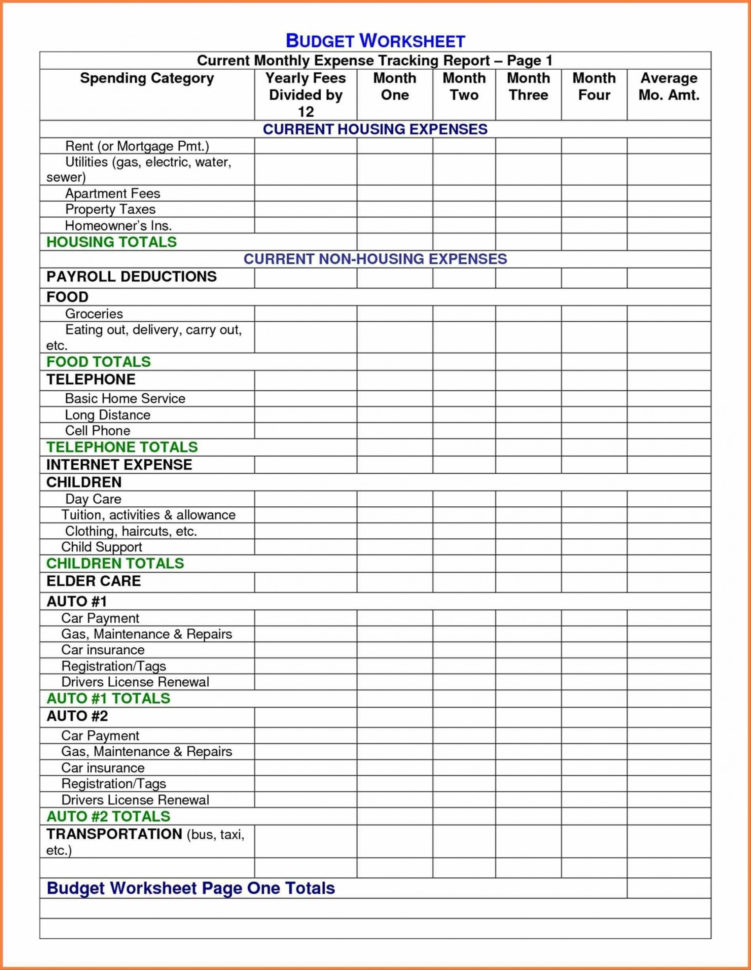

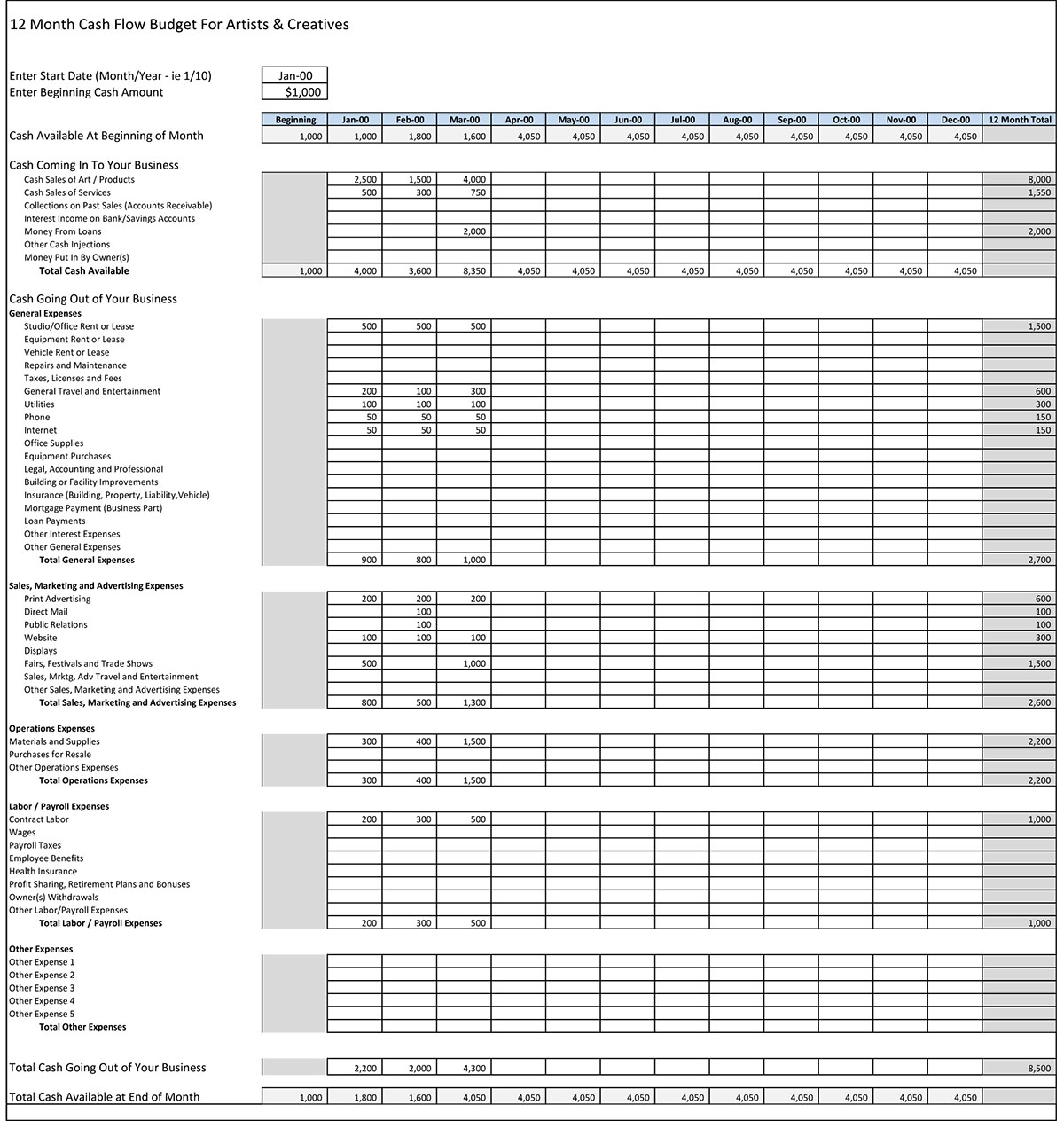

The idea of having a cash flow budget spreadsheet is to be able to create a financial plan based on the major accounts. The cells are used to label the major payments, the expenses and the income. By using a spreadsheet, you can make a budget and use the entries in your head to help you figure out how much money you will have in the month.

Using the various sheets you can develop a personal balance sheet as well as a cash flow budget. This will allow you to properly monitor your financial status so that you will know when you should contact a credit counselor.

To create a spreadsheet, you must be using Microsoft Excel or some other similar software. Other programs may also have the capability but you must keep in mind that only Microsoft excel comes with most of the major operating systems. You must first download this program to your computer.

Excel Made Easy – A Cash Flow Budget Spreadsheet Can Save You Time

A spreadsheet will work well for all types of people, all types of businesses and for all types of businesses from start-ups to the largest corporations. With a little time and effort, you can build a budget in just a few minutes.

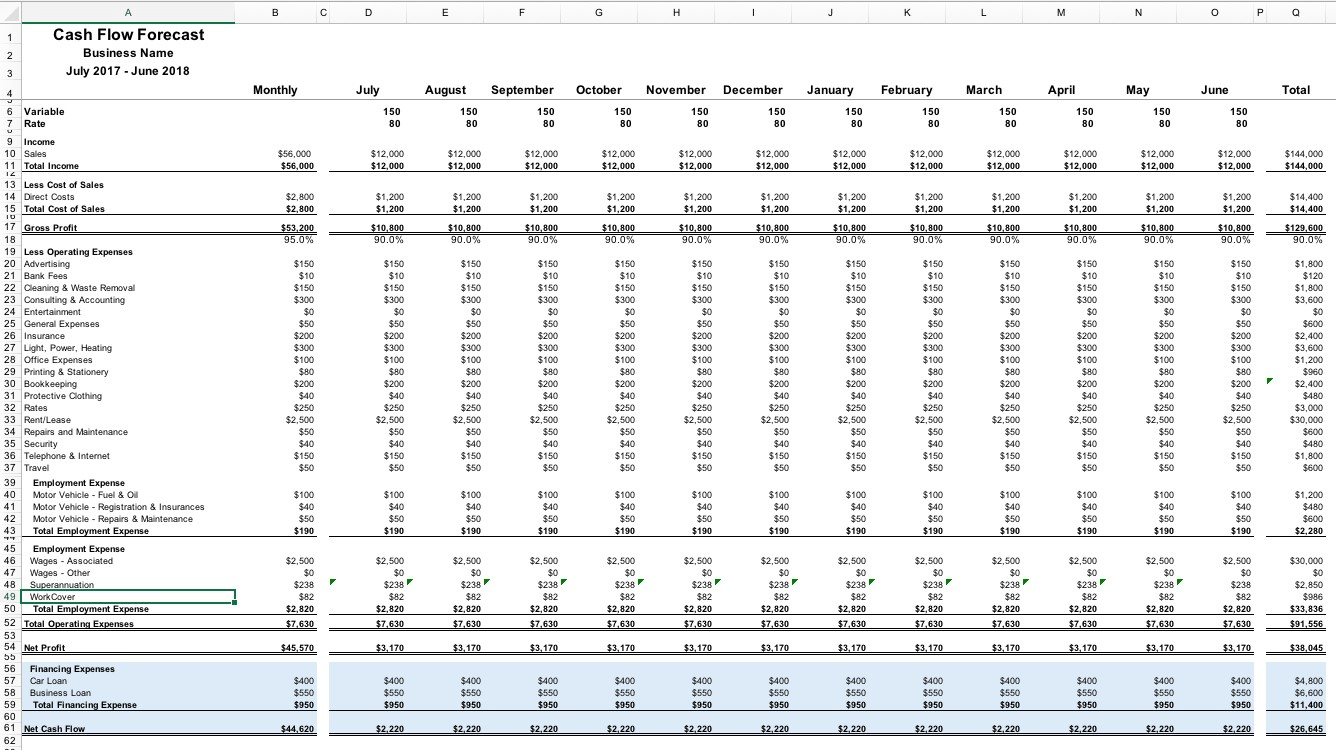

This software allows you to create three basic tabs, called columns, which are income statement, expense statement and cash flow statement. As soon as you create a spreadsheet, it can quickly be converted into a cash flow budget.

This is the income statement, which shows the dollar amount you have received for each month. There are different column formats available and they will match the income statement that you receive from your employer.

You may have to create a spreadsheet to have the income report. Many companies use one to determine if your pay should be garnished and if you should be put on a non pay period schedule. In this way, you can determine your pay.

The other two columns include the expenses and the cash flow statement. These are created to show you exactly how much income you have received and how much money you owe.

Once you have a cash flow statement, you will be able to see at a glance the status of your income. You will be able to see the major monthly payments. You will also see how much you owe, your outstanding debt and your interest rate.

Since you need to look at these things, you need to find the best way to manage your debt. Using a spreadsheet will allow you to stay on top of all of these issues so that you will be able to look back and use the information to make improvements.

By using a spreadsheet you will be able to look at personal finance matters and you will have an idea of where you are financially at any given time. This is a valuable tool and you should use it in all areas of your life. YOU MUST LOOK : cash flow analysis spreadsheet

Sample for Cash Flow Budget Spreadsheet