An expense tracker is a tool that you can use to track your expenses. The software will allow you to see all of your expenses, whether they are expenses on an item, purchase, or a business. To start using an online business expense tracker, you will need to download it…

Category: Expense

Yearly Expense Report Template

A yearly expense report template is a very useful tool for those who need to prepare one for tax purposes. It’s easy to use and gives you all the information you need to fill out the required fields on your annual return. To get a professional look, get an annual…

Office Expense Report

When an accountant is a part of a business, the responsibility of making an office expense report is shared. After all, when an accountant performs their work, the money that they get to spend will be the same as the money that a business owner has to spend. However, to…

Microsoft Expense Report Template

A Microsoft expense report template is something that all business owners should have at the disposal of their business. This is because it has many benefits that will enhance the effectiveness of your business. With a Microsoft expense report template, you can keep records of all the costs that you…

Detailed Expense Report Template

A detailed expense report template is just one of the many templates that you can find in an online resource. It is great for small business owners to get a rough idea on how they can decrease their expenses for at least one month. You can look through this and…

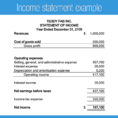

Profit And Expense Spreadsheet

Profit and expense sheets are often a product of accounting. It is an overview of how an organization uses their assets, income, and expenses. The Profit and Expense sheet is used by a wide variety of organizations. From the business owner to the accounting firm to the CFO to the…