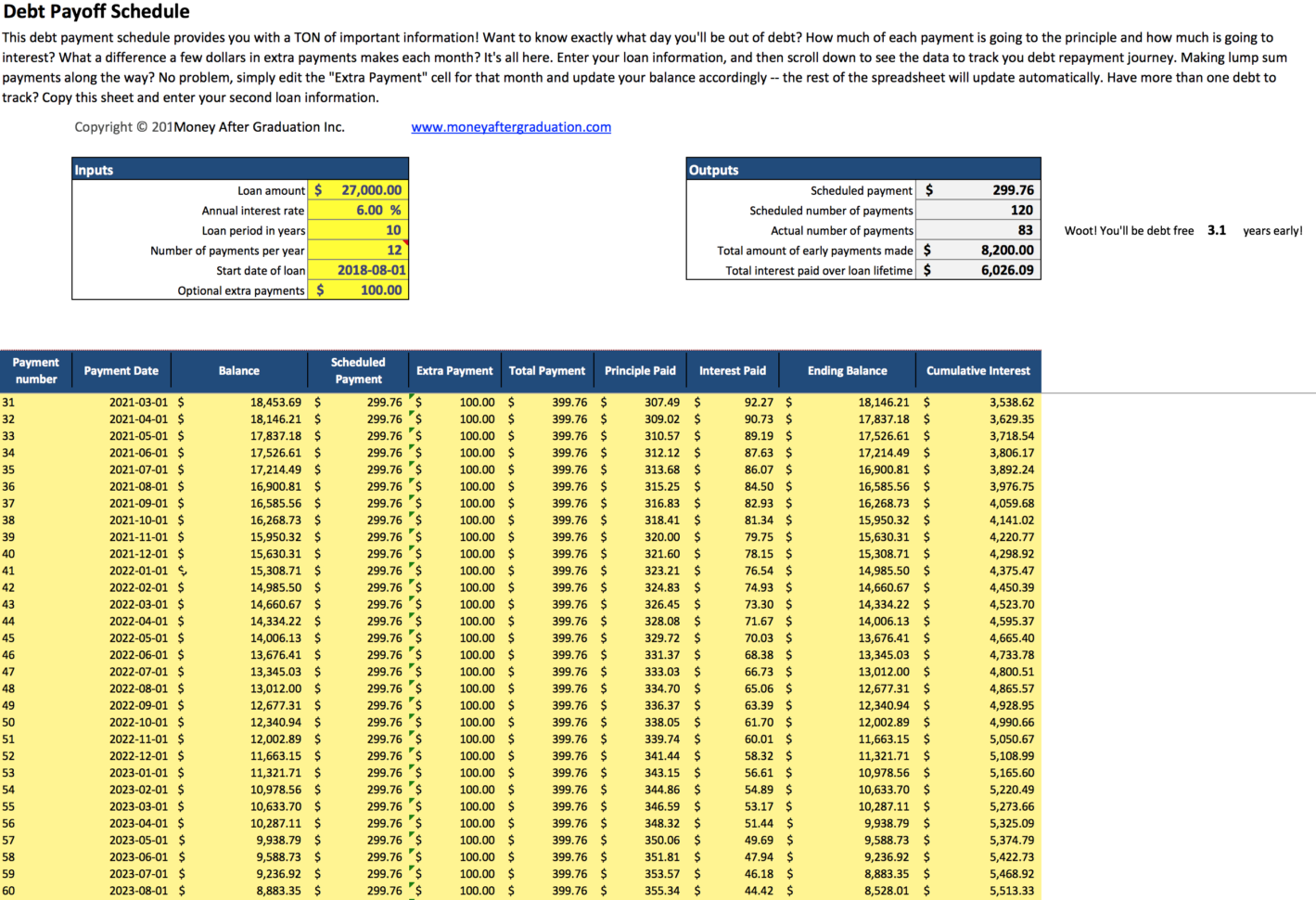

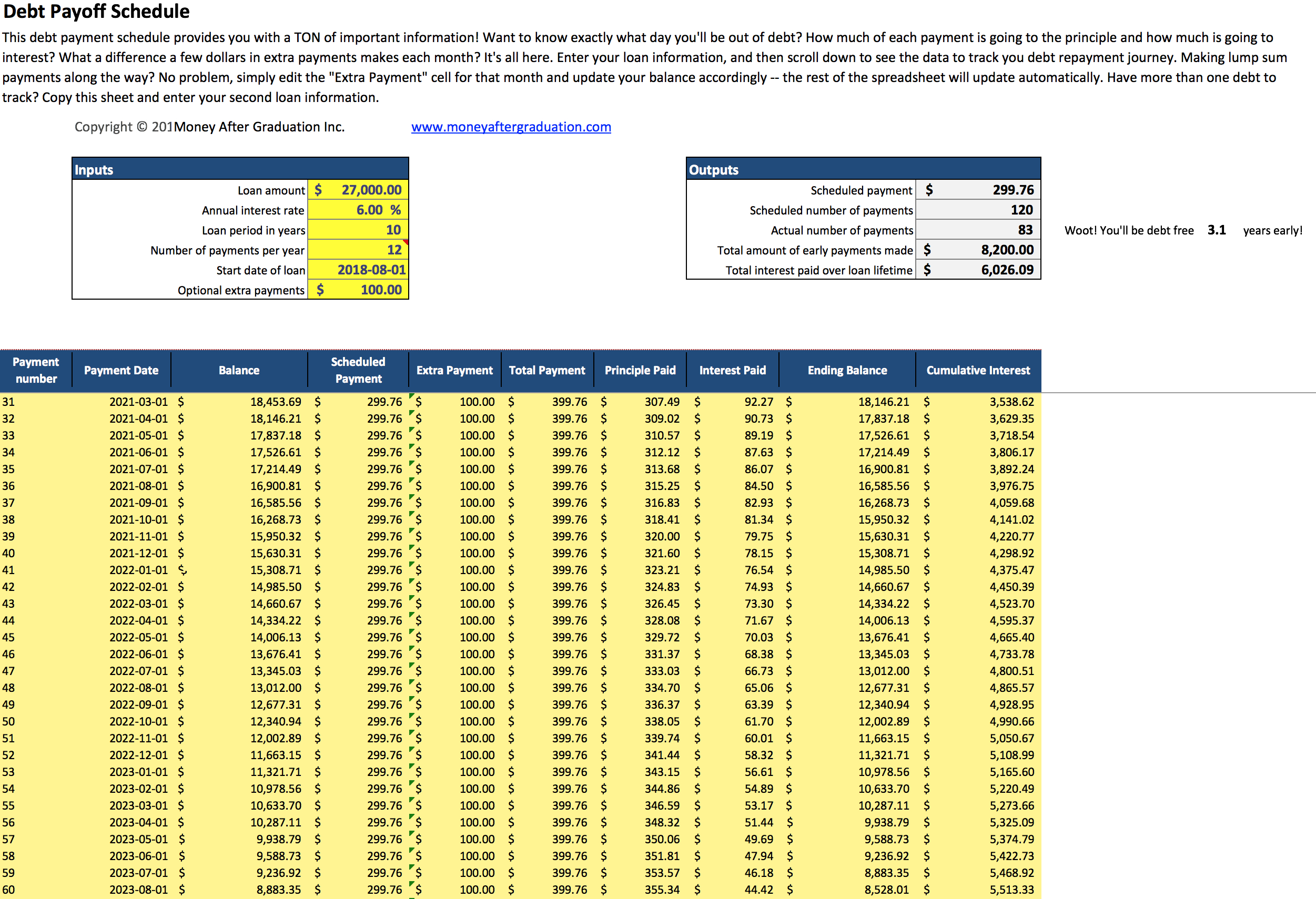

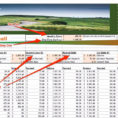

A debt payoff spreadsheet has made much better sense as the financial world continues to shift around. It is no longer just an economic tool, but more of a professional and smart move to achieve your goal. If you use a debt payoff spreadsheet, you will get an idea of how your money is flowing to your other creditors.

The first step is to take a look at your cell phone bill. Now that you have a complete list of every charge, you can enter them into the spreadsheet, leaving some blank, such as sales tax and mail charges.

Once you are done entering your cell phone bill, it is time to add in some expenses. This includes your bills for a cell phone, cable TV, air conditioning, groceries, and even a pair of shoes. Now, go back through the report and add all of your expenses to the total amount. If any of them are incorrect, try and get them to the spreadsheet so you can correct them there.

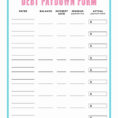

Debt Payoff Spreadsheet – How to Use a Debt Payoff Spreadsheet To Improve Your Credit Card Debt

Do this for all of your cell phone bills. The next step is to add in your expenses for gas and for food. You should be paying at least two gas cards, one for every use of a car.

Next, go back through your cell phone bill and add all of your credit card expenses. Be sure to include all charges on a credit card, such as travel, food, entertainment, and any other purchases. One important thing to note is that you must always know exactly what it is you are charging on each card.

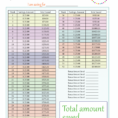

Finally, you want to get a list of all of your payments and paychecks from both your paychecks and your paycheck stubs. When it comes to a paycheck stub, you want to make sure that it shows the money that is due to you. You can use the spreadsheet to create an approximate payment schedule. This is handy to have in case you lose your job.

After you have created in your spreadsheet, you can go ahead and print out all of the information and take it with you to your local loan agency or bank. The information should show all of your money moving around the different financial institutions. This allows you to stay organized when it comes to getting out of debt.

When you are ready to file your loan request, you can print out your debt payoff spreadsheet. It will give you a good idea of how much you will need to pay off your debts. Then, you will be able to cut your payments into manageable amounts.

Take care when you are filling out your loan application. Make sure that you list all of your payments on your loan and then make sure that you use the best interest rate you can. The best interest rate is going to allow you to make a smaller monthly payment, which will allow you to pay off your loan in less time.

Another tip for using a debt payoff spreadsheet is to set up a budget. Once you get a clear idea of where your money is going, you can make adjustments to your budget. Your needs will be covered.

By keeping a running total of where your money is coming from, you will know what you can afford. When you do not have the funds to cover a particular expense, you can raise your budget to cover that expense, while still keeping the same total amount you have set for yourself.

Using a debt payoff spreadsheet is a great way to keep track of where your money is coming from. Your budget will give you a clear picture of where your money is going, and you will be able to keep track of your spending. SEE ALSO : debt payment spreadsheet

Sample for Debt Payoff Spreadsheet