In case you’re in need of a spreadsheet to help you look up your credit card payoff balances, you might want to look into the credit card payoff spreadsheet. If you’re not familiar with these types of spreadsheets, they basically are a spreadsheet that lists down your balances in a credit card for easy viewing and logging.

In fact, many general consumers use them on a daily basis as they make their daily commute to work, school, the grocery store, etc. And most credit card companies make these tools available for free as well.

They’re actually fairly common among some reward programs. Most commonly, they are used for payoff analysis, but you can also use them to monitor debt management, managing interest rates, or monitoring your overall credit score.

The Credit Card Payoff Spreadsheet

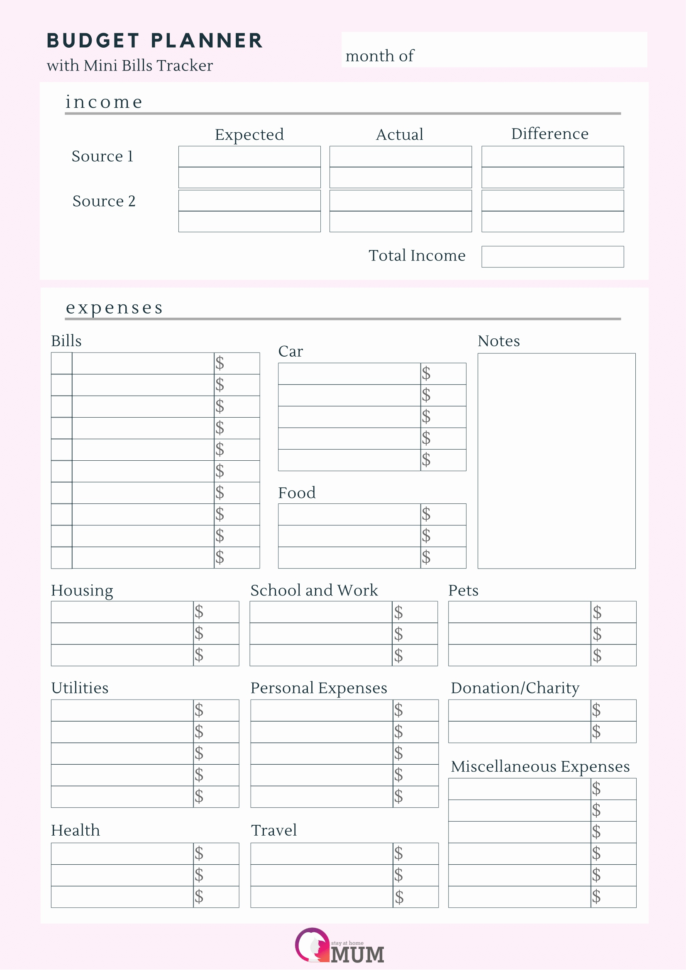

As you may know, it’s difficult to keep track of your entire credit card balances. But, because these spreadsheets are so quick to download, you can keep your whole life in front of you. You don’t have to worry about keeping track of each line item like you would with a monthly financial budgeting.

Also, it’s an easy way to make sure you’re making enough on your credit cards each month. It’s also very useful for companies. They can now simply upload the payment totals and receive a summary for easier reporting and analysis.

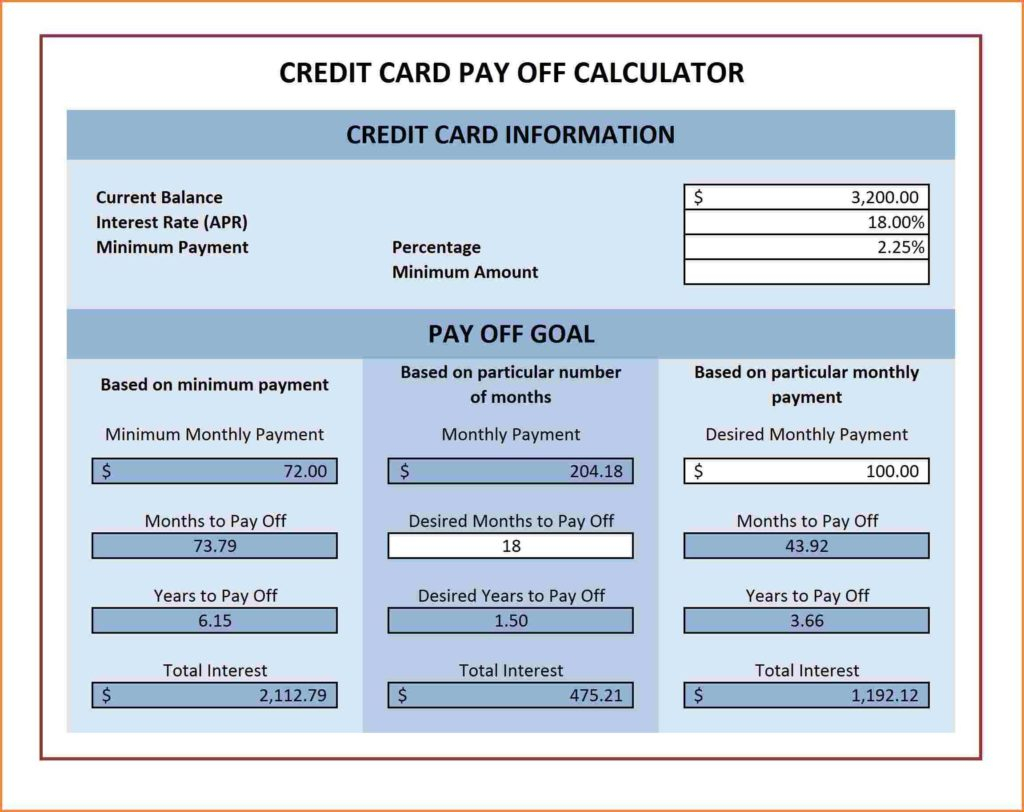

There are two kinds of spreadsheets, namely the pay off calculator and the online version. Both are great tools that are easy to utilize. So, which one should you use?

The online version is far more convenient, but it’s usually less accurate because of the limitations of the Internet. However, they still make a difference.

The calculator offers the convenience of quickly figuring out your payoff amounts. For example, if you live in an area where the average take home pay is about two hundred dollars per week, you could easily get a different amount if you use a specific online payoff calculator.

These payoff calculators can also offer great solutions for professional financial advisors. You don’t want to constantly ask, “Is my money making up to my expectations?”

The online version of these tools also makes tracking your credit score much easier because there’s no paper to deal with. It’s also a lot quicker and easier to do.

As you probably know, a good financial planner would recommend that you make a basic mortgage payment of about twenty percent of your gross monthly income. Then, gradually increase this percentage until you’ve reached your ultimate goal.

You might need a little math equation to do this, but it’s really simple. So, either way, once you have a pay off spreadsheet in place, all you need to do is log in to see how much you’re paying on your credit cards and how much you can afford to pay each month. YOU MUST LOOK : credit card payment spreadsheet

Sample for Credit Card Payoff Spreadsheet