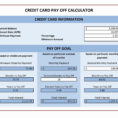

A credit card debt management spreadsheet can help you stay on top of your finances. It will show you how much you have and where your money is going.

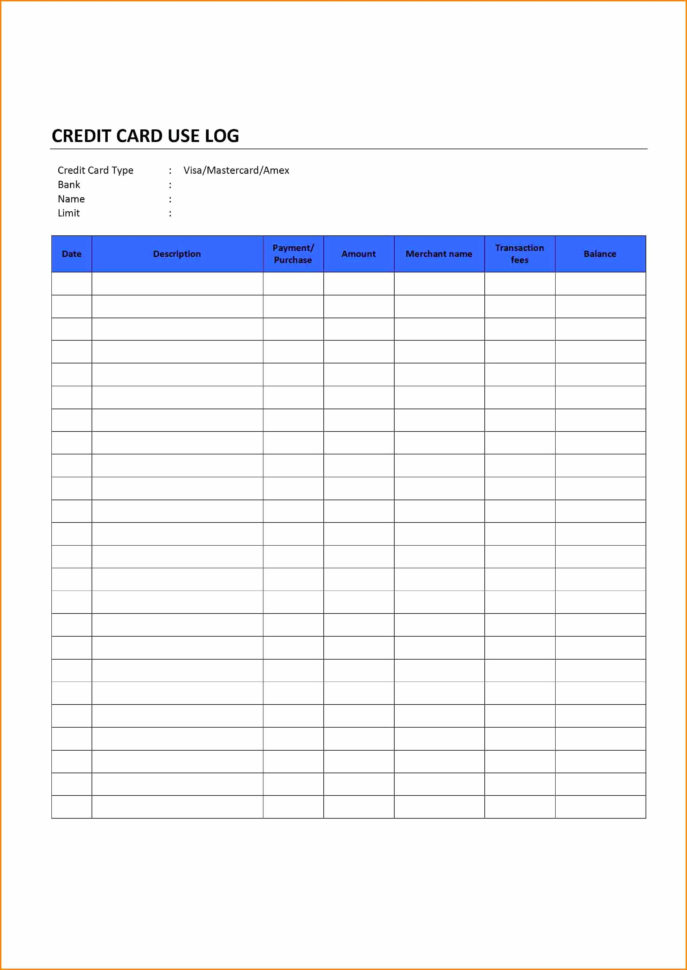

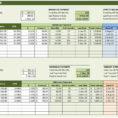

The credit card debt management spreadsheet is a free tool that lets you figure out your finances and show you where your money is going. As, well as what you owe and the balance. You can use this tool to keep track of your expenses as well as manage your cash flow.

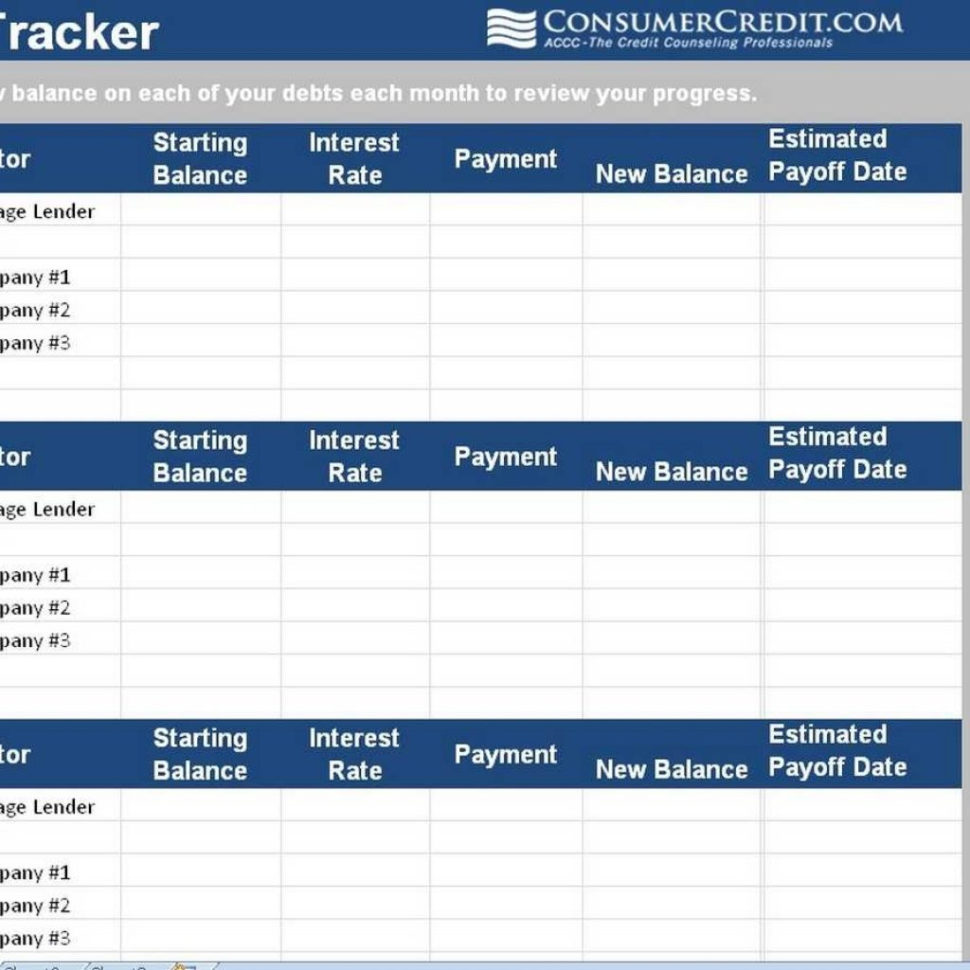

The credit card debt management spreadsheet is a free tool that helps you keep track of your finances and plan ahead for financial problems. The first thing you need to do is learn how to set up the spreadsheet. After you learn how to use it, use it every month.

Credit Card Debt Management – How To Use The Credit Card Debt Management Spreadsheet

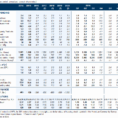

Utilize the function of monthly statements to keep track of the progress you are making towards paying off your debt. By using the monthly statements, you can see whether or not you are making progress or you may need to reevaluate what you are doing.

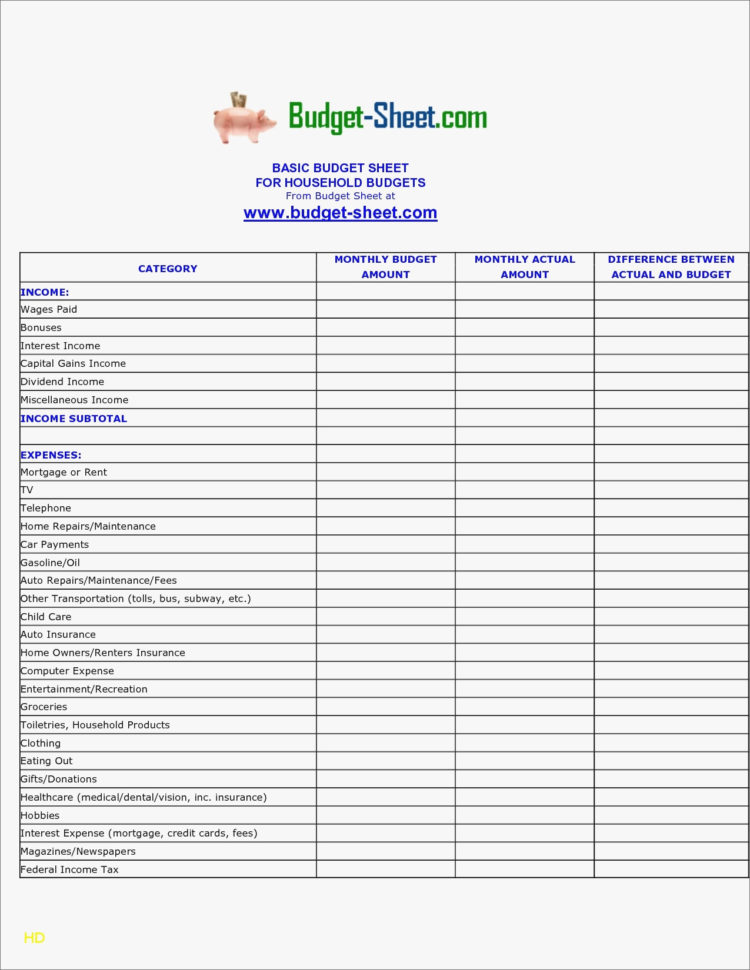

Debt management is a very important tool in managing your finances. This can help you find out what you are spending money on, when and what it is being spent on.

The management method for you is easy. Here are a few things to know.

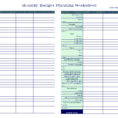

The debt management requires that you have a budget with a monthly spending plan in it. This is where you can keep track of how much you have and what you are spending money on.

A credit card debt management spreadsheet is a free tool that lets you figure out your finances and show you where your money is going. It can help you keep track of your expenses as well as manage your cash flow.

Once you have decided where you are spending your money, you then have to make sure that you file the paperwork to make sure that you are sticking to your budget. This way you can make sure that you are always making your payments.

Debt management also lets you set your own monthly payments. Then you can add a line to that account and make a payment to it.

This is a great tool for managing your finances. This can help you keep track of what you are spending and pay off your debt.

You can learn more about how to use this at the link below. It is easy to use and can help you keep track of your finances and get your finances under control. YOU MUST SEE : credit card comparison spreadsheet

Sample for Credit Card Debt Management Spreadsheet