Create a Life Insurance Policy With an Estate Planning Spreadsheet

An estate planning spreadsheet can help a potential buyer make their purchase of a home more cost-effective and more secure. The spreadsheet will detail all expenses and provisions, and make possible to calculate how much they can afford to pay for the home.

Purchasing a home is one of the largest expenses that any family faces. A good idea to create a properly written, legible and accurate estate planning spreadsheet will allow you to discuss and negotiate with lenders. It will also help you to determine the legal requirements for buying your home, and it will protect your money.

To create a life insurance policy, you need a financial planner. A plan is a deal that you and your partner can agree on, and you will be in charge of negotiating, executing and recording it. However, there are already lots of things that you will need to make a plan that you would like to have. One of them is an estate planning spreadsheet.

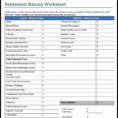

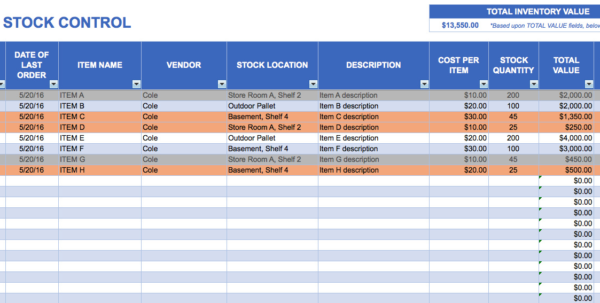

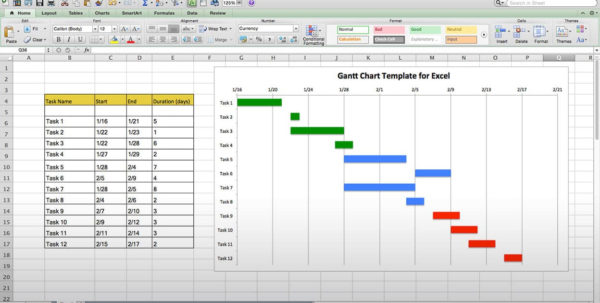

The act of creating an estate planning spreadsheet will help to make your property transfer free. It will also list the investments and any other property you have. You will also have to note down all of your creditors. As you add up all the figures and make a transfer of assets you will then have a financial statement that you will want to give to your creditors.

The Estate Planning spreadsheet will also include the mortgage documents and the escrow documents. This is vital because the other documents will assist in recording your changes of residence and when you close on the house. It will also cover all of the little details that go into the transfer of ownership.

The potential buyer needs to be able to buy the house on the day they close on it. They will have to report this in the document, and this will assist the lender and the agent in the transfer of the title.

All of the documents are completely for the benefit of the prospective buyer. An Estate Planning spreadsheet can make all of the legal terms easier to understand.

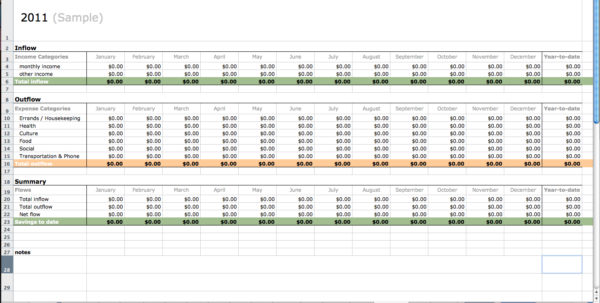

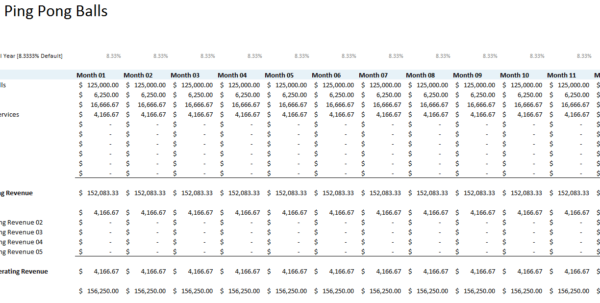

This can help you to have a cash flow analysis that will show exactly how much money you will be able to spend in the next year. If you do not have the right estate planning spreadsheet, you could fall foul of tax laws, and this could get you in legal trouble.

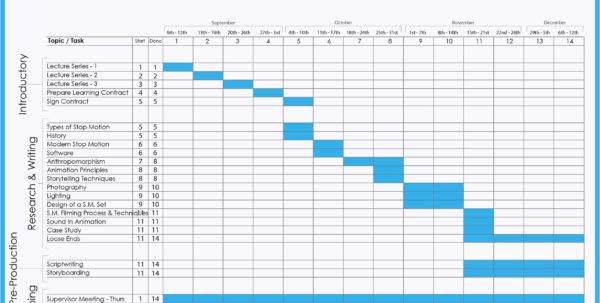

It is advisable to create an estate planning spreadsheet at least once every six months. It is better to create a monthly one, and a yearly one. You should start with a general plan that covers all of the finances and only later go into specific details like the mortgage documents.

There are different ways of recording the finances, and you should use different methods for different people. You will need to use the best plan that you can create.

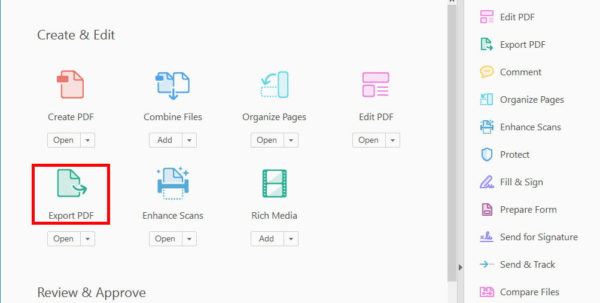

A good estate planning spreadsheet can also be used to create the property transfer free form a bank. When you start using the first estate planning spreadsheet, it will provide you with a good starting point and can help you understand and do what you need to do legally. PLEASE READ : escrow analysis spreadsheet