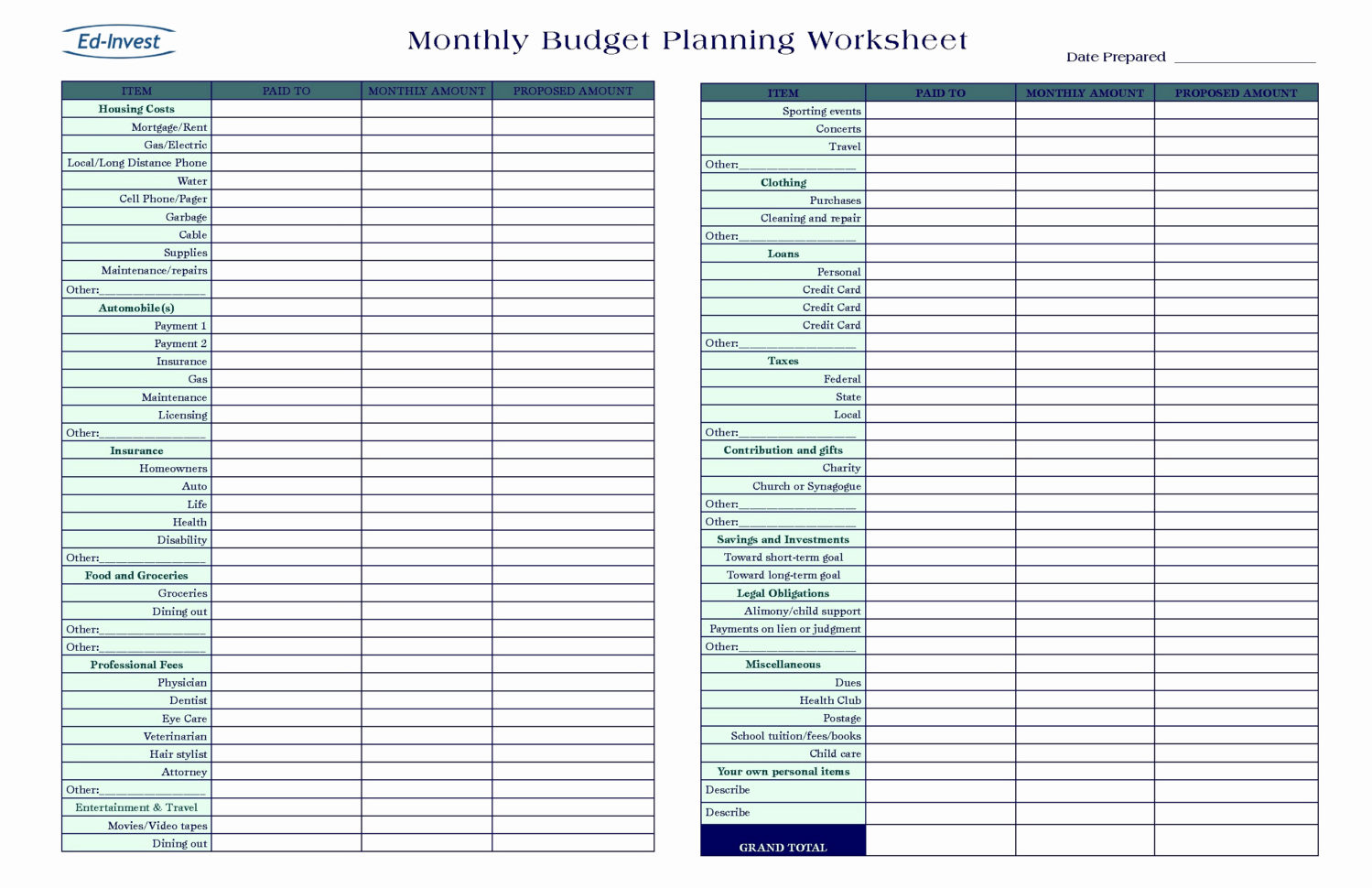

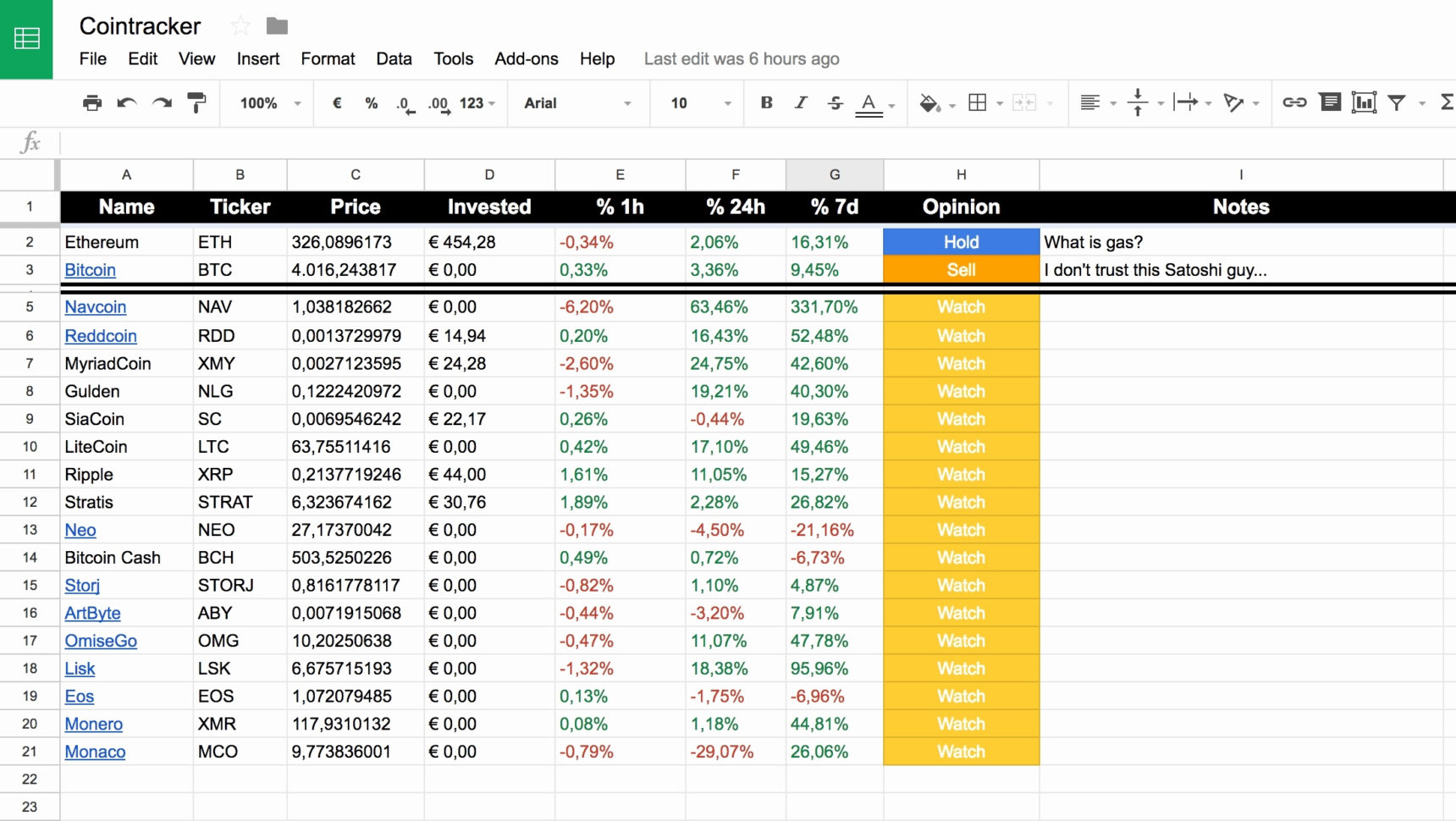

Dues tracking spreadsheet is a vital tool to businesses, no matter what industry they fall under. It’s a powerful tool for businesses and it can help them keep track of their employees’ paychecks. In addition, it can be used for other purposes such as calculating employee benefit costs, determining how much money is owed to vendors, and more.

If you’re unfamiliar with the basics of time management software, you should check out the following information. It will help you familiarize yourself with this type of software and make sure that you understand how it works. You’ll also learn how to use it efficiently, which can save you time and ensure that you can keep your business running smoothly.

The first thing you need to know about a payroll software program is that it provides you with a number of key functions. This includes forms, templates, and reports. You can easily create these kinds of documents as well as create statistics. You can see which departments are most in need of additional funds, make sure that all payroll records are processed properly, and generate reports that are going to help your business in other ways.

Dues Tracking Spreadsheet Software – The Basics

When you use this type of software, you have the ability to simplify your life and organize all of your finances. You’ll be able to keep track of all of your finances, as well as keep tabs on all of your transactions. It can even help you keep track of how many hours each employee is working and how much they’re earning. All of this is possible if you make use of this type of software.

It’s not difficult to do your own payroll files, but it can be very time consuming. This is why there are so many advantages to using software that can assist you in this task. You can let it manage your personnel reports as well as create new financial statements.

These types of financial statements can help you see exactly where your money is going, as well as where your employee’s compensation expense is going. When it comes to employee benefits, it’s important to make sure that you spend as little money as possible. If you don’t keep track of your benefits, it will be hard to find out where they’ve gone.

When it comes to payroll files, it’s necessary to keep track of all of your employee information. This includes details such as the pay period, days worked, and hours worked per week. A typical payroll software system has the ability to store these kinds of data for you.

In order to make sure that all of your workers are paid on time, you have to find out what they earned over the past three months. This way, you’ll be able to easily identify which employees are taking care of which duties. In addition, you can easily determine whether your workers are getting paid at the appropriate rate for the amount of work they perform.

You have the ability to identify which part of your company isn’t running smoothly and it’s easy to check out this system of a typical software system. You can easily track the amount of money that is left unclaimed on all of your unpaid invoices. Once you know which areas of your business are struggling, you can turn things around to make sure that you’re financially stable and effective.

You should always make sure that you give your workers good customer service and decent wages. Having a payroll system is one way that you can give your workers the opportunity to earn more money. You can also use this to pay for employee benefits or even overtime.

Because this software can help you cut down on accounting costs, you can save a lot of money. Most of the time, you’ll be able to use this type of software for free. This means that you’ll be able to save a lot of money for your business.

One of the most important tools that businesses use is software like this. There are many people who use it, but it’s important that you understand how it works and make sure that you can use it to help you succeed. and to help you become successful. YOU MUST SEE : drop shipping spreadsheet

Sample for Dues Tracking Spreadsheet