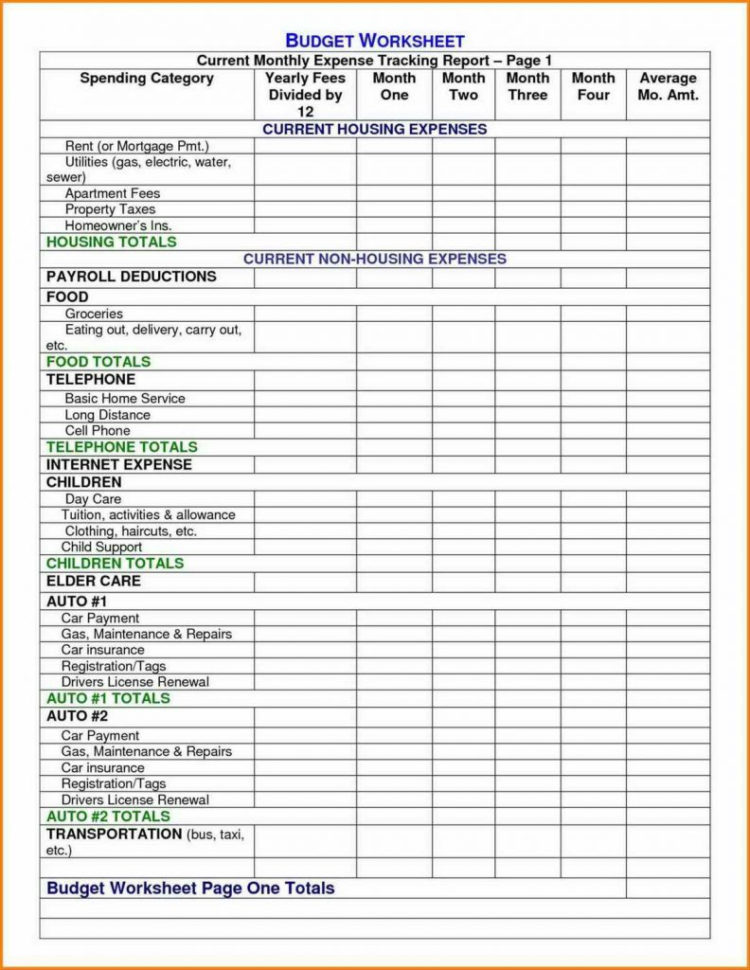

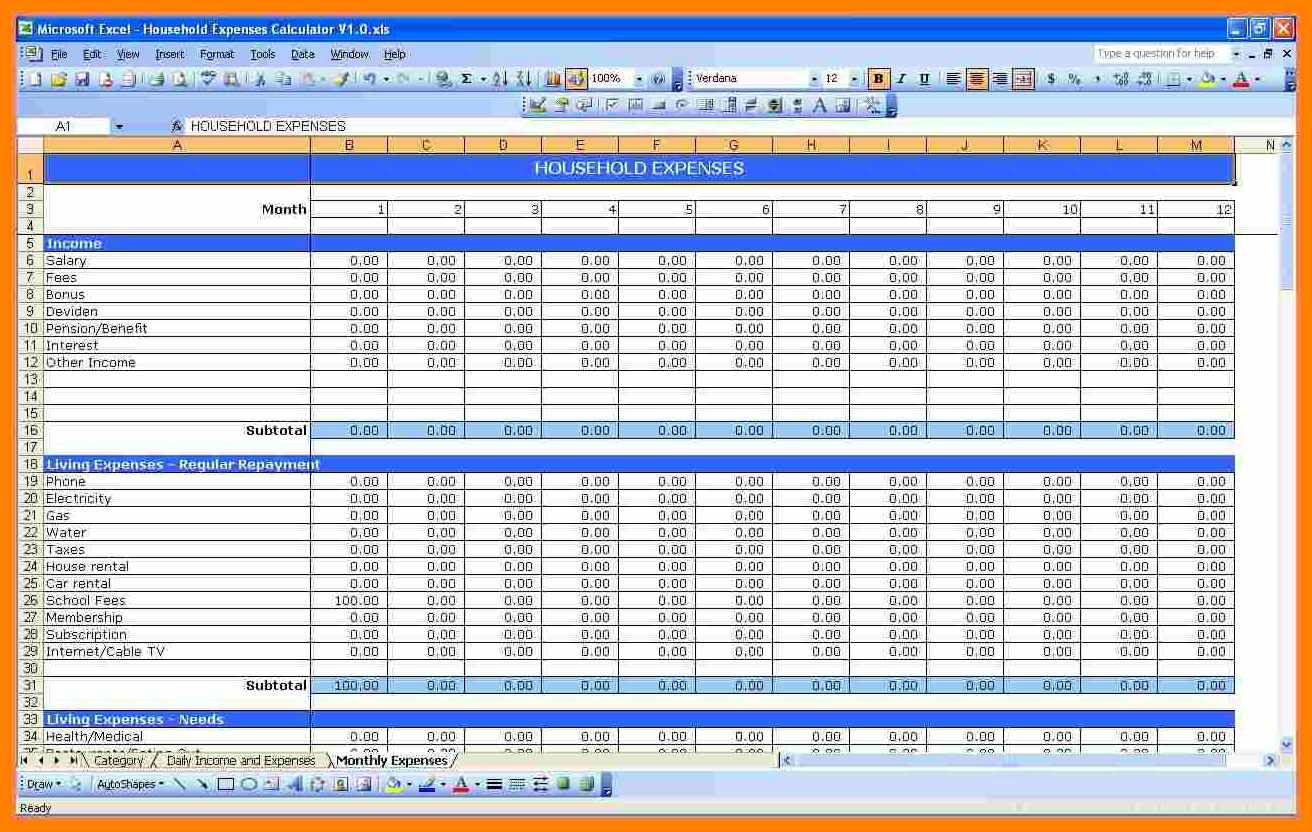

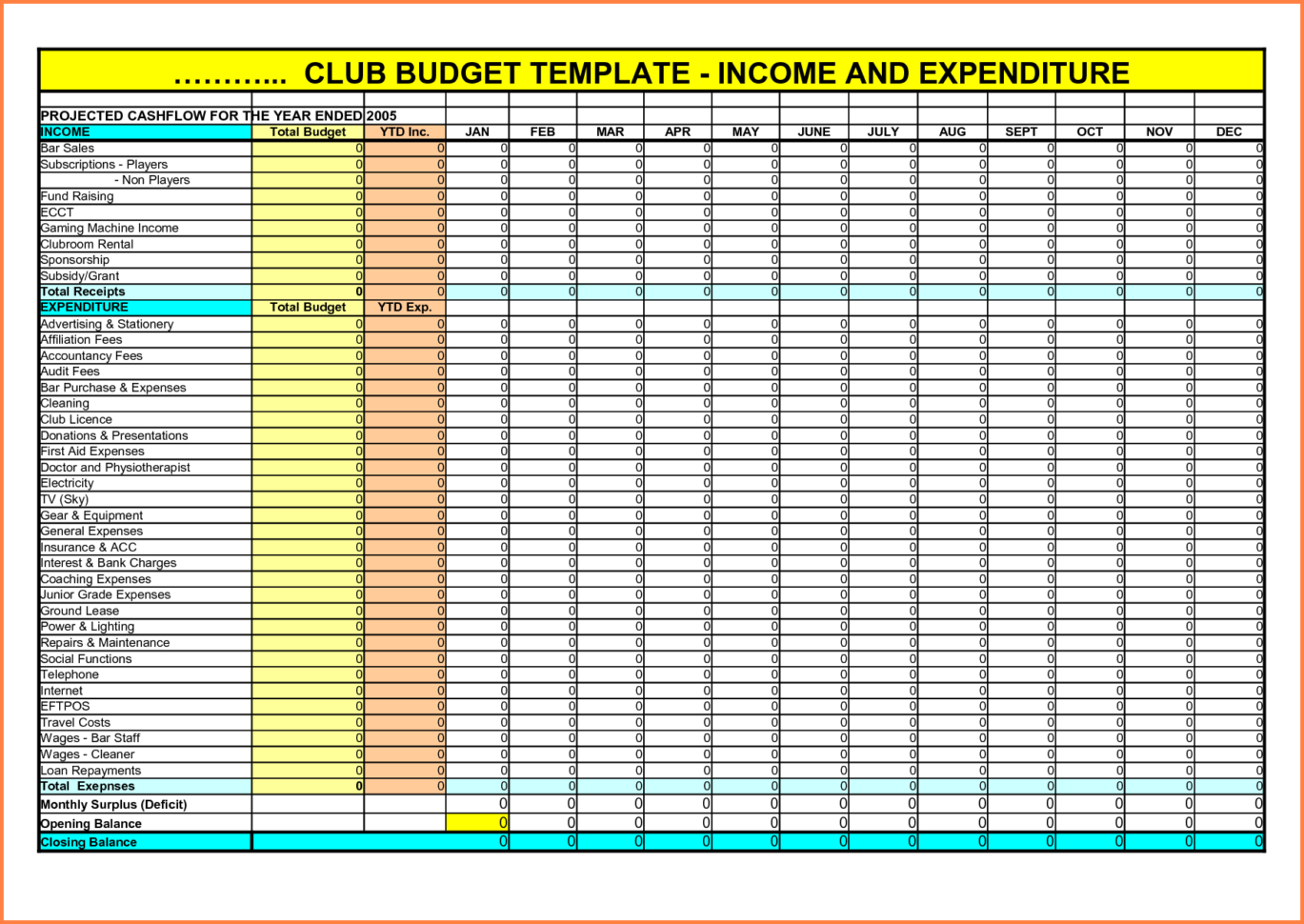

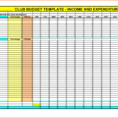

Expense spreadsheet is a chart used to record the expenditure on business and also to examine the cash flow. It helps in effective accounting. It is designed to show the income and expenditure of any business.

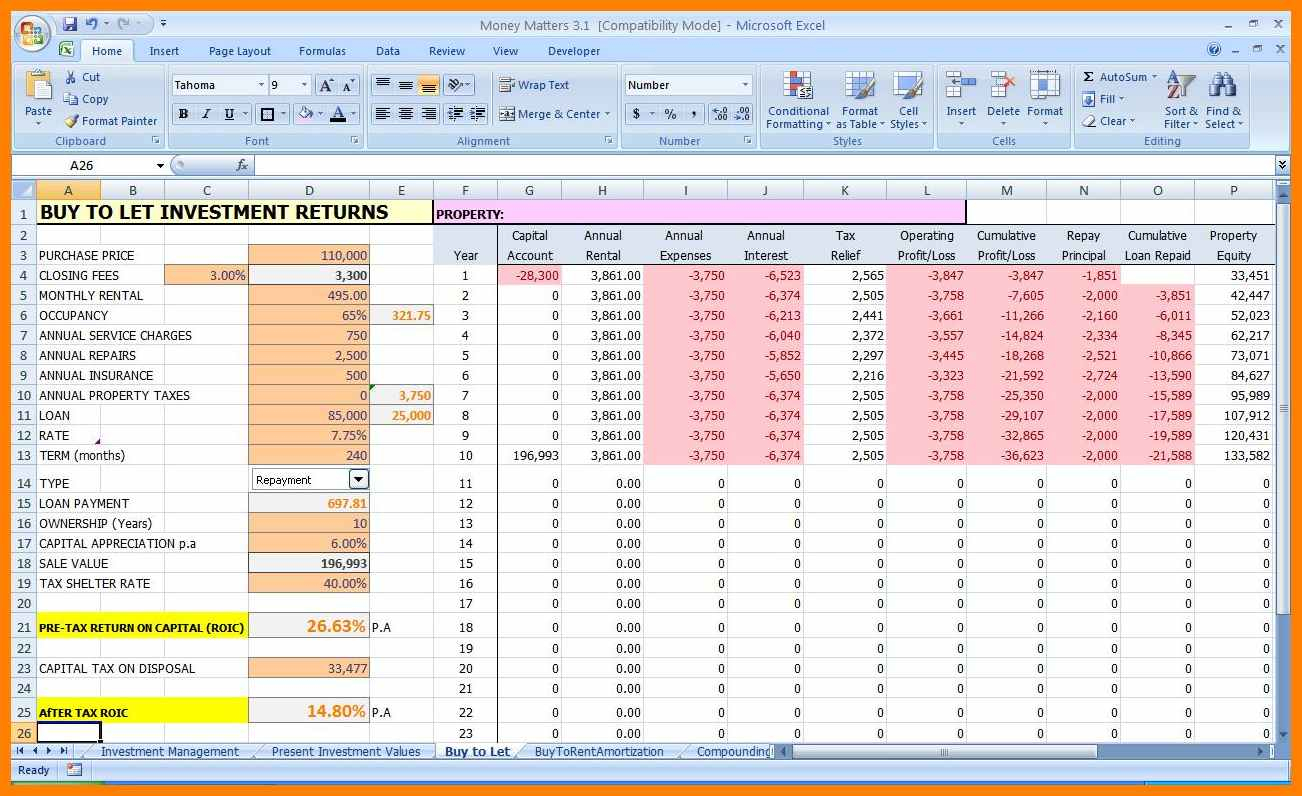

Expensing is the method where an item is written off after its sale. This method may be used in several industries. One of the common methods of expensing is the liquidation. The profit or loss from the sale of a tangible asset is written off as an expense of the business. When a business buys or leases a building or equipment from a supplier or an individual, it is recorded as a capital expenditure.

Any capital expenditure must be recorded as a capital expenditure in the enterprise’s expense spreadsheet. The amount that you can deduct for this expense must be more than your regular operating expenses. Capital expenditure is usually the most profitable way to improve profitability in any business.

Expense Spreadsheet

Any expense that you incur to keep your business running and to make more profits is also an expense. There are many ways that you can record all the expenses that you incur in your business. Some of these are listed below.

These expenses must be recorded on a weekly basis. You can deduct the expenses from your net profit after deducting the amount that you spend on each activity.

The office supplies include the supplies that you use to run your business like mails, fax machines, computers, printers, cell phones, etc. These supplies must be shown as an expense.

The salaries and wages of your employees also count as expenses. An employer will provide salaries and wages to employees to run his business. You should also include this as a line item in your expense spreadsheet.

Find out if there are many people working for you. If so, deduct the expenses incurred by these employees. It is very hard to maintain a single-person business.

You can deduct the expenses associated with your benefit plan. You can either deduct the monthly expenses or the lump sum expenses for your benefit plan.

If you are running a small business, you can deduct some of the expenses like buying office furniture, renting office space, and buying stationery to run your business. You may even be able to deduct some of the transportation costs.

If you have a part time job, deduct some of the expenses related to working and work hours. This includes transportation costs, utility bills, office supply and rent and so on.

Most of the expenses can be deducted. You just need to be certain about the accuracy of the expense spreadsheet. If the expenses you have recorded on the expense spreadsheet are incorrect, then you will have to be financially prepared to take a loss in case your business goes bust. READ ALSO : exchange rate spreadsheet

Sample for Expenditure Spreadsheet