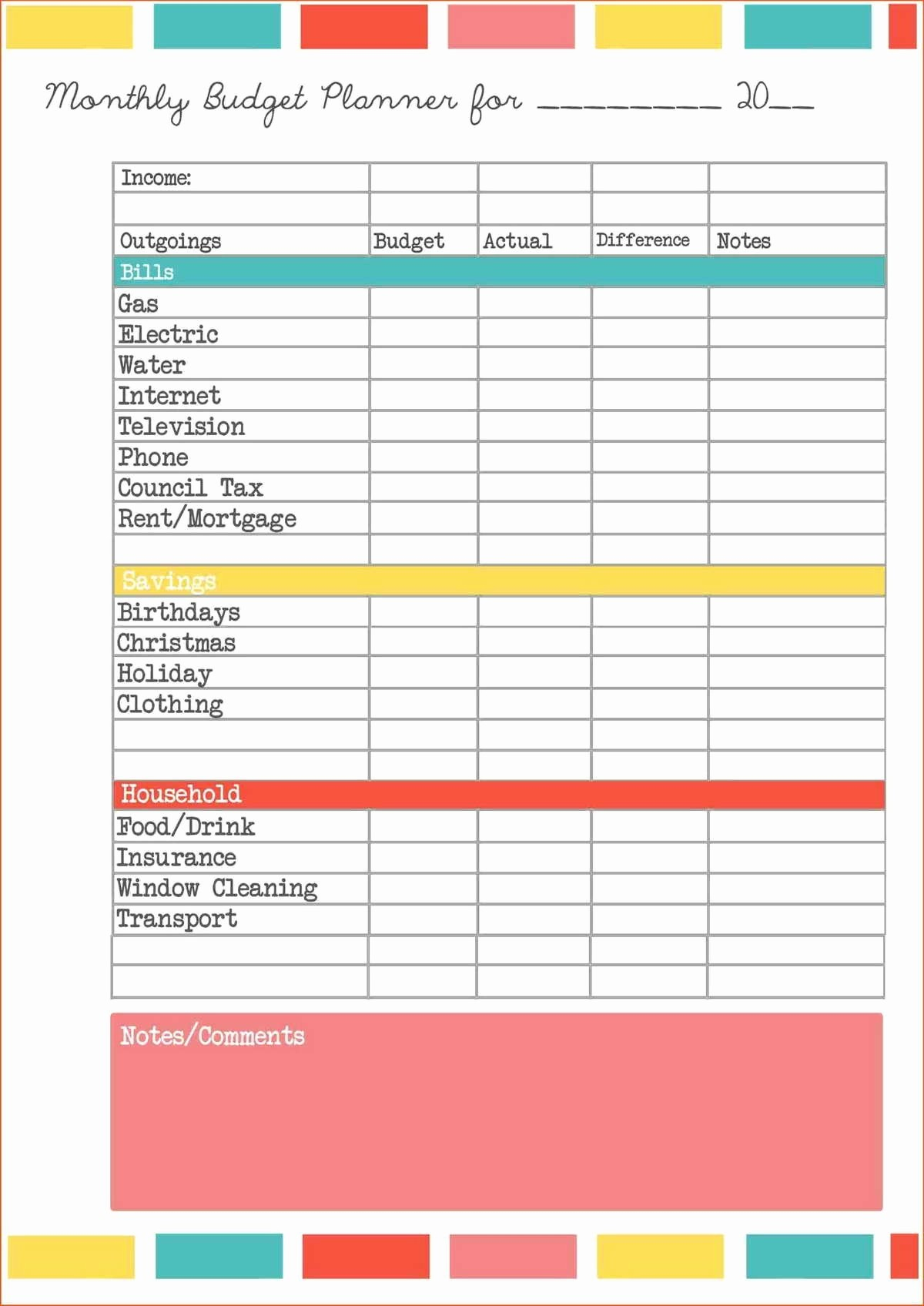

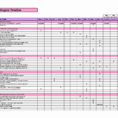

All expenses are comprised of numbers, dates, values, and descriptions. The expense amount should include all expenses such as travel, business-related purchases, and supplies. If you have items that you cannot or do not want to count as an expense, create a separate spreadsheet for these items and record it in the appropriate category.

One way to record an item as an expense is to enter it on the invoice details tab with its reference number. Alternatively, you may use the code in the parentheses next to the price to determine the expense category. If you have high-priced items, include it on the item details tab as an expense. Just make sure that the total price paid for each item is recorded.

Most expenses will include the cost of the transaction information you used to calculate the income of your business. Most transactions are considered a business expense if you incurred more than $1000 in transaction costs. The income will reflect the amount you received for the sales you made on a daily basis.

The various categories of expenses that you can include in your expenses spreadsheet include: payables, payroll, insurance, equipment, rent, advertising, vendor finance costs, and distribution costs. Your small business may also require other items that you need to record like personnel costs and license costs. Write down all these entries in the proper column.

It is very important to include all the expenses that you have incurred to a small business in your expenses spreadsheet. You may feel a little overwhelmed at this time but the sooner you get organized the better your chances of getting accurate results. In addition to having a separate expenses spreadsheet, you will also need to update your tax documents, payroll records, and transaction data each year. This helps you keep track of your taxes and reduce or eliminate any tax liabilities that you may have.

The first expense to include in your spreadsheet is your payroll expense. Make sure that you have an entry for every employee who worked during the calendar year. In the expense records tab, simply write the amount of your payroll expense in the corresponding column of the spreadsheet.

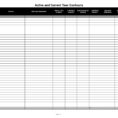

There are certain categories of people that should not be included in your expense totals. These include vacation, sick, or holiday pay. Similarly, if you have employees who are also contractors, write down their individual expense amounts.

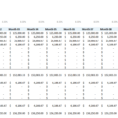

If you have any other employees that receive regular pay that is higher than what you are paying them, record the difference between their pay and yours in the entries of your receipts. If there is no difference between the amounts that you are paying your employees and the amount that you are paying your subcontractors, record the difference in the appropriate columns of your expense records. Your payroll should reflect the amounts that are really being paid.

The final expense to add to your small business expense spreadsheet is your general revenue and profit. To ensure that this information is accurate, it is important to know the total amount of profit for your business and subtract it from the total revenue you have generated during the year. To check this information, just use the appropriate line of code in the end of your expenses records. SEE ALSO : expense spreadsheet for small business

Sample for Expenses Spreadsheet Template For Small Business