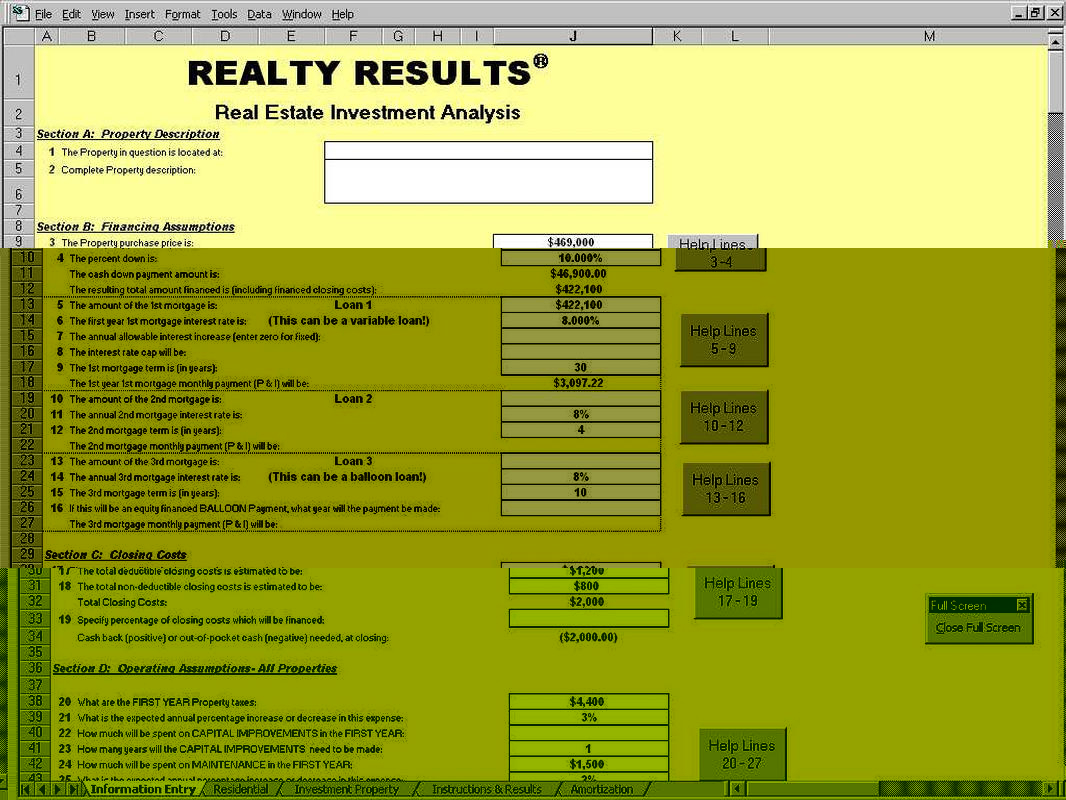

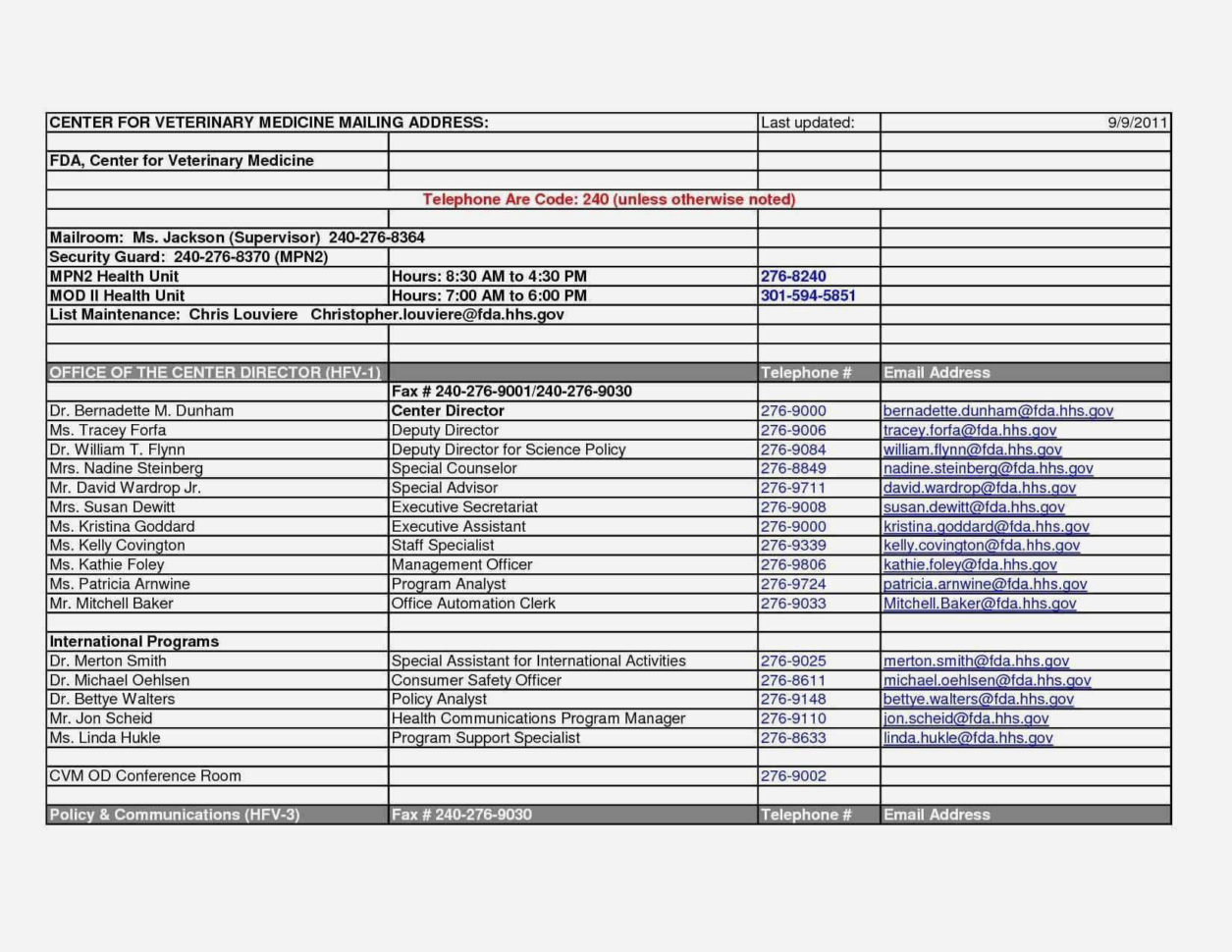

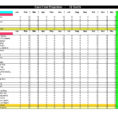

A cash flow analysis spreadsheet is a money saving financial tool which can be very helpful in guiding you through your own budgeting process. In many cases, a person without the spreadsheet can’t handle the complexities of how money flows through their lives and can easily miss out on essential savings.

The real money savings from using a cash flow spreadsheet are the one-time entries and the ease with which it allows for easy tracking of the cash flow which can be important when other measures are not working to accomplish the same thing. Another benefit is that they do not require much math or complex calculations and some of them have a built in loss calculator. This means that if you are not calculating the average or median income you are not having the correct information with which to make decisions about what to spend money on.

This is a smart way to start out your budgeting process since you will learn the basic needs of spending money. It is also important to note that most people are not well versed in this type of thing, so it is important to seek out more professional help as this can give you a better picture of what you can and cannot spend money on.

Can Cash Flow Analysis Be a Small Income For You?

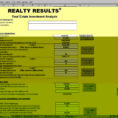

From an accounting standpoint, the money flow analysis spreadsheet can also help you determine the best times to use your money wisely by identifying when it is a good time to invest and when it is a good time to save. They can also help you make decisions about what types of investments to make.

The importance of investing in times of high demand is obvious because the value of money rises and falls with the times, which gives you a greater interest in it when the market is at its peak. For many people this is also the best time to get in on a project or start some business ventures because there is a greater chance of making money while the market is going up.

Cash flow analysis is also useful when deciding where to invest the money youhave saved. If you can determine how much money you will need to live comfortably for the next year or so and how much money you will need to save for the future, this can also play a big role in how to make the best decisions regarding money management.

It is also important to understand the basics of time management, which is why a cash flow analysis spreadsheet is so important to make the right choices about the type of investment. You will also need to figure out what to do with money that is now earning the highest return.

If you are fortunate enough to work with a supervisor who has a good understanding of time management, then you will have more success when working with a cash flow analysis spreadsheet. Otherwise, it can be as simple as knowing which investments to make and which ones you should save until they are earning the highest returns.

If you are at work or at home, then you should make time to study these principles and eventually apply them to the type of money management you are doing. With the proper money management you can allow your mind to wander and not worry so much about the bills you have to pay every month.

As you gain experience and the ability to follow directions, the time management will come easier to you. There is no limit to the amount of money you can earn when you have the right tools to guide you.

You can find the cash flow analysis spreadsheet at several sites and resources online that can help you learn the principles of time management and the tools you need to make the right decisions. Although they may seem to be complicated, there are actually only a few calculations and rules involved. YOU MUST READ : car sales commission spreadsheet

Sample for Cash Flow Analysis Spreadsheet