An Excel Expenses Template UK that fits your personal circumstances and the type of company you run is the best option to consider when you need to keep track of what you spend on paper. It can save you time and money in the long run and will help you…

Category: Expense

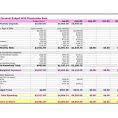

Business Expense Tracker Excel

Excel is the business expense tracker that every business must have in their arsenal. This software can help you make your money go further by helping you with your expense and finance records, reports, and the like. Business expense tracker excel has all the tools you need to be successful…

Project Expense Tracking

In order to successfully complete your personal or business project, there are certain common expenses that need to be kept track of. Some of these expenses are specific to the project, while others can be general to all projects. One of the more common expenses is payroll fees. Many businesses…

Spreadsheet For Tax Expenses

There are two main types of taxes: income taxes and sales taxes. Although most people tend to use the term sales tax to describe the concept of a personal income tax, there is another type of tax that is entirely separate from these two and is referred to as the…

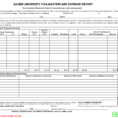

Credit Card Expense Report Template

The credit card expense report template is a short form that will help you be able to keep track of your expenses when using your credit cards. There are many people that use their credit cards every day but do not know how much they spend on them. With this…