The Pitfall of Cash Basis Accounting Spreadsheet

Cash basis was not giving them a very clear picture of the total functioning of the organization and cash flow proved to be a huge issue in their opinion. In cash basis, you merely recognize the quantity you actually paid. Given its simplicity of use, the money basis is popular in little businesses. It is used by individuals and small businesses. It is the simplest way to record your books. Cash basis and accrual basis are just a bit of the picture and it’s really important to check at both to comprehend what’s actually going on with your business.

The Little-Known Secrets to Cash Basis Accounting Spreadsheet

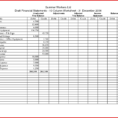

For those who have a lot of cash, you could also have lots of invisible commitments which you already will need to spend it on. You didn’t receive cash. It’s especially effective for ensuring you’re managing your cash effectively. Some should likewise be able to record cash received on account. Cash gives our business enterprise power the ability to employ the very best talent, purchasing power for those goods and services we must grow to make the most of new opportunities that may arise,” explained Div Bhansali, vice president of marketing at AccountantsWorld. A cash to accrual conversion can be divided up into several measures. At the end of the accounting period it will require the following journal entry to be made.

Cash Basis Accounting Spreadsheet and Cash Basis Accounting Spreadsheet – The Perfect Combination

Choosing which kind of accounting for your company is dependent on several factors. Based on the size of your organization, you may choose to start out with cash-basis accounting. Accrual accounting is utilized by the majority of business owners. The principal reason for using accrual accounting is to receive an unbiased and accurate picture of the company at any given stage. It is the practice of recording revenues when they are earned and recording expenses when they are owed. It is the most common method used by businesses. Likewise, accrual basis accounting offers you a simpler way to verify whether you do, in reality, have the money on hand, combined with different assets, that you will need for investing in your institution’s future.

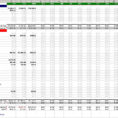

Bookkeeping with a spreadsheet is well-known by many little businesses, for a number of reasons. Otherwise, you need to pick cash accounting. Cash accounting may also be cost-effective, particularly if your business enterprise structure is a sole proprietorship or partnership. It is objective and easier to carry out, cash either comes into the business or goes out of the business. Cash basis accounting is dependent on your organization’s cash activity. It does not require complex accounting software. It is simple and may be sufficient for some small businesses.

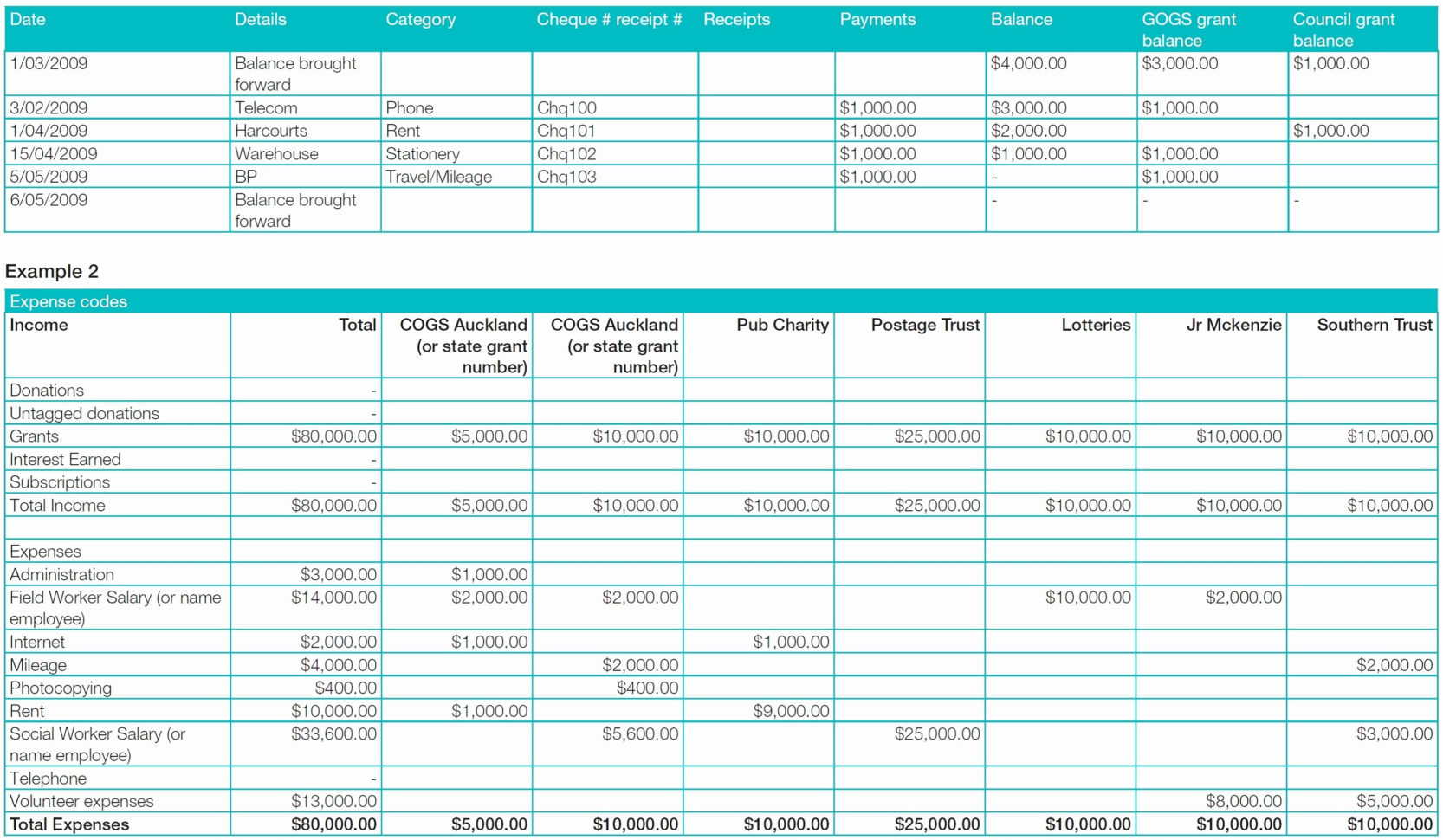

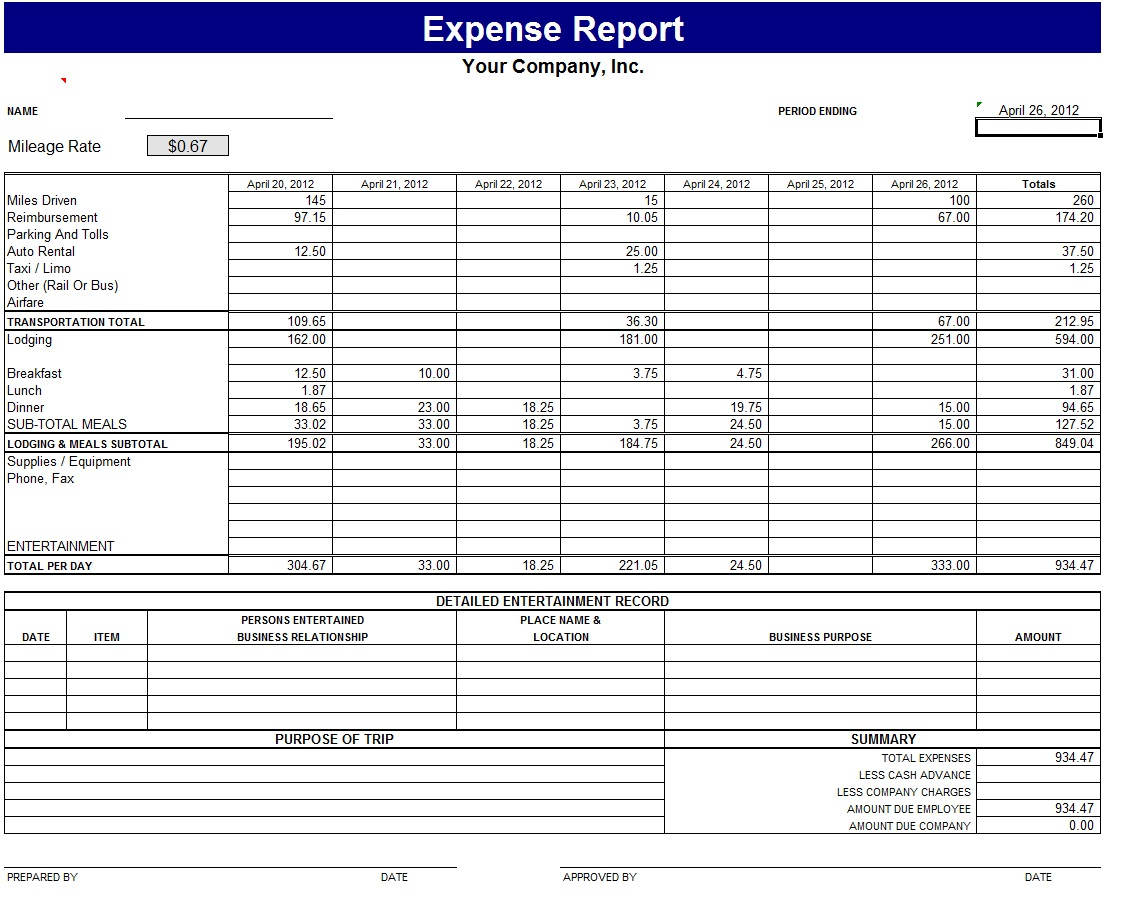

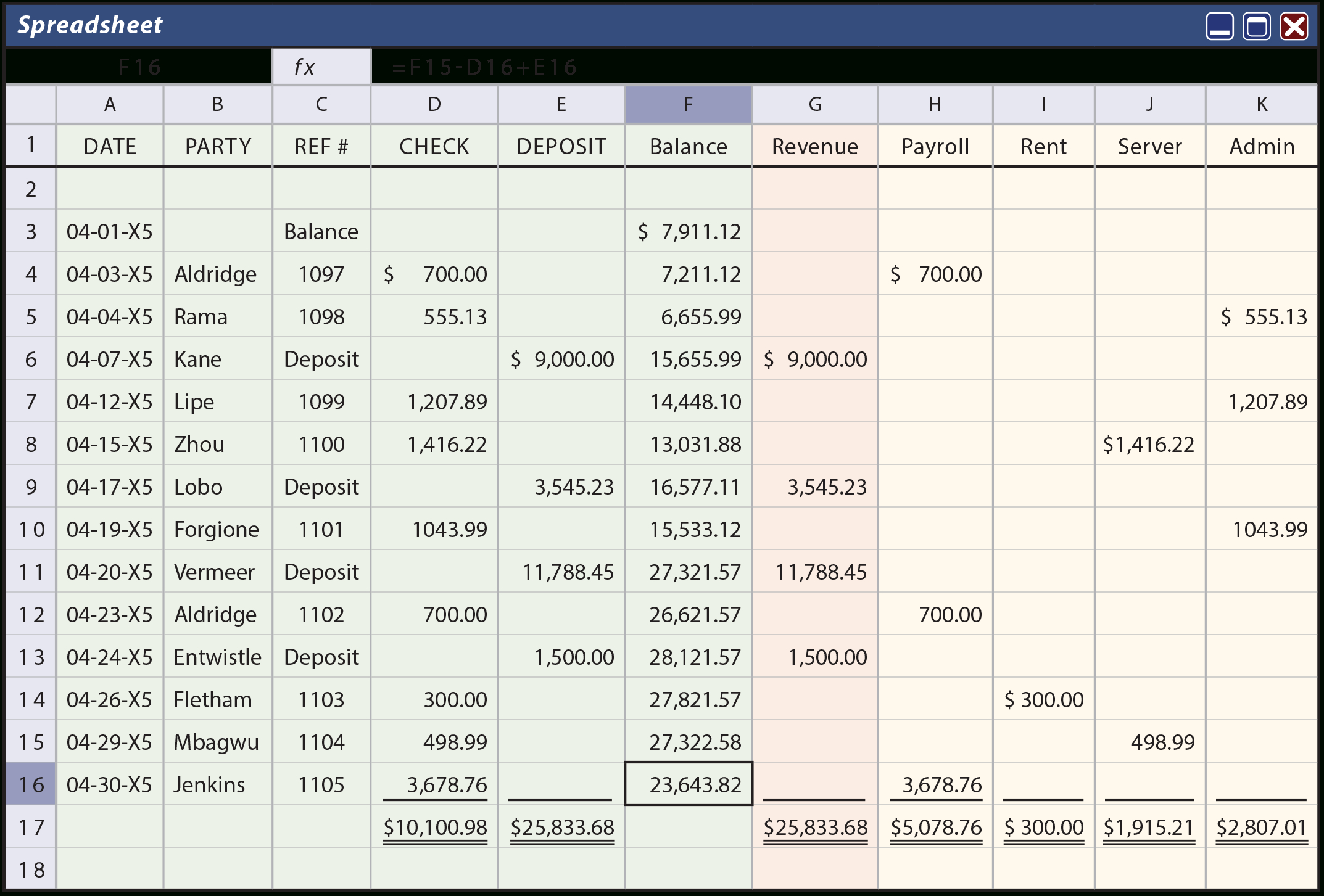

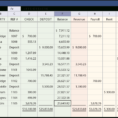

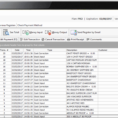

To start, you are want to find out how you need to construct your spreadsheet. Spreadsheets are usually utilised to look after data. The spreadsheet will allow you to figure out the charge to open a restaurant and schedule every labor hour to offer you instant feedback of the expenses related to your scheduling decisions. Providing that it has been kept up to date and accurate it will be obvious if the difference is an error or not. Furthermore, a new spreadsheet needs to be started each VAT quarter, so the column totals (pink figures at the peak of each column) end up showing the right totals for each VAT return. You’re able to locate other spreadsheets that offer a more thorough investment analysis (for example, 10-year cash flow projections). You will notice adownloadable spreadsheet reportusing a web-based browser.

The template is found in PDF format. A totally free spreadsheet template can be used by a huge scope of individuals. To begin quickly, it could possibly be useful to use a familiar Excel accounting template.

Sample for Cash Basis Accounting Spreadsheet