Category: Excel

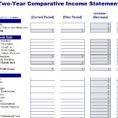

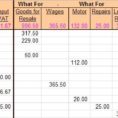

Monthly Financial Planning

Basic Bookkeeping Spreadsheet

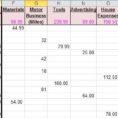

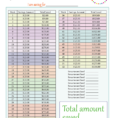

Spreadsheet For Tax Expenses

There are two main types of taxes: income taxes and sales taxes. Although most people tend to use the term sales tax to describe the concept of a personal income tax, there is another type of tax that is entirely separate from these two and is referred to as the…

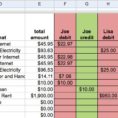

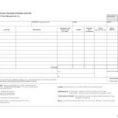

Debt Management Spreadsheet

Using a Debt Management Spreadsheet to Manage Your Finances Debt management is a service that is intended to manage one’s finances and is meant to prevent bankruptcy. A management plan will help the debtor to get back on track with finances and to gain financial control. If this sounds like…

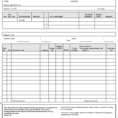

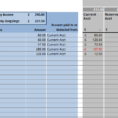

Credit Card Expense Report Template

The credit card expense report template is a short form that will help you be able to keep track of your expenses when using your credit cards. There are many people that use their credit cards every day but do not know how much they spend on them. With this…