Using a debt tracker spreadsheet is the fastest way to get rid of your debts and get a better credit rating. The only problem is that most people will not find this information, because it is not the most interesting thing in the world. What they will find is a spreadsheet filled with numbers.

Imagine if you had ten years ago when you started to have loans to repay, and then you took out your first mortgage, and you could not pay the interest on that loan, what would happen? Would you be able to pay off all your outstanding debts in ten years? If you were a good credit risk and you did not pay your bills regularly you would be losing your house in ten years.

So if you have ten years to live, then you will have spent ten years paying interest on your debts. So at the end of ten years you will still owe ten times your credit limit and in the meantime, you will have paid more than you can afford.

Debt Tracker Spreadsheet – How to Use a Debt Tracker Spreadsheet to Get Rid of Your Debts

That is why you need to decide what your debts are, or at least what you think you owe. In my next article I will tell you about how to calculate that.

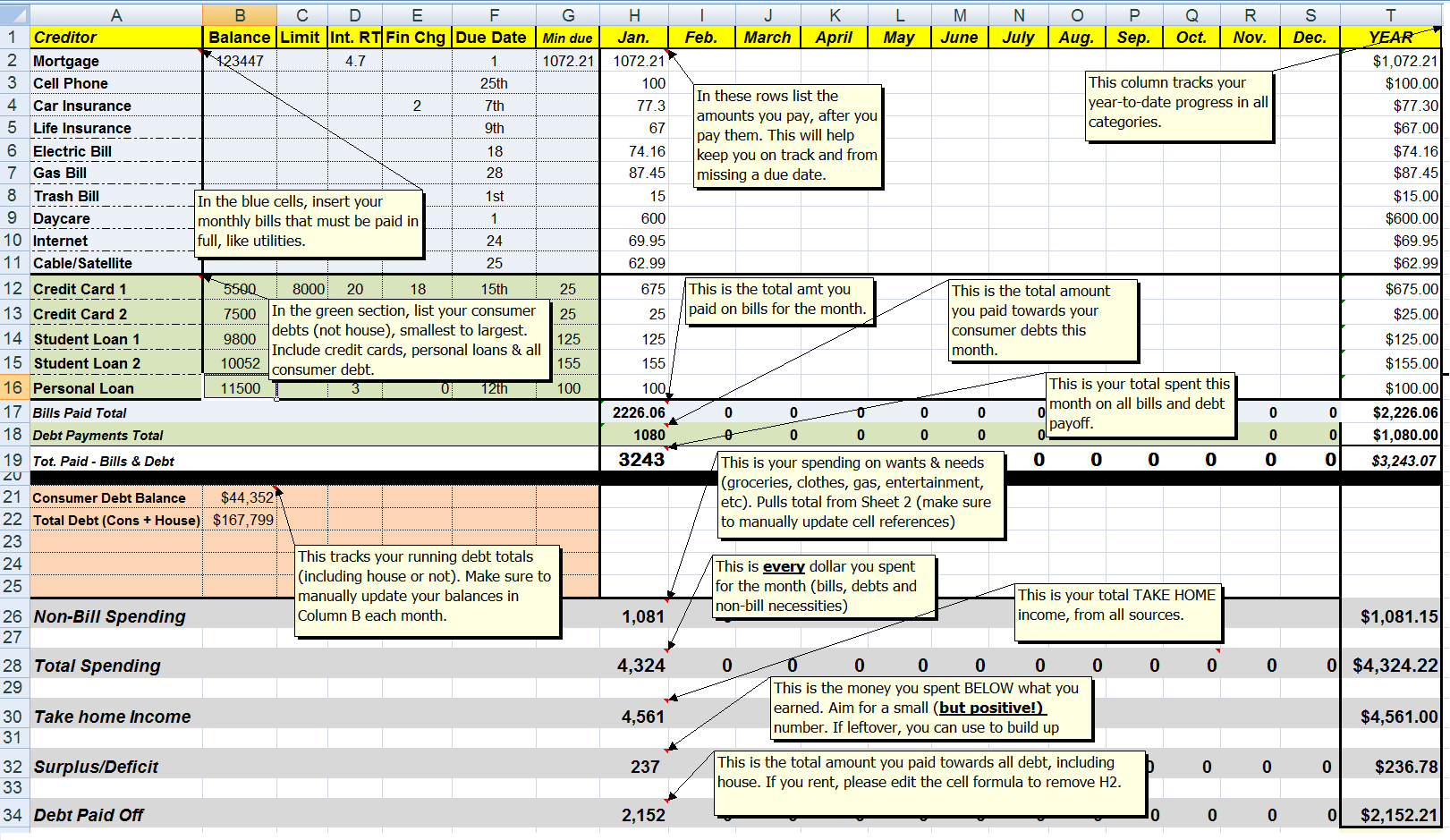

In this article I will show you how to use a new spreadsheet to find out what your debts are, so that you can decide what you owe. This new tool will give you back more cash than you will ever be able to pay, but you can make the math work for you.

In this article I will show you how to start with a spreadsheet and work backwards to see what your debts are. This works because it is almost impossible to take a loan without asking for a mortgage, and if you do not pay the loan back, then your property is taken. But your bank will be very lenient about what you can afford to pay them. You can, with a spreadsheet, work backwards from there.

At the moment, your only option is to try and negotiate with your financial institutions to pay off your debts, and the best that they can give you is a longer repayment term. This means that you will pay more than your credit limit every month, which is bound to add up to tens of thousands of pounds every year. Sooner or later you will have to let the creditors know that you have no intention of paying back the money, and when they come to this you will be forced to sell your home.

Finding out your debts is as easy as using a spreadsheet, just fill in the amount of debt that you think you owe. Then you will need to determine how much you are supposed to pay each month and of course if you could afford to pay even half.

Once you have completed this new spreadsheet you will need to add your income. This is just a way of telling you how much you can afford to pay each month.

This allows you to calculate the amount of money that you can borrow each month and the minimum amount that you have to pay. This is important because the spreadsheet will then tell you what you can afford to pay each month, which means that you will only be borrowing what you can afford.

Once you have done this, and it is very easy to do, you can now begin your negotiations with your financial institutions to see what you can achieve. There is a process where you will negotiate with your lenders and set up a system for paying off your debts that does not include interest, but just the minimum repayment amount.

It is really very simple to use a new spreadsheet to find out what your debts are, and it does not cost anything to use. The biggest advantage of a debt tracker spreadsheet is that it gives you the most accurate result, so that you will know what you are paying each month, and how much you should be. PLEASE READ : debt spreadsheet