Category: Excel

Time Spreadsheet Template

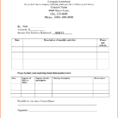

General Labor Invoice

Some people may find the concept of General Labor Invoice a little too far-fetched, but the concept is actually one of the most cost-effective business tools in existence. In a nutshell, it’s an invoice that outlines how much a worker is expected to work. The terms of the invoice are…

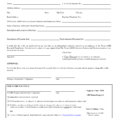

Billing Invoice Sample

The Good, the Bad and Billing Invoice Sample Invoicing can help you to track the transaction of the customers. Basically an invoice contains some information linked to the services supplied by your business. You will need an invoice that is likely to make your small business appear professional and isn’t…

Excel Spreadsheet Gantt Chart Template

Independent Contractor Invoice Sample

An independent contractor invoice sample can be a valuable tool in determining whether or not an employee is really a contractor. Being a contractor is a huge benefit for some individuals, but the term may have negative connotations for some. Contractors are those who hire outside employees to complete work…

Rent Invoice Template

A unique rent invoice template can be an amazing way to make the most of your rental business. Now that more than ever it is a good idea to look at an email template when working on a lease agreement. A rent invoice template can help to get you started…