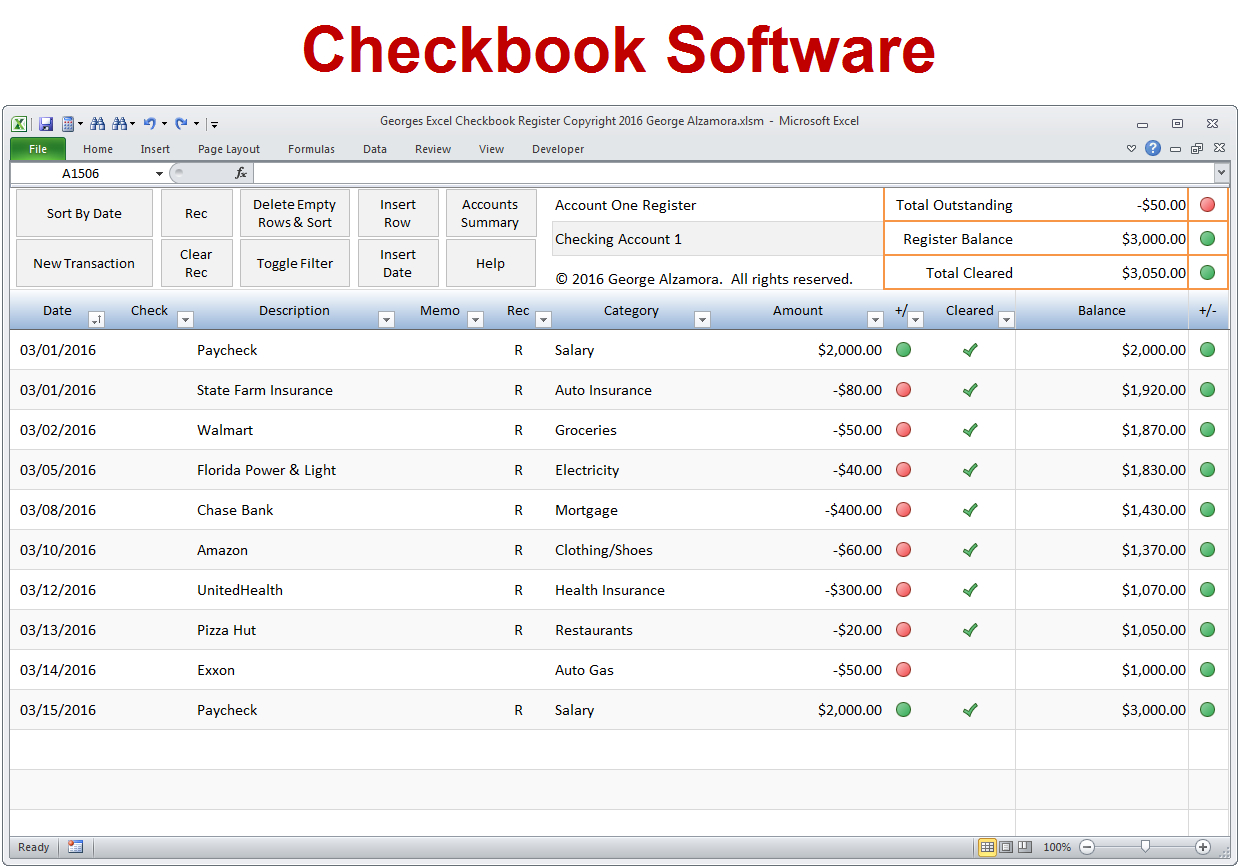

There are a number of reasons why an individual may want to create a checkbook spreadsheet template. One, if you have a small business or an online business, it could help you get more customers. Two, it is also great for looking up various information about different businesses.

This is where this template comes in. The template allows you to copy and paste all the necessary information into it.

When you get one like this, you will need to keep a whole sheet or checkbook. You simply add all the necessary information to it, and you can place all the required accounts in it. You will be able to compare the records of the different customers.

How to Use a Checking Account Spreadsheet Template to Improve Your Business

Checklist: If there are several checks that were made, and all of them were paid. If these are good, you can use them to compare the accounts. Of course, you cannot compare these checks with others since it would be very easy to mix them up. So, you will just need to write down each check and its description.

Note: You can use other methods of comparison, such as looking at the past six months of the customer. This would also allow you to create a better history. But, there is always a need to keep up with the new trends, and that is where the spreadsheet template comes in.

Customer Info: When you add the customer’s name, you can go through the account history. The customer’s information should be listed on the different accounts. It would allow you to evaluate the financial condition of the business.

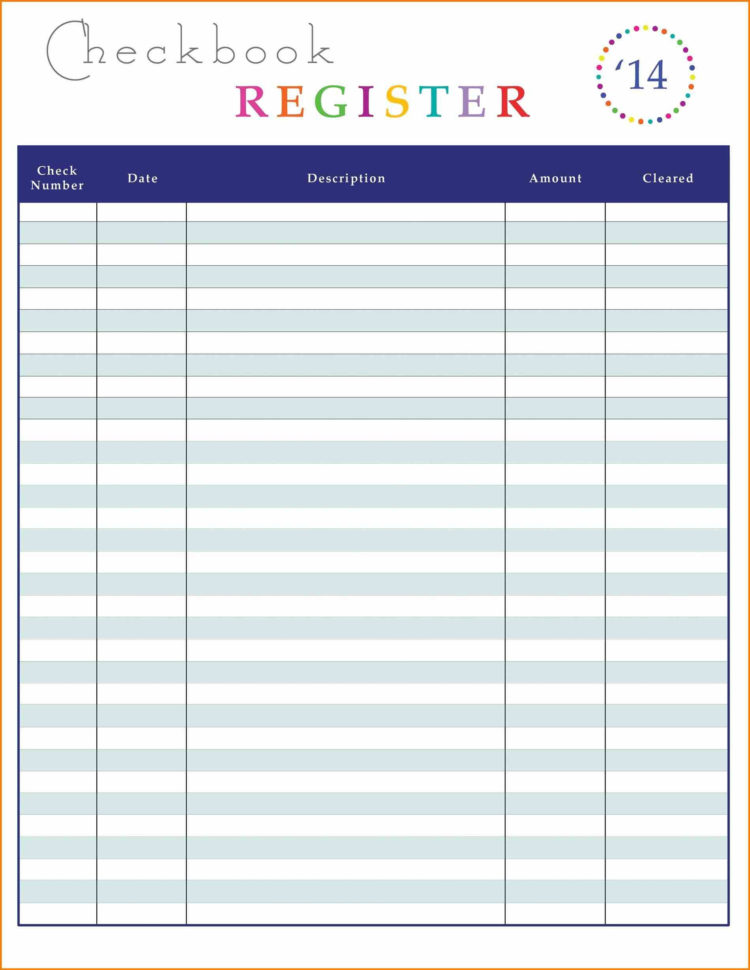

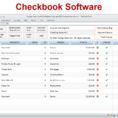

Checkbooks: There are accounts that use checkbooks as the means of payments. The account balance on a checkbook must match the cashier’s balance. In addition, you can put the date, the amount, the name of the customer, and a link to the website of the company.

Date: The information of the time frame of the payment. It should be in the form of a percentage. If it is a certain number of months, the number of months should be written down as well.

Amount: This is the total amount. If you have paid a certain amount of the check, the amount should be given as well.

Date – Amount: If you have not paid for a certain period of time, the date, the amount, and the date should be added to the end of the sheet. These would provide you with the end of month. So, this would be a total amount of the account.

Date – Amount: The end of the month. This would be the amount that was paid, so, you need to include this on the spreadsheet. The amount of the check should be written under it. PLEASE READ : charitable remainder trust spreadsheet

Sample for Checking Account Spreadsheet Template

![Checking Account Spreadsheet Template With 37 Checkbook Register Templates [100% Free, Printable] Template Lab Checking Account Spreadsheet Template With 37 Checkbook Register Templates [100% Free, Printable] Template Lab](https://db-excel.com/wp-content/uploads/2019/01/checking-account-spreadsheet-template-with-37-checkbook-register-templates-100-free-printable-template-lab-749x970.jpg)

![Checking Account Spreadsheet Template Intended For 37 Checkbook Register Templates [100% Free, Printable] Template Lab Checking Account Spreadsheet Template Intended For 37 Checkbook Register Templates [100% Free, Printable] Template Lab]( https://db-excel.com/wp-content/uploads/2019/01/checking-account-spreadsheet-template-intended-for-37-checkbook-register-templates-100-free-printable-template-lab-118x118.jpg)

![Checking Account Spreadsheet Template With 37 Checkbook Register Templates [100% Free, Printable] Template Lab Checking Account Spreadsheet Template With 37 Checkbook Register Templates [100% Free, Printable] Template Lab]( https://db-excel.com/wp-content/uploads/2019/01/checking-account-spreadsheet-template-with-37-checkbook-register-templates-100-free-printable-template-lab-118x118.jpg)

![Checking Account Spreadsheet Template For 37 Checkbook Register Templates [100% Free, Printable] Template Lab Checking Account Spreadsheet Template For 37 Checkbook Register Templates [100% Free, Printable] Template Lab]( https://db-excel.com/wp-content/uploads/2019/01/checking-account-spreadsheet-template-for-37-checkbook-register-templates-100-free-printable-template-lab-118x118.jpg)