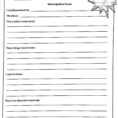

Capital Gains Tax Worksheet in an understanding medium can be utilized to check students skills and knowledge by answering questions. Because in the Student Worksheet about 90% of the contents of the whole guide are issues, both multiple choice and solution issues which are not available. While the remainder consists of a brief summary of the subject matter. Using worksheet, teachers no longer need to bother to collect questions or questions. With the press the teacher is only required to focus on providing a optimum understanding of the given subject. For the evaluation and test of studying outcomes, the teacher only wants to share with and strong the issues previously available in the worksheet. Because just about the worksheet acts as helpful tips for pupils in holding out education projects both independently and in groups.

The Character of Capital Gains Tax Worksheet in Studying

Capital Gains Tax Worksheet as a derivative of large methods answer questions. Applying Worksheets suggests facilitating pupils to be able to answer questions about topics they’ve learned. With the Worksheet, students can realize the niche matter as a whole more easily. Since addressing the questions in the Worksheet is the same as learning about a subject over and once more, of course pupils can realize deeply. Making Worksheets an instrument of teaching and learning activities is a highly effective strategy for training students memories in learning matter matter. Since when utilizing Worksheets, pupils are focused on answering the questions that are already available. Using Worksheets has been established to support student learning achievement.

Capital Gains Tax Worksheet are a type of studying aid. Generally the Worksheet is an understanding instrument as a complement or perhaps a way of encouraging the implementation of the studying Plan. Scholar worksheets in the proper execution of blankets of report in the shape of data and issues (questions) that must be solved by students. This Capital Gains Tax Worksheet is well applied to encourage the engagement of pupils in studying both utilized in the application of advised practices and to provide growth training. In the act of studying, Worksheets intention to find methods and request of concepts.

Items to Contemplate When Producing Capital Gains Tax Worksheet

Capital Gains Tax Worksheet are a stimulus or instructor guidance in education that will be presented in writing so that in writing it must look closely at the conditions of graphic press as visible media to entice the interest of students. At least the Worksheet as a media card. While the contents of the meaning of the Worksheet should focus on the weather of writing visual press, the hierarchy of the material and the selection of issues being an successful and powerful stimulus. Through the Worksheet the instructor asks students to solution the questions which were accessible after increasing specific topic matter. Equally privately and in groups.

Conceptually, Capital Gains Tax Worksheet are a learning medium for teaching students storage on instructions learned in the classroom. Worksheets can also be regarded as the application form of the problem bank theory to teach scholar intelligence. Additionally, Worksheets can also be used to judge periodic education outcomes whose status is informal. Educators may use Worksheets to learn student understanding of the niche matter that has been submitted.

Benefits of Capital Gains Tax Worksheet in Learning

Capital Gains Tax Worksheet can be utilized as self-teaching, training students to be independent, comfortable, disciplined, and responsible and may make decisions. Educational Worksheets in training and studying activities may be used at the period of concept planting (conveying new concepts) or at the point of knowledge concepts (the sophisticated stage of notion planting). Usage of worksheets in the idea knowledge stage implies that Worksheets are used to examine a subject with the purpose of deepening the knowledge of subjects which were realized in the previous point, namely idea planting.