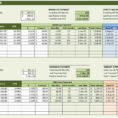

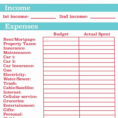

A debt free spreadsheet can make your financial life much easier. The spreadsheet is a spreadsheet with a built in budget tool, which can keep track of your income and expenses. This tool enables you to allocate money for expenses that are important to you and to track whether your money is being spent effectively.

It is extremely difficult to live a financially sound financial life. This is because many people are not aware of the necessity of budgeting and aren’t aware of the solutions that are available. This leaves them in a position where they don’t know what to do next.

Many people aren’t aware that an overview of their finances should include two areas: the balance sheet and the expense list. This is because when you understand how your finances work, you’ll be able to identify problems and find solutions to them.

Help Yourself Eliminate Debt With a Debt Free Sheet

This can really help you keep a tab on your finances, and it can also help you find ways to save money. If you’re serious about achieving financial freedom, you need to know about your finances so that you can help yourself to improve your situation.

As far as budget software goes, there are a number of different software packages available. Each one has its own unique advantages and disadvantages. You need to do your research to decide which one is the best for you.

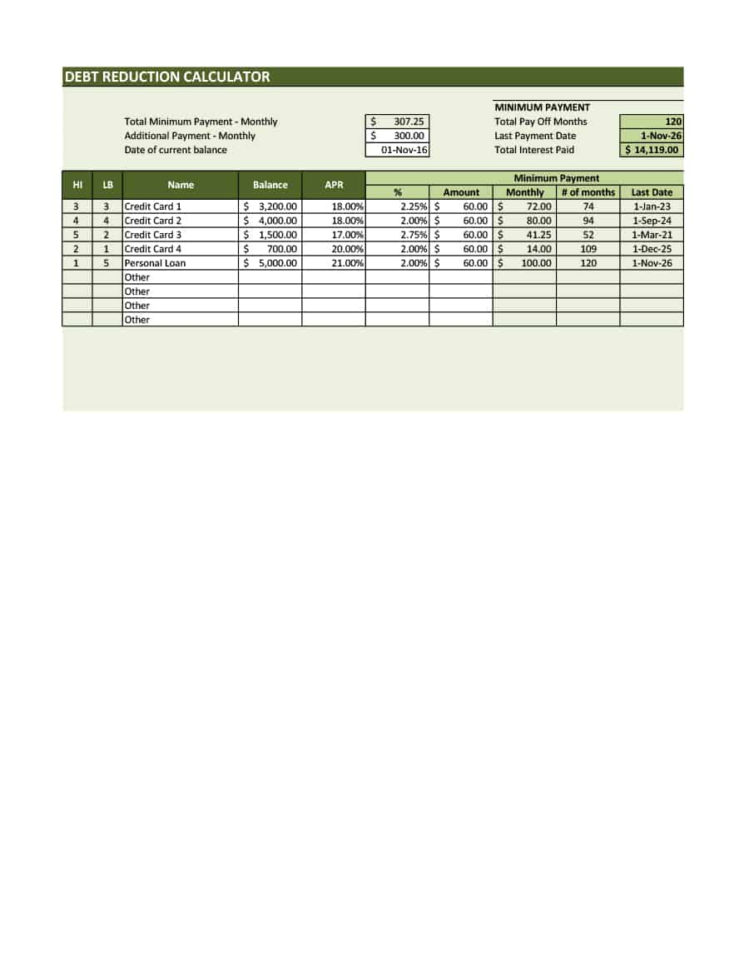

A debt free spreadsheet can make your life easier by allowing you to create a monthly budget and to see where your money is going. It is a great help in the creation of an organized financial plan.

Most of the budget software requires you to enter information, usually on a spreadsheet, into it. Once this is done, you can monitor the details of your finances from your home computer. It is very easy to enter the budget into the software, and once it is completed, you can use it again to monitor how much money you have been spending.

To make a debt free spreadsheet, you will need a computer with an internet connection, a spreadsheet program, and a credit card or other payment processor. If you choose to use a debit card, you will also need to get an online payee to process the credit card payments.

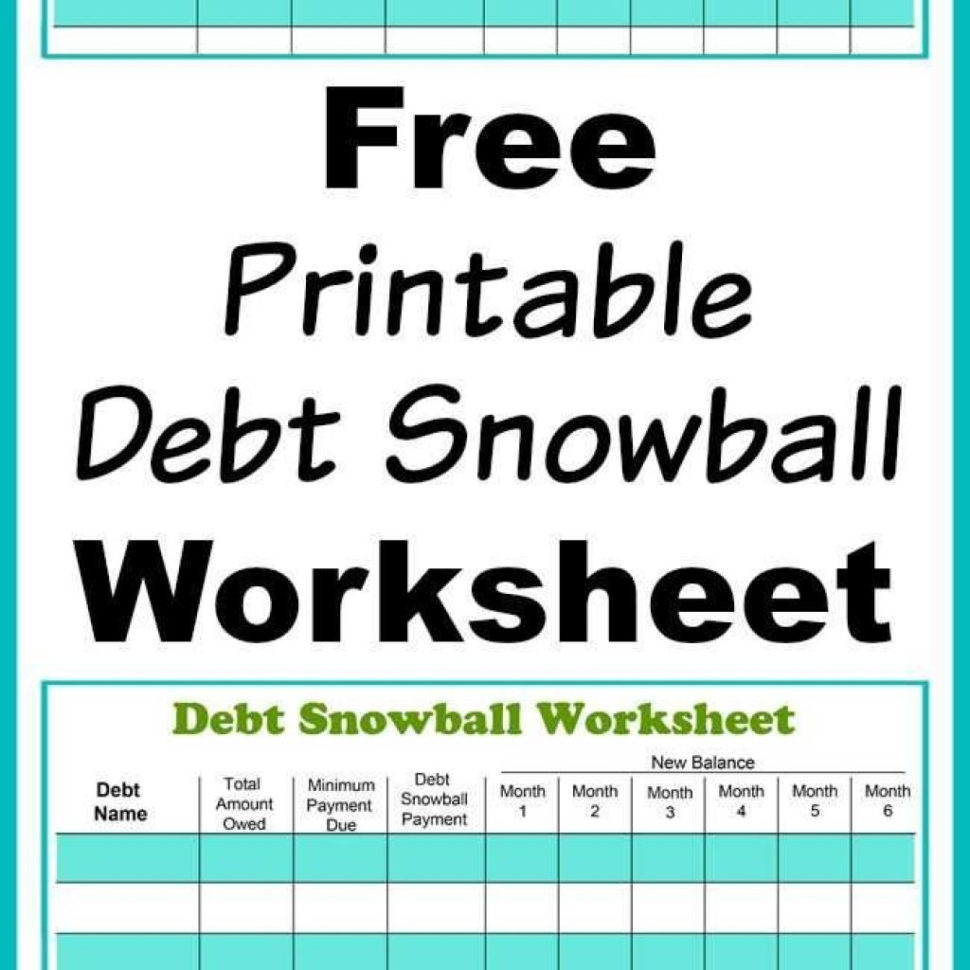

All you need to do to make this happen is to download a free spreadsheet from the internet. There are a number of different versions available, but they all do the same thing. They allow you to create a budget that you can use to manage your finances.

The debt-free spreadsheet can create a budget for you, and it can make a monthly review of your financial affairs. When you look at your monthly budget, you can see where you’ve spent the money, where you’ve made savings, and where you might need to cut back on expenses.

You should use the budget to create a plan that will help you stay on track. This isn’t the time to change your habits. You should stick to your plan, or else you’ll be setting yourself up for failure.

There are plenty of benefits to creating a monthly budget for your finances. If you want to get a good idea of where you stand, you need to keep an eye on your finances. PLEASE SEE : debt free calculator spreadsheet

Sample for Debt Free Spreadsheet