Category: Excel

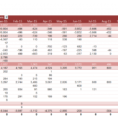

Office Expense Report

When an accountant is a part of a business, the responsibility of making an office expense report is shared. After all, when an accountant performs their work, the money that they get to spend will be the same as the money that a business owner has to spend. However, to…

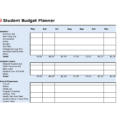

College Budget Template

A college budget template is used to help students and parents to calculate the exact costs of attendance and living expenses. A college budget template is also used for financial planning because they provide an easy and practical solution to numerous financial matters, and they can be used by people…

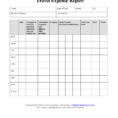

Microsoft Expense Report Template

A Microsoft expense report template is something that all business owners should have at the disposal of their business. This is because it has many benefits that will enhance the effectiveness of your business. With a Microsoft expense report template, you can keep records of all the costs that you…

Personal Finance Chart Of Accounts

Personal Finance Chart Of Accounts Guide In accounting, accounts are categorized into various types based on what they represent. Each account is provided a particular number based on the essence of the account. Rather than having expense categories, you’ve got expense accounts. If you would like to bring a new…

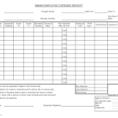

Blank Trial Balance Sheet

The Do This, Get That Guide On Blank Trial Balance Sheet 2 New Questions About Blank Trial Balance Sheet 2 The balance sheet can be quite sophisticated in some templates, attempt to prevent using them. It is mandatory to be prepared by law and to complete the accounting cycle. Making…