The only problem with using a debt spreadsheet is that some people will not agree with it. I will explain the advantages and disadvantages of using a debt spreadsheet to help you understand better.

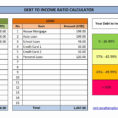

You can get financial information about your family and your business. Some of these financial statements will tell you how much money you have available, how much debt you have, and what you owe. This can help you in deciding on a debt management plan.

Some of the free debt related software is offered on the internet and they can help you figure out how much you owe. However, there are some professional debt software tools on the internet and some of them are pricey.

Debt Management Software – Is it Really Effective?

When it comes to handling your financial problems, you will not be able to solve the problem in one step. There are certain steps that you will need to do first.

Some of the free online resources will not help you figure out your finances or even show you the financial statements. You will have to download the software to your computer and then find out where you can get the required information from your creditors. You will have to provide the information about your assets and liabilities.

The creditors will give you the details that you need for calculating the payments. Some of the creditors will even provide you with financial reports that are free and also give you advice on how to deal with your creditors. It will also help you in the future.

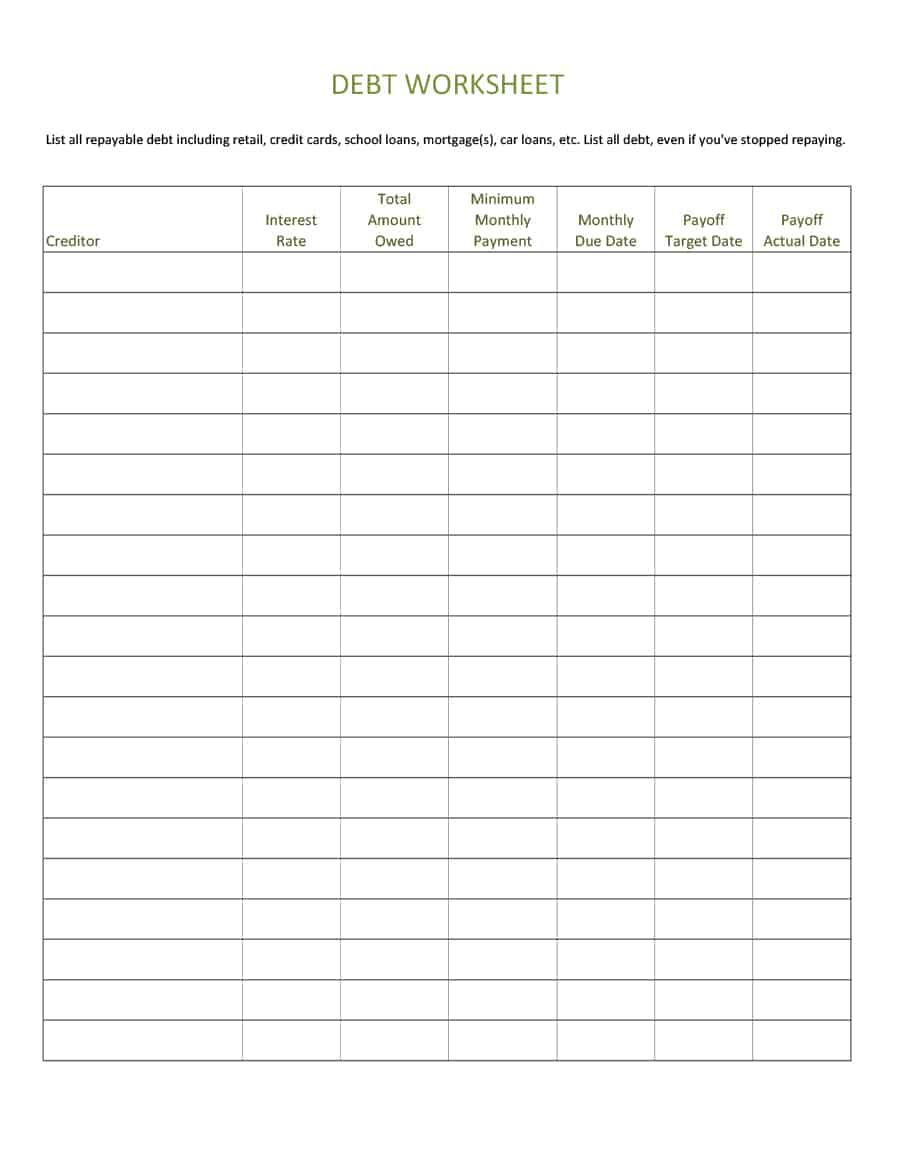

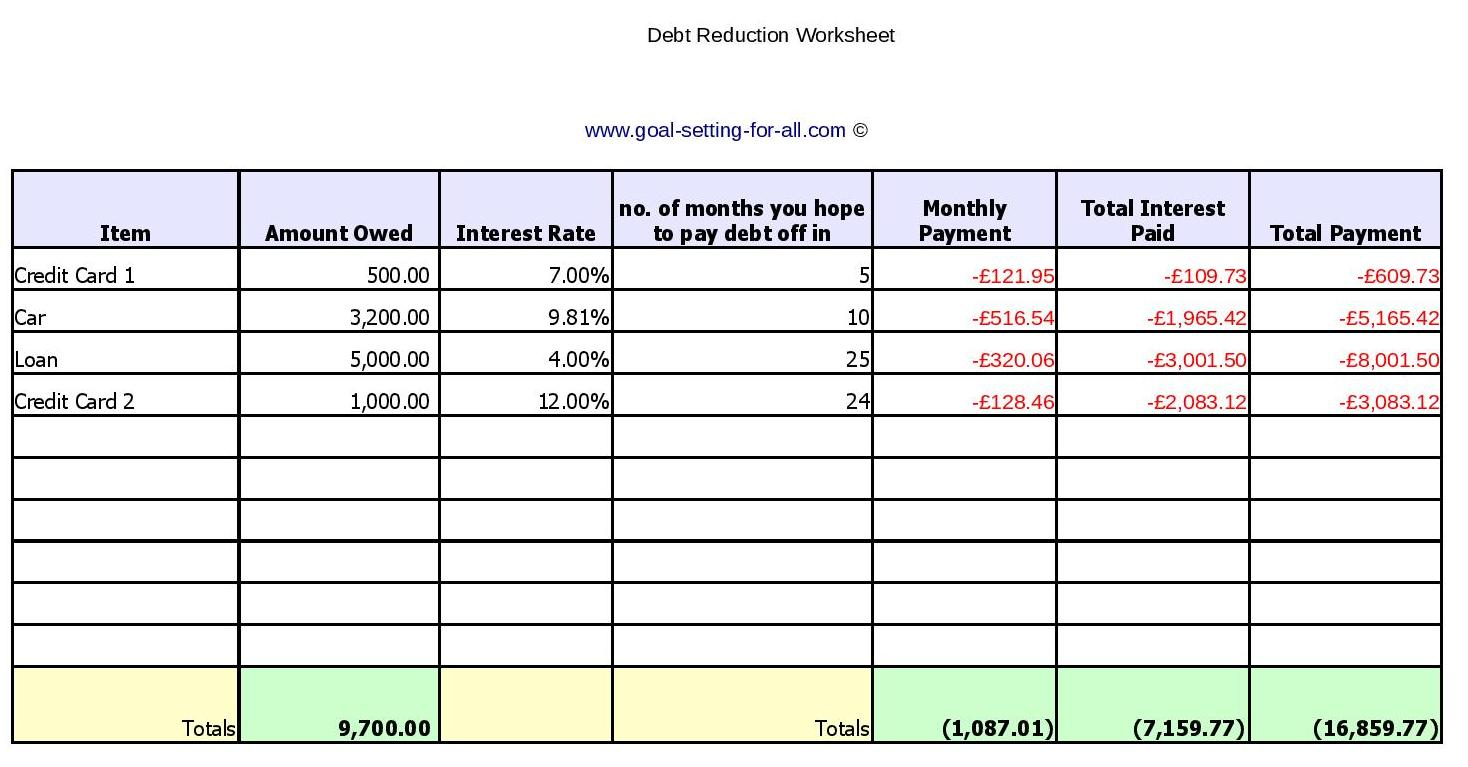

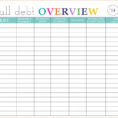

There are many resources that can help you decide how to manage your debt. A debt spreadsheet is one of them.

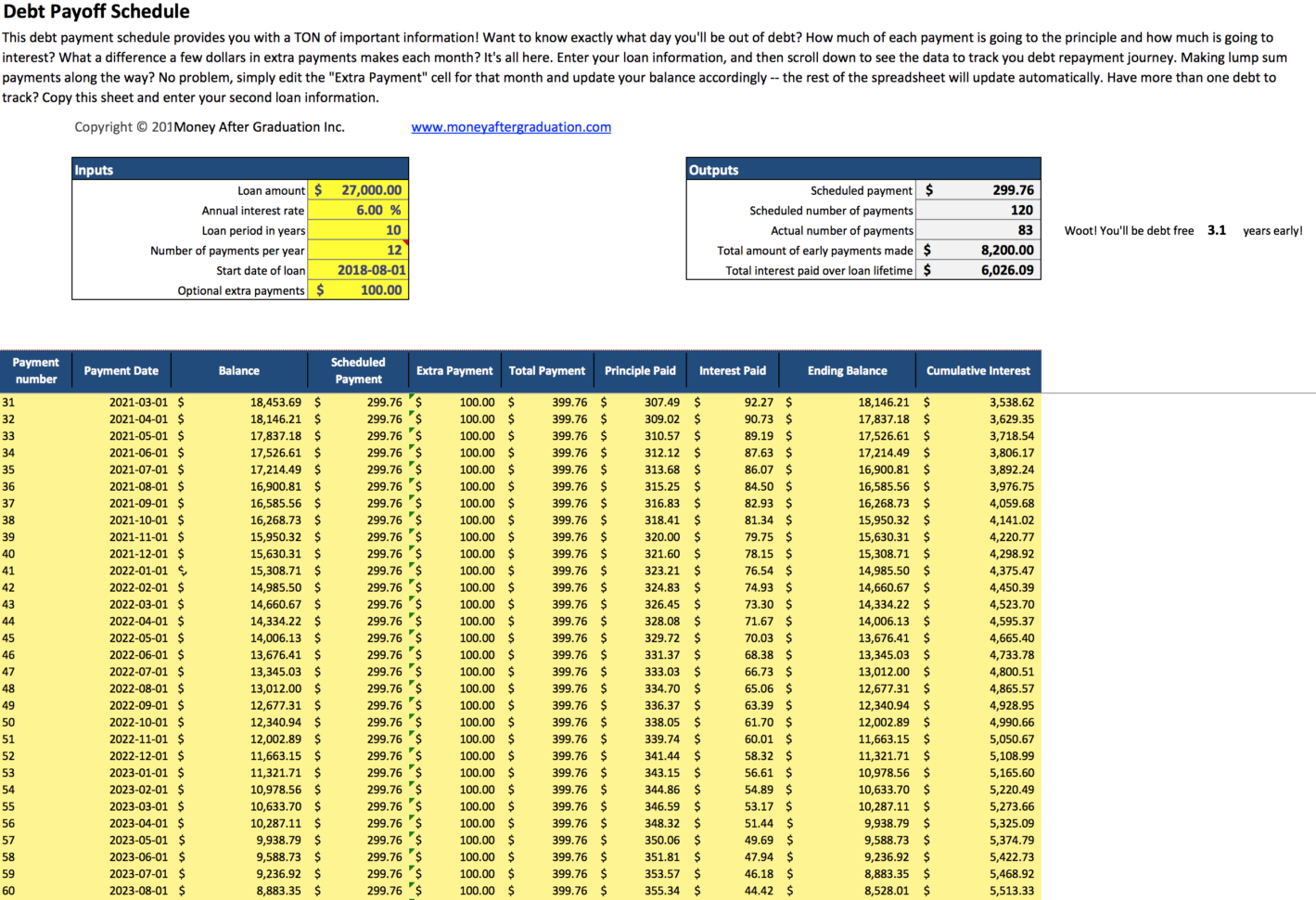

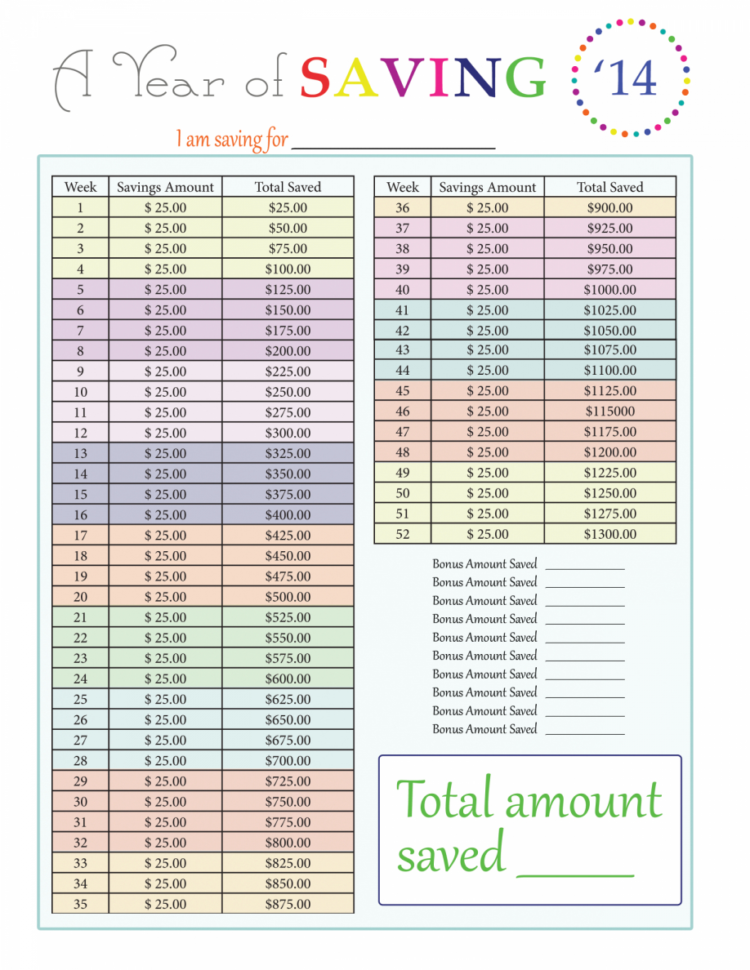

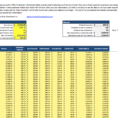

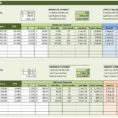

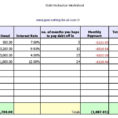

Once you are able to locate the free resources, you can go to an online financial site and download a spreadsheet. It is the spreadsheet that will guide you onhow to manage your finances so that you do not get into more debt and you keep your money in your own account.

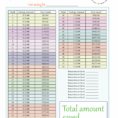

You will be able to check your monthly income and expenses with the help of a financial report. The chart will show you how much income you have left after all your expenses are subtracted.

You will be able to identify the problem areas in your finances. If there is a large gap between your income and the amount of expenses, then you will have to consider the following options:

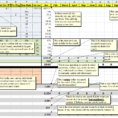

To find a debt management program is one of the most effective ways to solve your debt problem. You will be able to identify the right option for you and then you will get the solution.

You will be able to have a list of financial statements so that you will know the facts about your financial status. You will have to take into consideration other factors such as employment status, credit ratings, and more. PLEASE SEE : debt snowball spreadsheet google docs