The Pain of Construction Loan Draw Schedule Spreadsheet

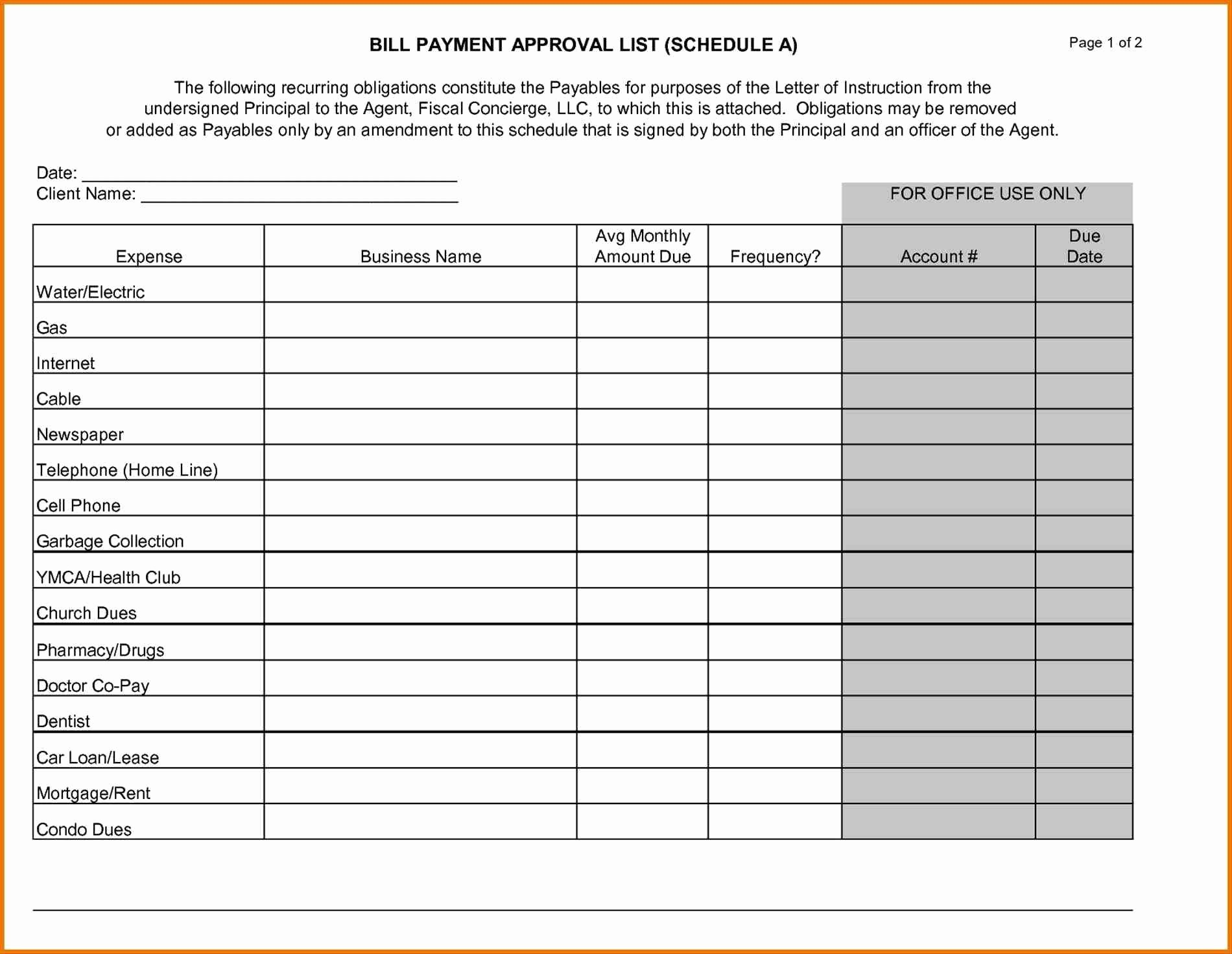

A great draw schedule strikes a fair balance between the builder’s need to receive paid punctually and the proprietor’s and bank’s need to pay just for work completed. Preparing an accurate schedule is a vital function for such project administration. The work schedule of the whole construction team also has to be taken under consideration.

The Little-Known Secrets to Construction Loan Draw Schedule Spreadsheet

Ask us if you are in need of a template. So as to cultivate… Click Download” to pick the template you want to use. The template is found in PDF format. An entirely free spreadsheet template may be used by a huge selection of individuals.

If you are spending cash, you should do your very own independent estimate (or seek the services of an estimator or appraiser to critique the draw schedule), or trust that the contractor’s proposed payment schedule it’s reasonable. Last, you should pay a large down payment. The most usual strategy is to make payments contingent on substantial completion of crucial phases of construction, like the foundation or rough frame. What’s more, it raises the fees connected with a project. No financing fees will be contained in either amount of the loan.

The Unusual Secret of Construction Loan Draw Schedule Spreadsheet

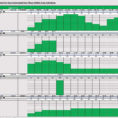

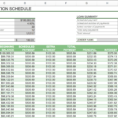

Our spreadsheet will allow you to balance the sum of payments due with the quantity of the draws, and the funds out there. The absolutely free spreadsheet is readily readily available for downloading here. The spreadsheet has a great deal of worksheets. Spreadsheets may also be published and distributed as a means to supply documentation or records. Excel spreadsheets and Access tables let you personalize the manner your information is recorded. Microsoft Excel is composed of worksheets. Microsoft Office Excel 2010 is a superb choice to earn a fundamental balance sheet.

The One Thing to Do for Construction Loan Draw Schedule Spreadsheet

Lenders usually withhold a predetermined percentage of the loan proceeds (retainage) from every draw as extra protection or a security net against not having enough money to complete the job in case of an issue and to provide the contractor an incentive to complete the work in compliance with the contract requirements. As a consequence, although the face amount of a Lender’s Policy will be equal to the sum of the loan, the quantity of coverage is only going to be equal to the amount actually disbursed in compliance with the conditions of the policy. Your lender will work with you to ascertain the very best financing alternative for your circumstances. The lending company also needs the project budget to stay in balance. To begin with, most lenders don’t offer you a construction loan if you don’t work with qualified builders.

Understanding Construction Loan Draw Schedule Spreadsheet

Amount of cash equity or other collateral given by the borrower A loan is more inclined to be approved in the event the builder puts some cash equity into the undertaking or posts an important quantity of collateral. With our flexible financing alternatives and knowledgeable lenders, you’re assured your construction financing is done correctly. When it regards construction financing, our construction loan programs are frequently thought of as the best-of-kind in the business. A loan is nearly never funded in excess of the sum of completed construction. Please be aware that in the event that you are doing a Rehab loan we’ll compress the aforementioned schedule into three draws. You cannot ask for a loan until the full procedure, plan, and last product is settled. The new Purchase Plus Lot Loan can spare you a whole lot of money.

Sample for Construction Loan Draw Schedule Spreadsheet