When starting a new business, it is important to set up an Excel moving expense spreadsheet. It can help the owner of the business stay organized and make sure that their employees are spending their money properly.

Expenses should be documented, tracked, and written down in a specific location where everyone can see them. The employees will be more motivated to come in early on a Monday morning if they know what they have to do for the day. This is something that will save you money by having everything organized for you.

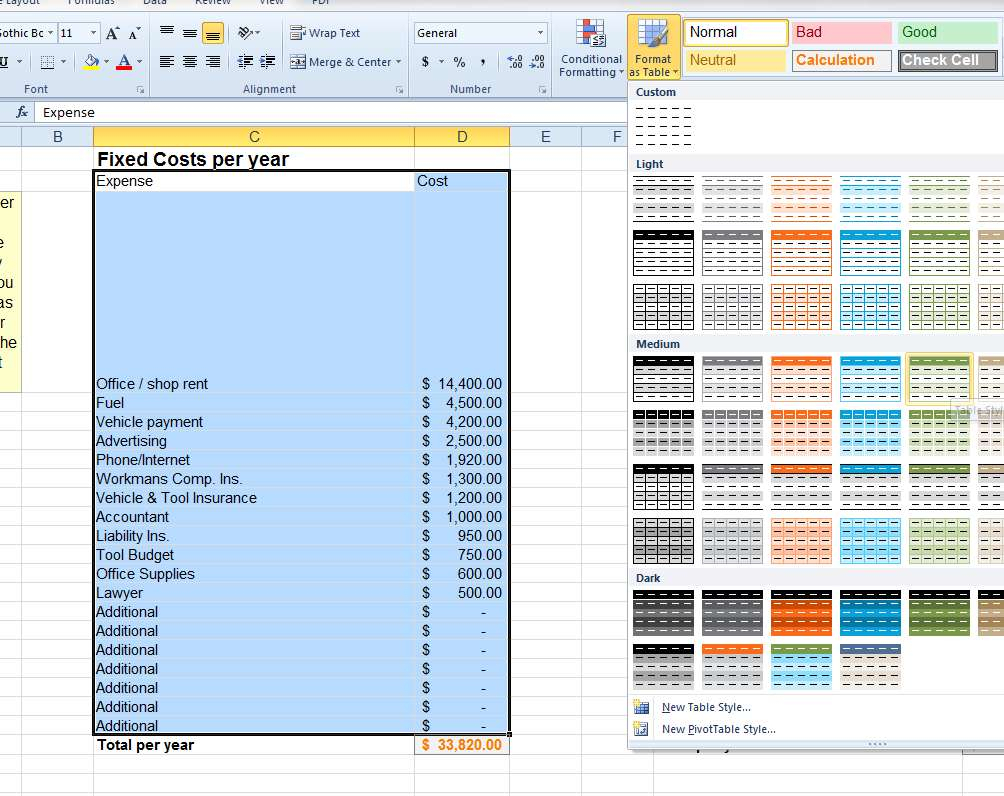

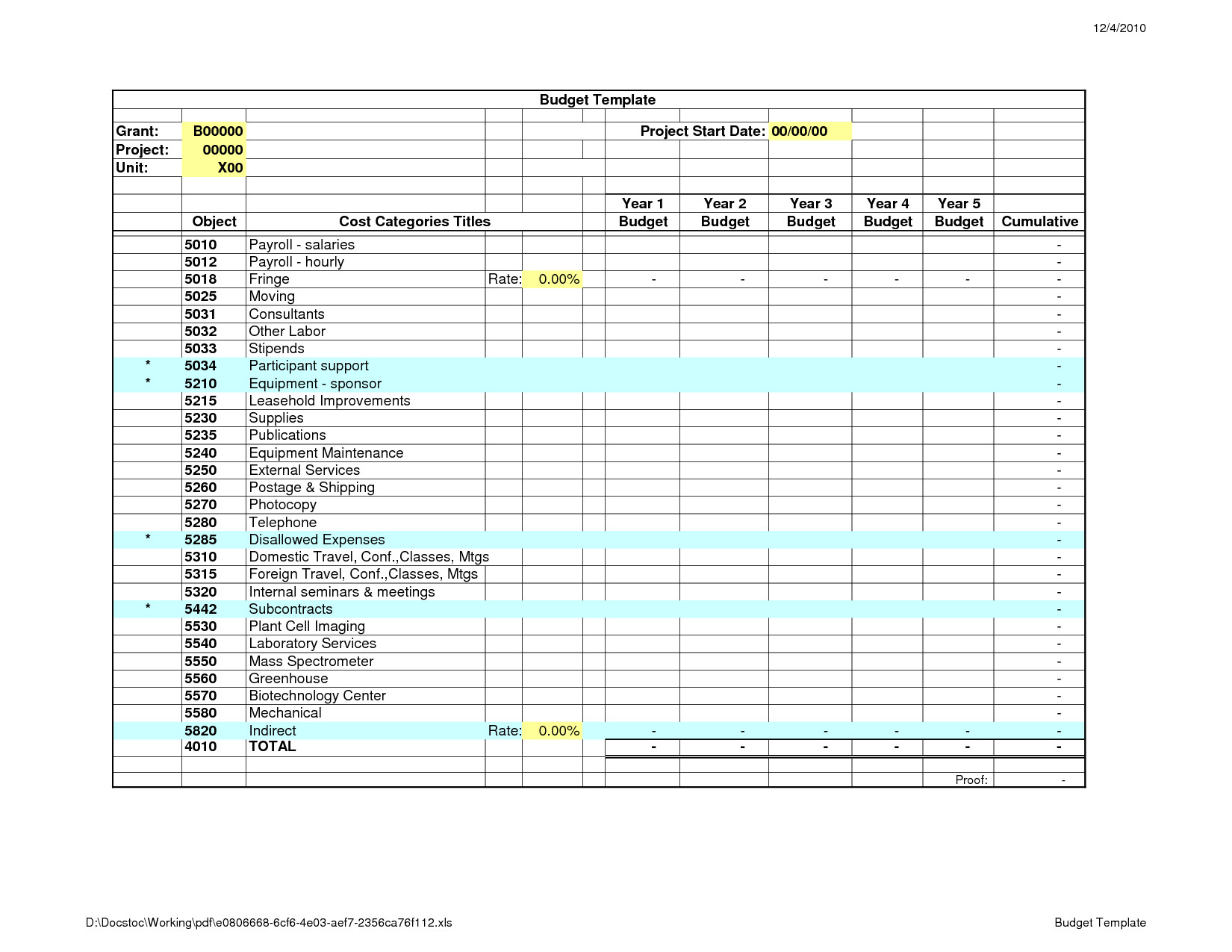

There are often large expenses that will need to be paid on an annual basis. These can include purchase orders, shipping, accounting for inventory, purchases and various other costs that are a part of running your business. While not necessary, it may be helpful to include these expenses on your Excel moving expense spreadsheet.

Accounting for BusinessExpenses With an Excel Moving Expense Spreadsheet

The first expense you will need to track is purchase orders. You will need a computer program that will track them for you. The program should have a specific program to export to Excel, which will allow you to write down the cost of each item as well as how much you spend on each individual item.

Every employee should have a journal on their computer where they will record their tasks for the day. These tasks should be submitted to their supervisor. The supervisors can then use this information to create an overview of the entire workday. The person who creates the excel moving expense spreadsheet should also record these tasks and sales totals at the end of the day to provide an accurate look at how the day went.

Other expenses include sales, receipts, accounts receivable, and income statements. Having a separate sheet for these is also good. A separate sheet of paper allows for thorough tracking of each sales transaction.

All sales should be noted. Although not strictly needed, if you offer any discounts, coupons, or other incentives that could help the customer make up their mind, you will want to be sure to include them on your expense report. This will allow you to better plan out your budget.

When purchasing any new equipment, it can be a good idea to write down all of the components that you need and the estimated cost. This will ensure that you will have all of the parts you need for the project when you purchase them.

Each invoice costs you money and should be recorded. It is important to be able to quantify each item as a separate cost. If you cannot come up with a total price at the time of purchase, you may want to order a paper to help you track and record these items.

All credit card statement should be added to the expense report. When your customer pays with their credit card, it is best to purchase credit cards in bulk. This will allow you to get discounts that will offset any over-limit charges and fees.

Purchasing equipment should be documented as well as any equipment maintenance or repairs. In order to prepare the proper budget for the purchase, it is also necessary to record equipment in-service dates. These dates are critical when setting up the budget because they provide an exact count of the number of hours that you are going to be purchasing the equipment for.

All of these items can be easily recorded and documented on an expense sheet. By keeping a record of these transactions, the owner of the business can keep track of all of the expenses for each employee. Not only will this help to organize the day-to-day transactions, but it will help to provide a clear record of what is going on within the company. READ ALSO : excel money spreadsheet

Sample for Excel Moving Expense Spreadsheet