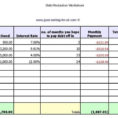

Debt Reduction Spreadsheet – Student Loans, College Financial Aid and Debt Reduction Strategies

There are two types of consumers that need a debt reduction spreadsheet and they are both college students. Let’s look at these two groups of consumers and what they need to know to be successful with their debt reduction strategies.

Students – There are several sources for college financial aid, but many of these don’t come with a guarantee that the government grants or loans will actually be used. A good student loan consolidation program is the best solution to ensure you are paying off your student loans.

Debtors – People who are looking for a way to decrease their debts have several options available to them. Many of these plans involve different methods of debt elimination including credit counseling, debt settlement, and debt consolidation.

Students and debtors who are looking for a debt reduction plan should analyze the plans available to them. They should consider the various options that each of these programs offer.

Student Loan Consolidation – Most student loan consolidation programs come with a monthly payment of around fifty to seventy-five dollars. It is possible to receive up to sixty-six percent of the total debt that was outstanding prior to enrollment in the consolidation program. The total amount that is owed will continue to be repaid through the same lender.

This means that the monthly payments you make each month will not impact your credit score any more than the interest rate that is being paid on the loans is. If the consolidation company that you choose offers a good loan repayment plan, you should be able to save money by eliminating the high interest rate associated with the first set of loans.

Credit Counseling – There are also several counseling companies out there that can help you manage your debt. These companies will advise you on how to deal with the creditors and will also help you determine the best option for you. Sometimes, consolidation companies offer credit counseling.

Debt settlement – Debt settlement offers the possibility to eliminate between fifty to seventy-five percent of your total debt. The payments that you make each month will not affect your credit score any more than the interest rate that is being paid on the debt consolidation loans.

If you are looking for a debt consolidation program, remember that the payment of your debt will not increase any further than the payment that you are making now. The interest rate that you are paying will not change either.

Debt settlement is the best method to get your debt under control, but it will also give you more time to deal with the creditors. If you have a lot of debt, you may find that the creditors are willing to negotiate a lower interest rate.

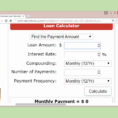

If you are in financial trouble, it is important to work with a consolidation company. You may need to use a debt reduction spreadsheet to reduce your overall debt by a significant amount. PLEASE READ : debt management spreadsheet