Using a debt repayment calculator is a simple way to plan out your debt repayment options and get a handle on your finances. Calculators are very popular because they can also help you understand how your debt will be repaid and where your money is going to come from, whether you’re paying for the cost of the repayments or for the interest payments.

With the internet, it’s now possible to make use of a debt repayment calculator that you can access through your favourite web browser, on the internet. One of the most popular and the easiest to use calculators is the Ivey’s debt repayment calculator, which is available on the website of Bank of America.

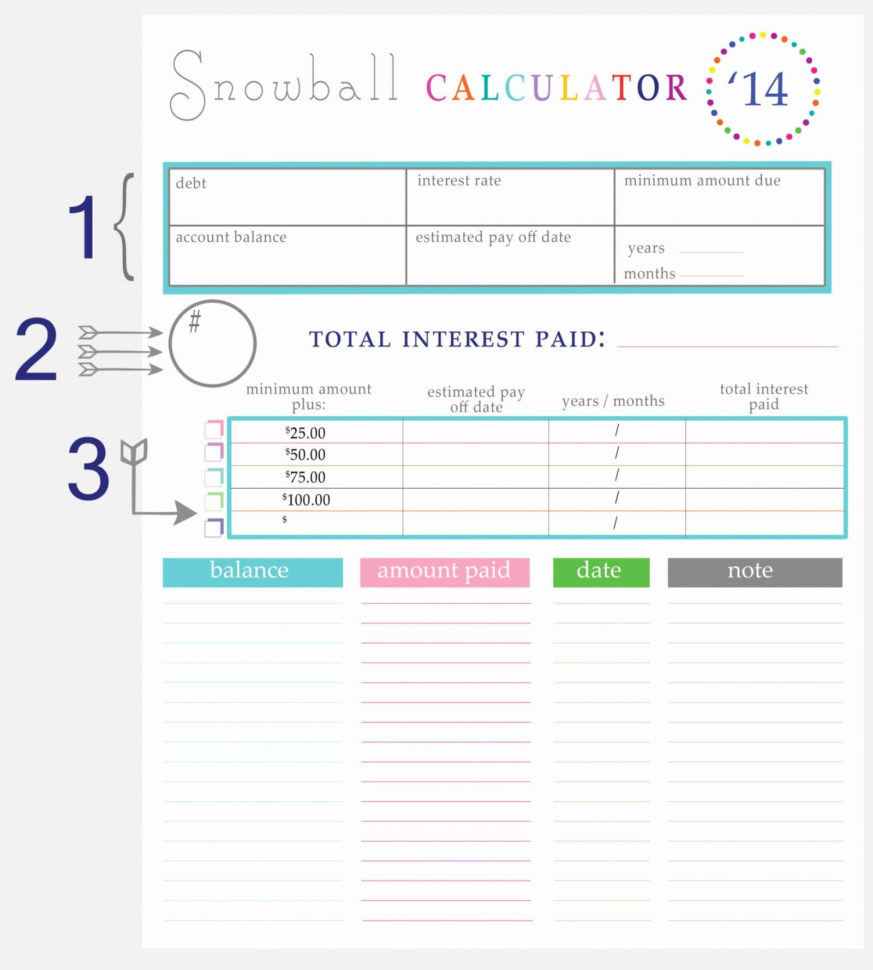

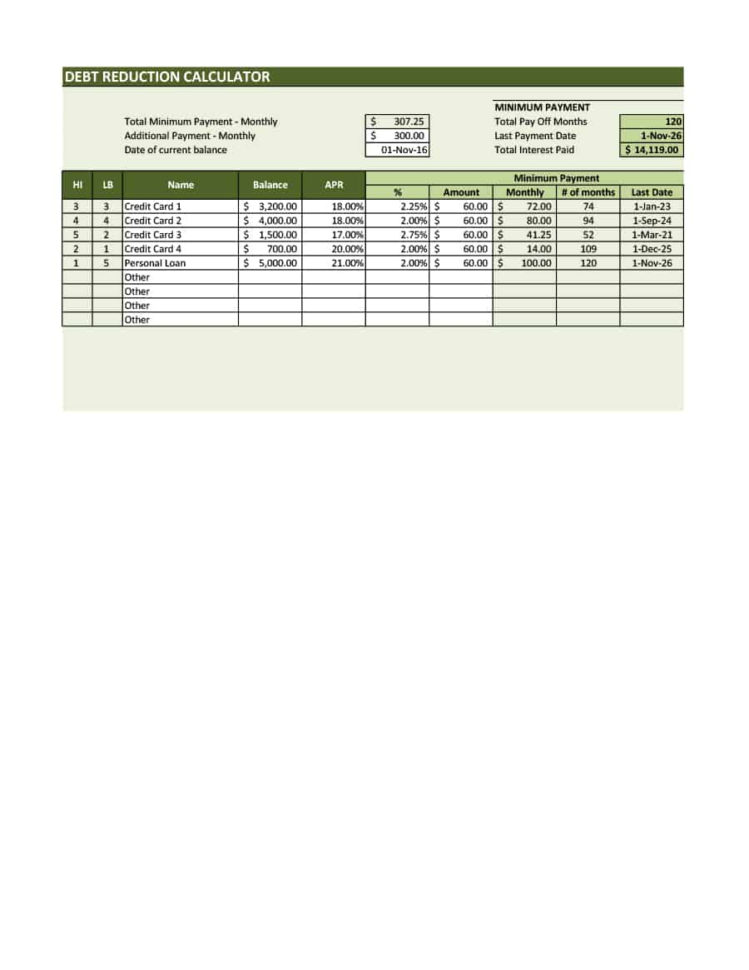

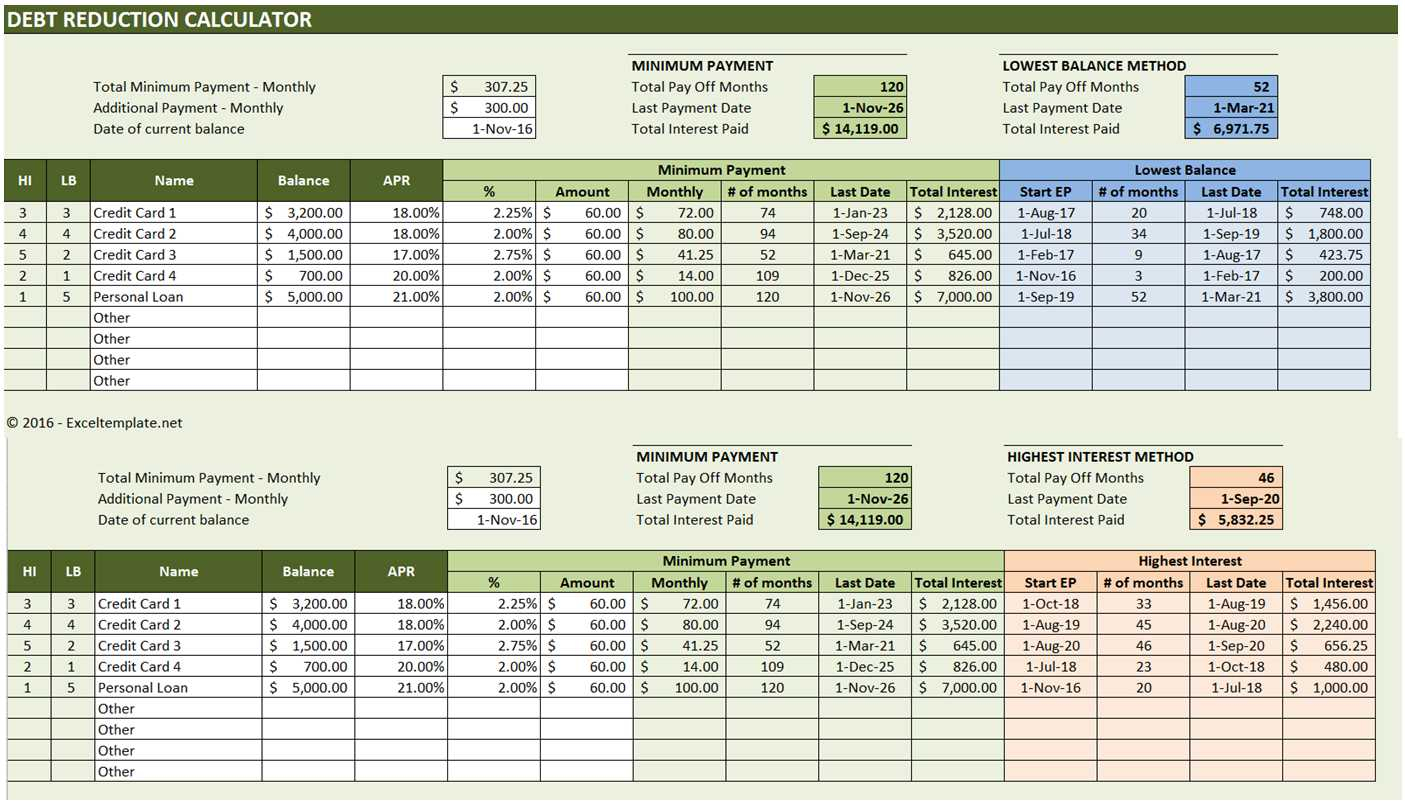

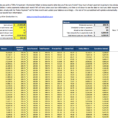

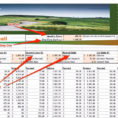

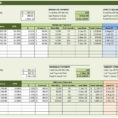

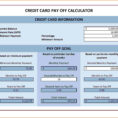

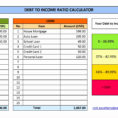

A debt repayment calculator spreadsheet is an excel file that you can convert into an Excel spreadsheet and you can do this yourself by downloading and installing a particular program or any number of easy to use programs that are available online. The benefits of a spreadsheet are many, it lets you see how much you owe and where you are in relation to repaying your debt, including the present and future debt repayments.

Using a Debt Repayment Calculator Spreadsheet For Maximum Financial Planning

You’ll find that most lenders will recommend that you use a debt repayment calculator spreadsheet, but there are some details you need to keep in mind to help your overall goal of meeting your repayment obligation. It’s also important to realize that if you use a spreadsheet to calculate the amount of money you will pay each month, that will depend on how you’re planning to pay your loan, with a loan that requires a monthly payment of $100, it would be just fine to leave the calculator spreadsheet open so that you could see how your income was affected by a new loan and the change in your debt repayments.

There are many companies that provide you with free and easy to use versions of these calculators, but many of them are not as user friendly as the ones provided by their online or offline counterpart. As with most things, you will need to spend some time on researching each calculator that you find and its website before you decide on one.

While it’s not always necessary to use a calculator, or rather, one of the more popular calculator spreadsheet, to calculate your financial situation, it’s always a good idea to have a tool to look at the balance of your debt, so that you know where you stand and which option might help you get out of the hole faster. One of the biggest factors in choosing the right debt repayment calculator spreadsheet is that you must be able to consider several important variables in order to determine your overall goal.

It’s always a good idea to consider your current financial situation and how you plan to pay off your debt. This is an important factor to take into consideration.

Once you’ve determined what your debts are and where you plan to pay off the rest, then you can take a look at how you plan to finance your chosen method of repayment. The calculator spreadsheet can help you see exactly how you will be able to afford the repayments and which financial institution you should choose.

For example, interest rates may be lower if you opt for unsecured loans, such as the unsecured credit card debts that you hold. Or you could also opt for variable rate loans, which could mean paying more in interest.

If you are in doubt, then contact a professional financial advisor and get all the information you need to make a good decision. If you are not sure about what to do, simply follow the links below for more detailed information.

When you make use of the internet and its various online websites, it is often the case that you want to compare different plans and rates of interest. A spreadsheet can really help you to do this and can save you hours of searching around looking for the best deal.

So now you know a bit more about the debt repayment calculator, you are able to see how you will pay off your debt and how much money you’ll need to put towards your repayments each month. It’s an invaluable tool and it will help you make better decisions, and pay off your debts quicker. LOOK ALSO : debt reduction plan spreadsheet

Sample for Debt Repayment Calculator Spreadsheet