Budget forms are used by many businesses to ensure that the income received from an employee is used for the business’s profits. Some businesses hire a freelance worker to fill out these forms. The freelancer does the work and receives the payment as compensation. A freelancer that fills out a…

Category: Excel

Excel Expenses Template UK

An Excel Expenses Template UK that fits your personal circumstances and the type of company you run is the best option to consider when you need to keep track of what you spend on paper. It can save you time and money in the long run and will help you…

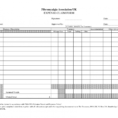

Attendance Tracking Spreadsheet Template

An attendance tracking spreadsheet template can help you in getting all the details for your business organized. Whether it is a small business corporate or university and is concerned with current numbers or those which are past due. Whether you are an employer or student or just a parent of…

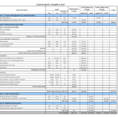

Personal Budget Finance

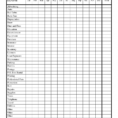

Business Expense Tracker Excel

Excel is the business expense tracker that every business must have in their arsenal. This software can help you make your money go further by helping you with your expense and finance records, reports, and the like. Business expense tracker excel has all the tools you need to be successful…

Financial Planning Excel Sheet

The Pitfall of Financial Planning Excel Sheet The Financial Planning Excel Sheet Pitfall When you’ve established a budget, you are going to want to make decent use of all that spare money which you’ve been in a position to create. Given the simple fact a family budget isn’t exactly an…

Project Expense Tracking

In order to successfully complete your personal or business project, there are certain common expenses that need to be kept track of. Some of these expenses are specific to the project, while others can be general to all projects. One of the more common expenses is payroll fees. Many businesses…