One Easy Trick for Dividend Aristocrats Spreadsheet Revealed

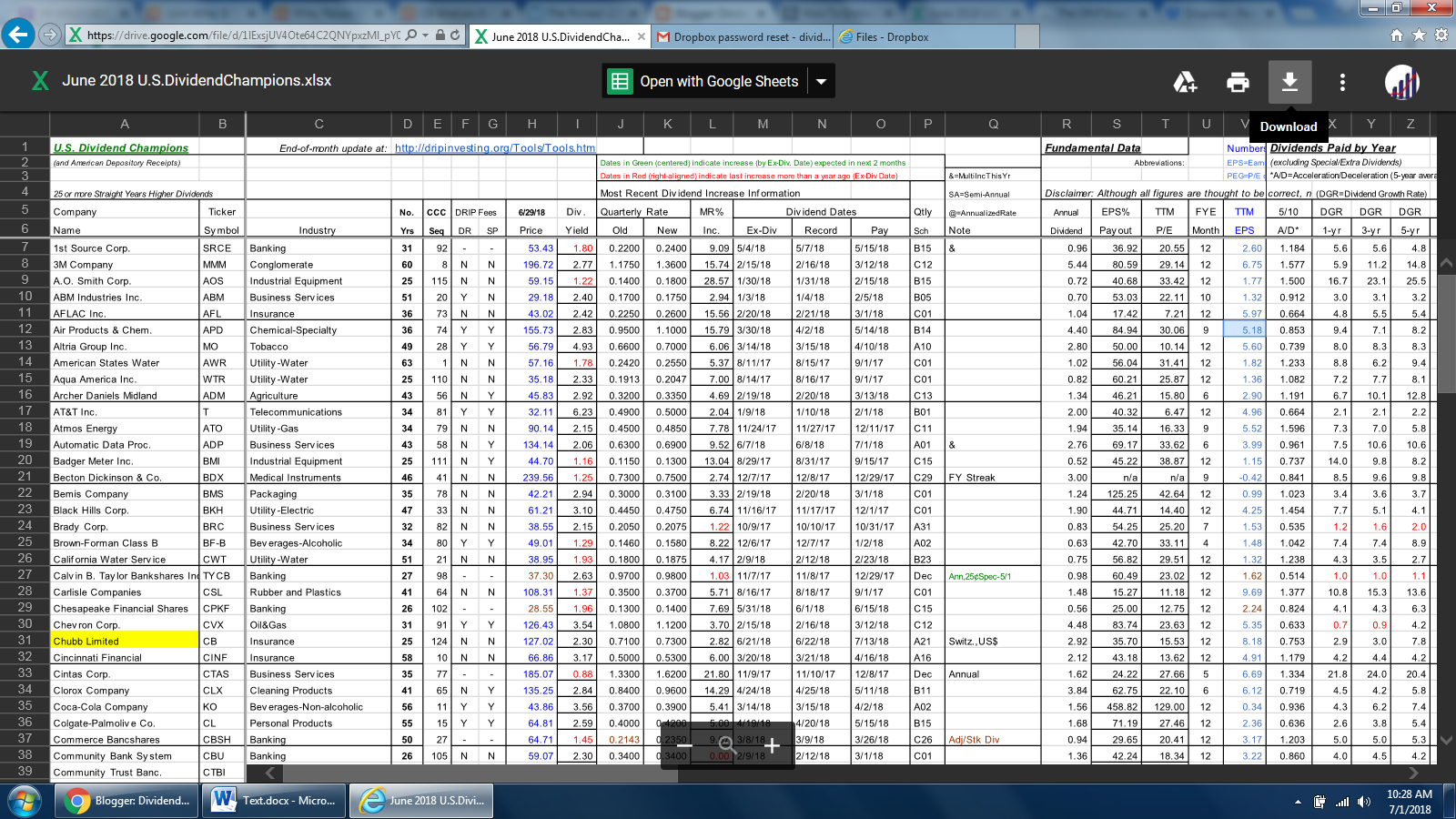

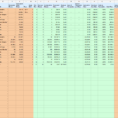

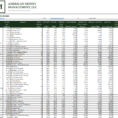

To start with, you’ve got to ready the spreadsheet in Google Apps. It’s possible that you name your spreadsheet whatever you would like. You may use the Dividend Aristocrats spreadsheet to swiftly find excellent dividend investment ideas.

What Is So Fascinating About Dividend Aristocrats Spreadsheet?

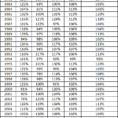

There’s an extra item known as the trading expense ratio, or TER, which isn’t included in the MER. Put simply, for every single dollar you generate in extra yield you may lose a whole lot more than that dollar in the cost return. Growth and value has to be considered too. There are many other factors about the markets generally or the implementation of any particular investment strategy, which can’t be fully accounted for the in the preparation of simulated outcomes and all of which may adversely affect actual outcomes. Moreover, pre-defined yield criteria have to be met. It’s well worth exploring the features of the Dividend Aristocrats in detail to learn why they’ve performed so well.

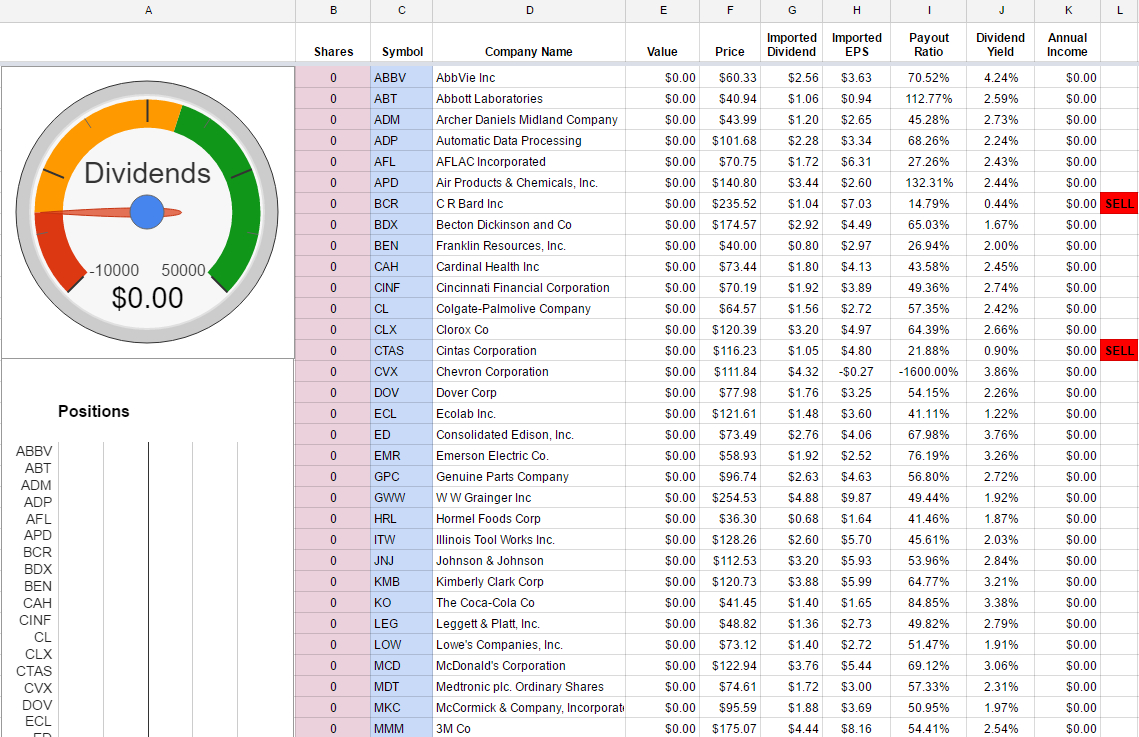

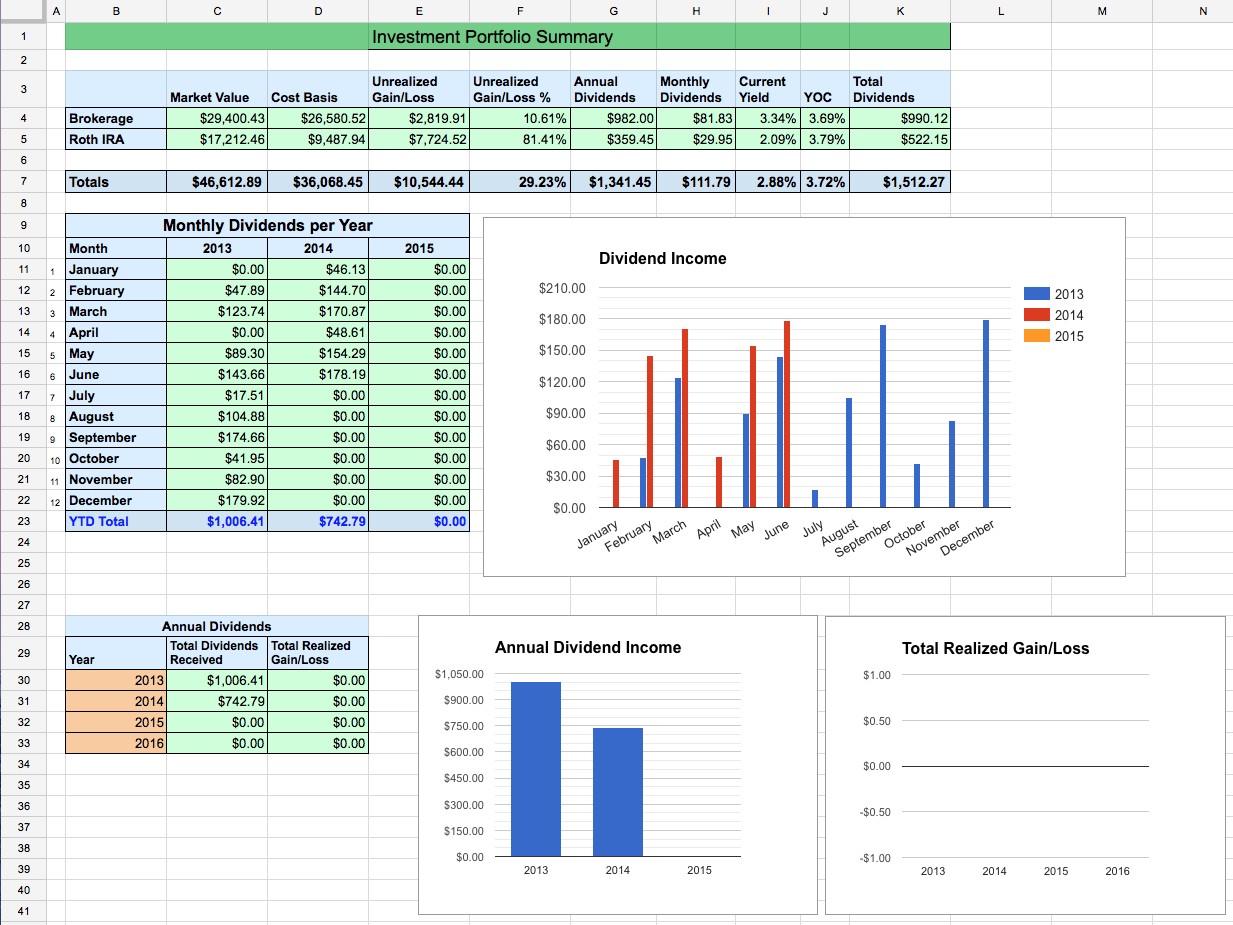

You can make your own pension utilizing immediate annuities from a private insurance carrier. With a dividend growth ETF, it is possible to essentially allocate a particular quantity of income to the particular ETF on a continuing basis monthly and sleep VERY well at night knowing your money is working for you. That prospective income can be quite lucrative for portfolios. Ultimately, if you invest primarily for current income, you may want to know which of the Dividend Aristocrats give the greatest yields. To begin with, because dividends come from the a firm’s bottom line, a good history of raising its payout implies that the business must have some kind of competitive benefit to keep generating profits. You’re also reinvesting your dividends back in the marketplace. Sure Dividend employs The 8 Rules of Dividend Investing to develop high excellent dividend development portfolios.

For index additions, the business should have increased dividend in the very first year of the prior five decades of review for dividend development. Let’s try to get the companies that we are going to be speaking about in 50 decades. Second, it demonstrates that the organization is prepared to return value to shareholders in the kind of dividends. These dividend development companies therefore have a tendency to be more mature companies in nature and don’t consist of many of today’s widely held newer companies like the FANG stocks. A top quality business should outperform a mediocre business over an extended time period, the other things being equal. When a provider makes money, they often have two options on this cash flow. There are lots of companies with sizable financial moats, but not all them are ready to pay a dividend.

You don’t need to be rich to begin your dividend growth portfolio, you just need to be consistent. Investors are challenged since the international financial crisis to discover sources of income without introducing duration and credit risk in their portfolios. Dividend development investors are typically the opposite. Dividend investing has been part of my portfolio strategy since I started MDJ but using a bit more focus on building that part of the portfolio in late decades. Well, investing in individual businesses in the dividend aristocrats list is definitely a thing to do. In addition, the organization’s solid Humira cash flows allow it to put money into research and development and acquisitions that have bolstered the corporation’s product pipeline. The simple way’, and the affordable way’.

Dividend Aristocrats Spreadsheet and Dividend Aristocrats Spreadsheet – The Perfect Combination

The prospectus provides you with a fantastic idea of the fees connected with the fund, the trading restrictions and more. If you want dividend-paying stocks, you’ve got to know more about the Dividend Aristocrats. Nevertheless, it is possible to find some good dividend development stocks in a number of the sectors. The very best dividend development stocks increase there dividend payments annually. Dividend development stocks with a consistent history of increasing dividends are usually viewed as the best of breed stocks. Moreover, hypothetical trading doesn’t involve financial risk. The downside to each of these ETFs is they have expense ratios you must pay every year to invest inside them.

ETFs are simpler to manage, and they follow a specific index which can help reduce the danger of owning individual stocks. If you opt to put money into low-fee ETFs, be certain you look at the discount brokerages that allow commission-free ETF trading. It permits you to seek out the most appropriate ETFs for you by ranking them depending on your preferences. When deciding on a European dividend ETF one needs to consider several different elements along with the methodology of the underlying index and functioning of an ETF.

Using ETFs is a simple approach to improve your income without working more. Not all dividend they are created equal. The ETFs that concentrate on dividend aristocrats typically give investors exposure to companies in many different industries. In various words, these ETFs aren’t necessarily the ones that pay the greatest dividends. Dividend ETFs offer you several advantages. The simple way is investing in a superb dividend growth ETF.

Sample for Dividend Aristocrats Spreadsheet