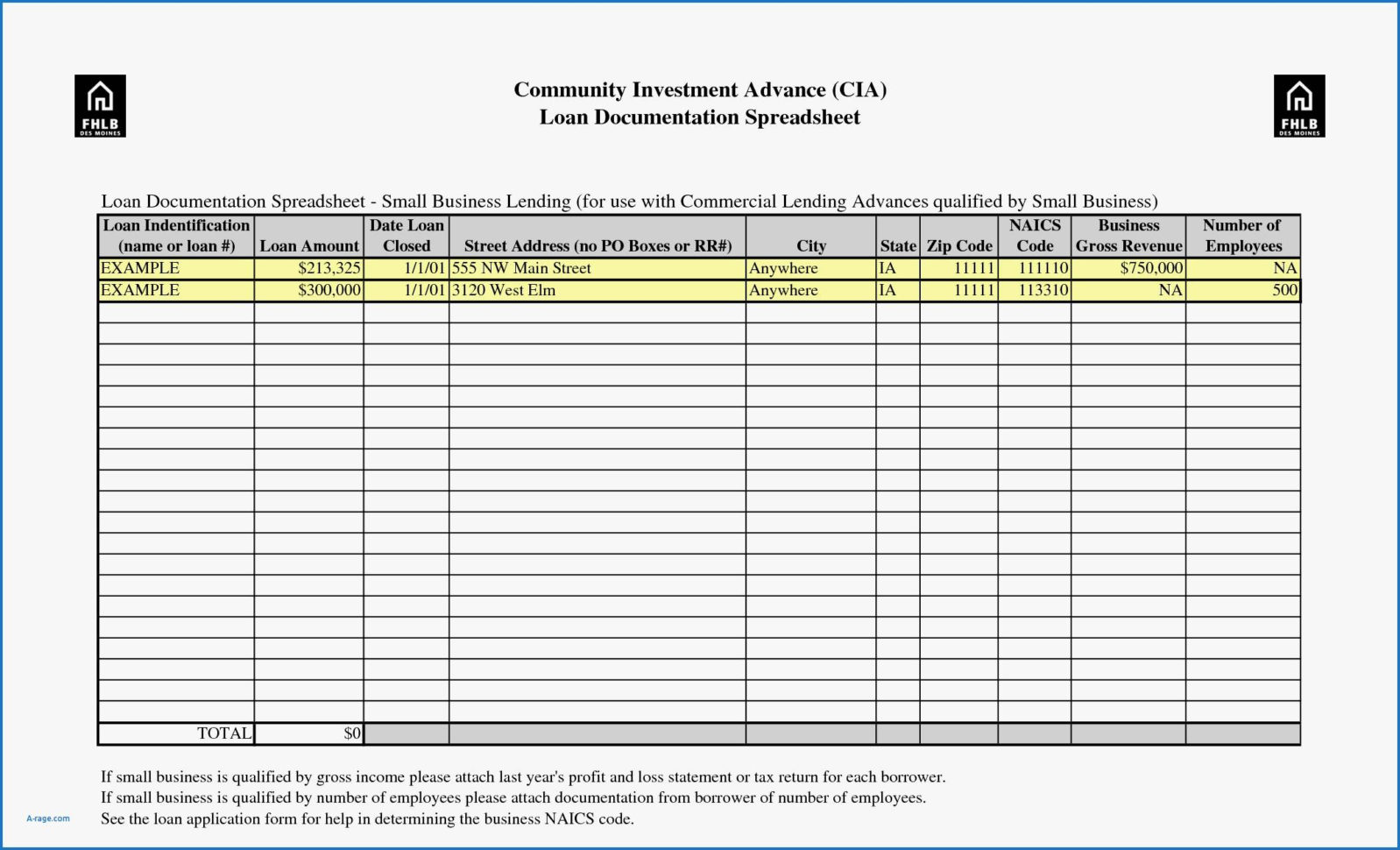

If you are a commercial borrower, or you are thinking about starting your own business, then you will need to look into commercial loan comparison spreadsheet. This is an interactive spreadsheet that will allow you to enter the details of each company that you would like to know more about. You can do this by typing in their contact information and going through the associated details.

The results that you will receive on this spreadsheet will be valuable because it will include your credit history along with other important financial information. It is like a comprehensive report of companies that you are considering for your business.

When you are comparing the loan offers of different companies, you will find out the rates of interest that they offer and you will also be able to determine whether these companies have been in business for a long time or not. You will also be able to determine how much debt that each company is offering and how your debt to income ratio will be as well.

Commercial Loan Comparison Spreadsheet

One of the first things that you will notice when you compare the offers for commercial business loans is that there is a cost that the lenders will charge for obtaining the loan. This cost is normally referred to as origination fee or late payment penalty.

There are several quotes offered by the lenders, which will differ according to the cost that they charge. However, one quote will always be similar and you will be able to determine the best option from these offers.

A commercial loan comparison spreadsheet will give you an opportunity to get hold of a comprehensive picture of all the quotes that are being offered by different companies. By doing this, you will be able to make a proper assessment and you will also be able to discover which company provides the best deal.

What is the best way to know whether you are choosing the right company to provide the loan application? In the commercial world, if you are working with someone that you are not familiar with, you are always advised to check their experience.

You must be able to get the best possible information regarding the current application process as well as the money in the hands of the company. If the company seems to be easy to work with, then you can be sure that the application is simple and the money will not be a burden to you.

You should make sure that the company you are working with is offering a good standard of services for the commercial loan and that they are going to offer assistance with the business loans. All the companies should be willing to help you so that you will not have to worry about the same trouble again.

If you are working with someone that you know that is more experienced and you believe that you will be able to go over the loan application with them, then you are right. However, if you want to get hold of as much information as possible, then you should always go for the simple version that is provided by a loan company.

Remember that you should always make use of a loan calculator in order to get the best possible information regarding the loan application. This will help you determine whether you will be eligible for the loan or not. YOU MUST LOOK : commercial lease analysis spreadsheet

Sample for Commercial Loan Comparison Spreadsheet