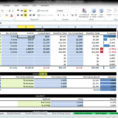

When you are buying or selling a business, or even when you are a landlord, there are a lot of tools that you can use to help you decide if you want to rent or buy the property. A commercial real estate lease analysis spreadsheet will allow you to get a better picture of the overall lease payments that you would have to make.

The main objective of this type of report is to show you all the different details regarding the lease agreement for commercial property, and give you some insight into how you should negotiate it. This will give you a better understanding of what you need to be looking for in a lease.

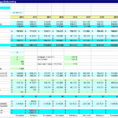

One of the first things that you should look at when you are getting a property that you would like to use for a business is the value of the property. Your budget will influence how much you can pay for the property, and the lease will determine how much you have to pay for the amount of rent. If you have a low budget, then you may not want to pay a high rent, as the rent would be pretty much negotiable.

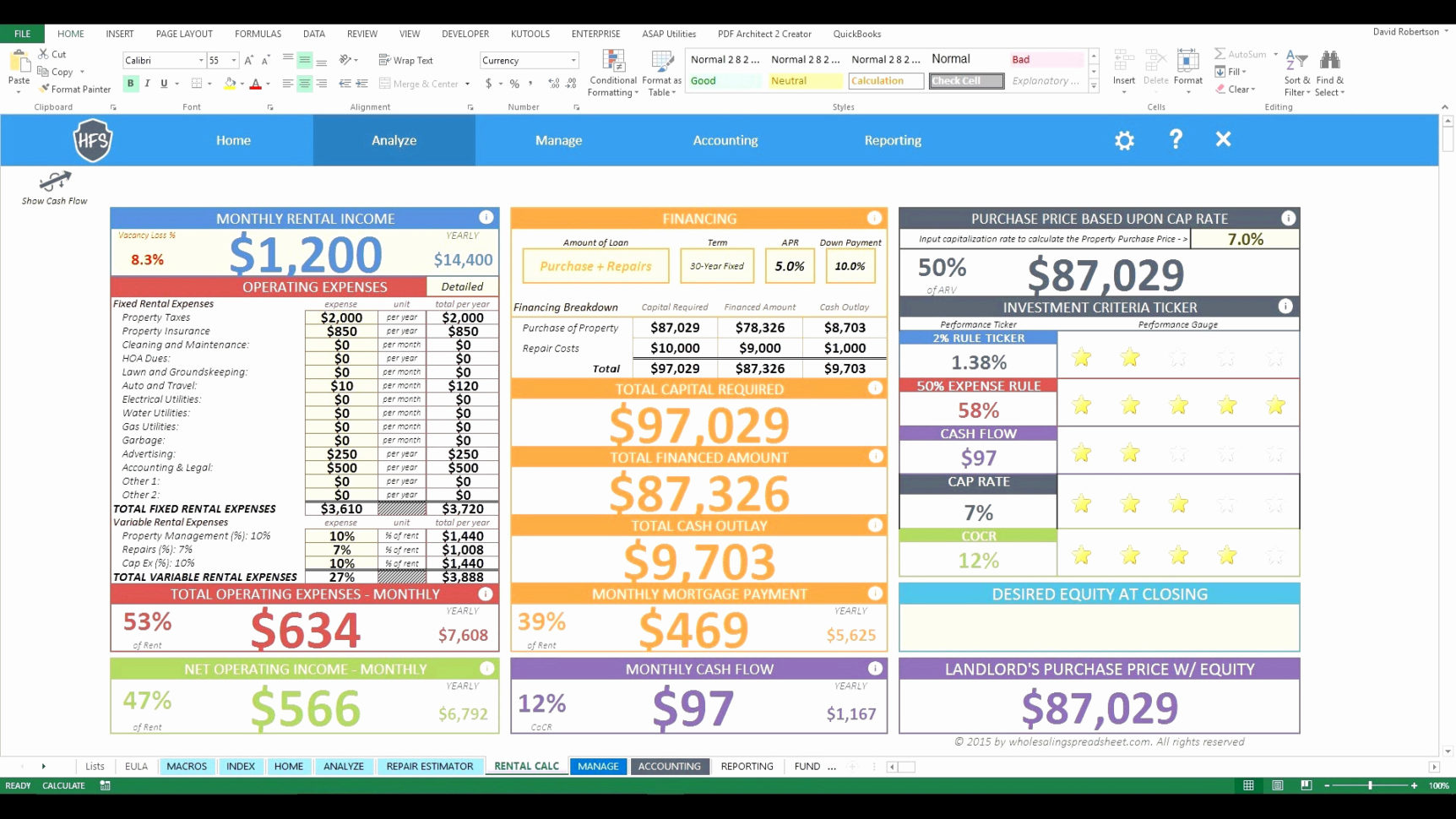

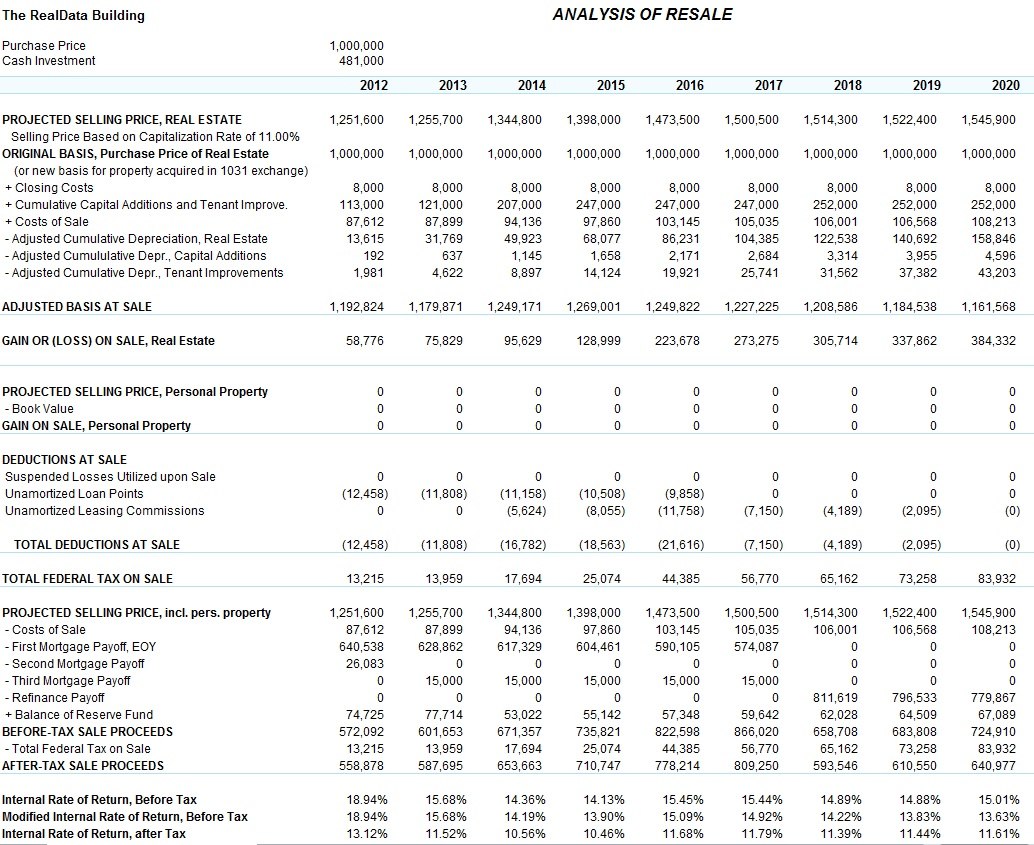

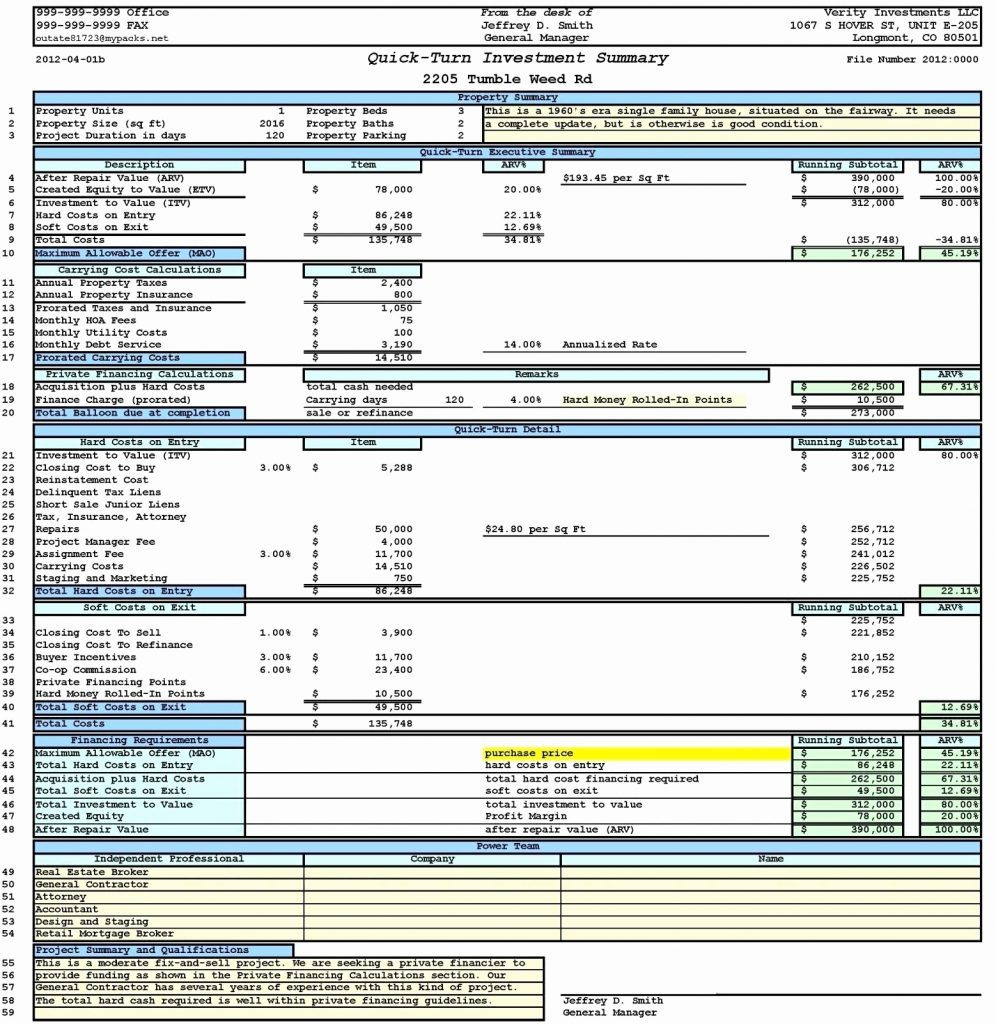

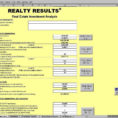

Commercial Real Estate Lease Analysis Spreadsheet

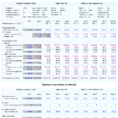

When you are trying to figure out the actual value of the property, you should compare the appraisal of the property with the appraised value of the property by other financial institutions. This will give you an idea of the worth of the property and if you should be worried about losing money in the deal.

When you are looking at this report, you need to analyze the costs of renting the property, and if you would rather pay less rent for the property, then you should be able to negotiate it accordingly. It would be more cost effective for you to pay a higher rent on a leased property than the amount of rent that you are paying for a rented property.

A commercial real estate lease analysis will also include the number of tenants that you would want to rent the property. You would need to find a balance between the number of tenants that you need, and the number of tenants that you can afford.

As you are trying to get a deal that is beneficial for you, you have to take into consideration any possible financial losses that you may incur. This will take a good look at how your business would fare with or without having tenants in the property.

A commercial real estate lease analysis will give you a list of all the fees that you would need to pay monthly or yearly, and any other fees that you would have to pay such as insurance or inspections. It will also give you the different payment options that you have.

To use this type of report, you would first have to get a copy of the lease contract that is being used by the business. This should be a very simple process and most of the time, there should not be any problem with getting a copy of the contract.

After you have gotten the lease contract and the lease agreement, you can use the commercial real estate lease analysis spreadsheet to help you determine what you should do. If you are going to rent a property, you can look at the lease agreement to see if there are any loopholes that can be exploited.

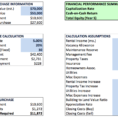

Another important thing to keep in mind is that the commercial real estate lease analysis will only show you the general facts. You will need to look at the details to get a better picture of what you need to be looking for in a lease. PLEASE LOOK : commercial real estate analysis spreadsheet

Sample for Commercial Real Estate Lease Analysis Spreadsheet