How To Put Together A Debt Payoff Spreadsheet

If you have credit card debt and have no idea where to begin, then it is advisable that you get a debt payoff spreadsheet so that you will be able to determine the amount of money you need to pay. You can simply use any debt consolidation or debt settlement company for you to consolidate your existing loans with them, but in case you do not want to use one, then here are some ideas on how to put together a spreadsheet on how much you need to pay off.

It is extremely important that you start your calculation first thing every day to start with, and this is the time when you will be able to plan the amount of money you want to pay back. This way, you will not be surprised in the middle of the month because the total amount you owe will have increased by the due date. With a debt payoff spreadsheet, you will know exactly how much you need to pay each month for the rest of your life.

One of the biggest expenses you have in this instance is going to be your credit card bill. You might be able to cut this in half if you begin to plan your expenses on paper. Even though you might not want to actually call the credit card companies and say, “I am going to write you a check on the first of the month for ten percent of your balance” just yet, this is still an important step towards paying your bills.

If you think you are going to have a lot of difficulty paying off all of your credit card bills, then maybe you should start paying it off with a credit card consolidation loan. You will be able to find a consolidation loan through the Internet. You can use your spreadsheet to keep track of how much you need to pay every month, along with how much is currently being used.

The consolidation loan will offer you a lower interest rate than you would have gotten from the credit card companies. However, you will still need to pay a decent amount in fees and monthly payments on this consolidation loan.

Once you have a debt payoff spreadsheet and are aware of how much you are actually going to have to pay each month, you will have a better idea on where you can go with your finances. The other thing you can do with your spreadsheet is to figure out whether or not it is possible to start saving more money.

If you start a debt payoff spreadsheet, you will be able to see the impact that your changes are having on your debt. As you add more money to your account, you will be able to decrease the amount you are taking out of your savings. This will help you to build your savings and reduce your credit card debt.

The best thing about doing it this way is that you will actually have a credit card that you can use to pay for things that you would normally have had to use a credit card for. This is a huge advantage if you cannot easily handle your finances due to poor credit. It could possibly help you get approved for a mortgage or another type of loan that is easy to obtain.

It is also a smart idea to hold onto this money as long as you can for a rainy day. It may be possible that you will get lucky and start getting a decent amount of interest for this money. So it may be better to invest it instead of spending it.

While you are waiting for your finances to improve, you may wish to start making a minimum monthly payments to help prevent you from falling further into debt. You will still have to pay a good portion of the balances each month, but you will be able to have the peace of mind knowing that if you make your minimum payments, you will be able to eliminate your debt before you ever have to begin worrying about it again.

No matter what type of debt consolidation or debt repayment strategy you choose, the most important thing is to follow the advice of your spreadsheet so that you do not miss a payment and end up with a worse credit score than before. It is vital that you remember that the details of your debt are critical to your financial well-being. SEE ALSO : create your own spreadsheet

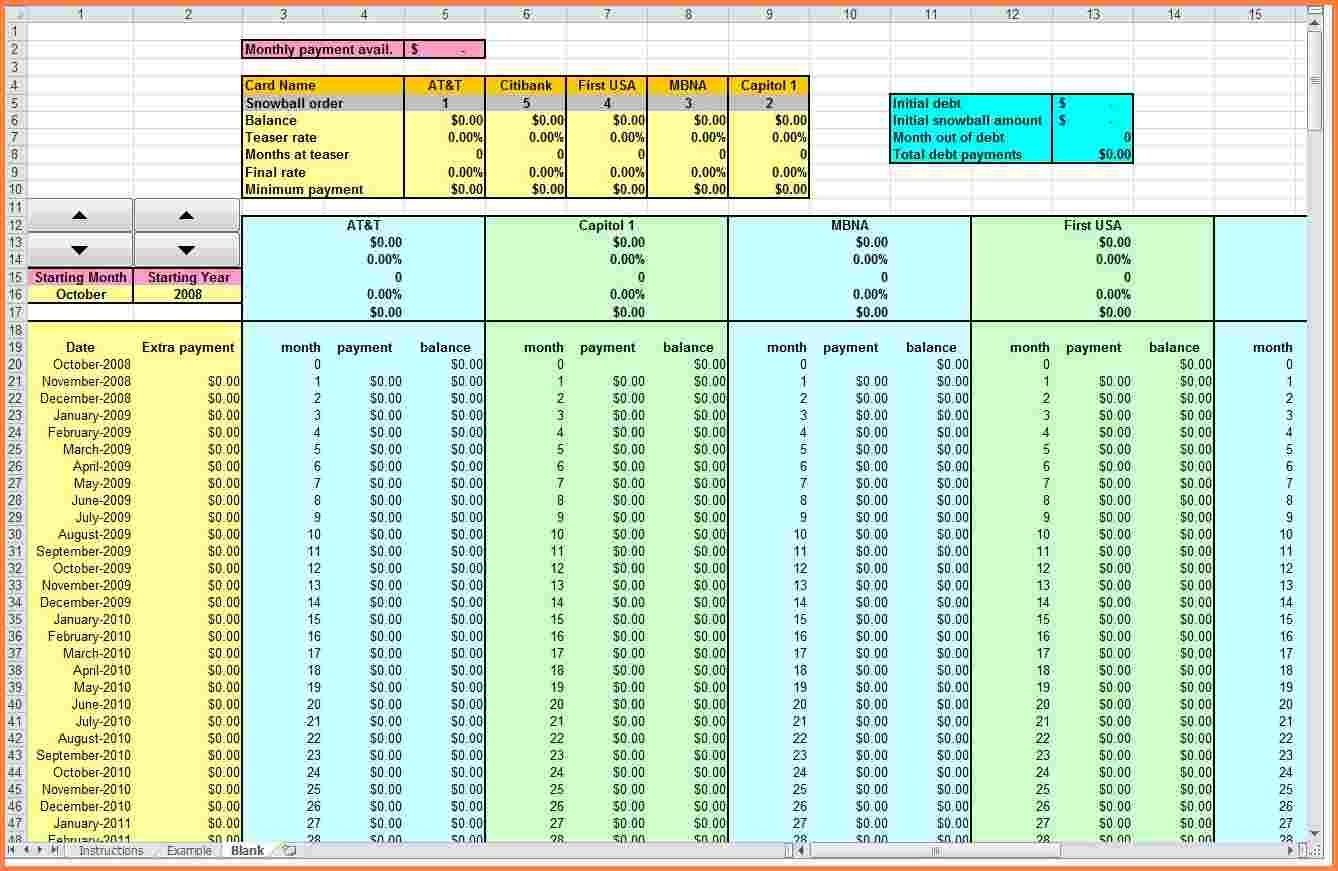

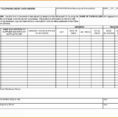

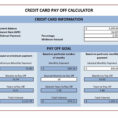

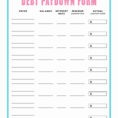

Sample for Credit Card Debt Payoff Spreadsheet