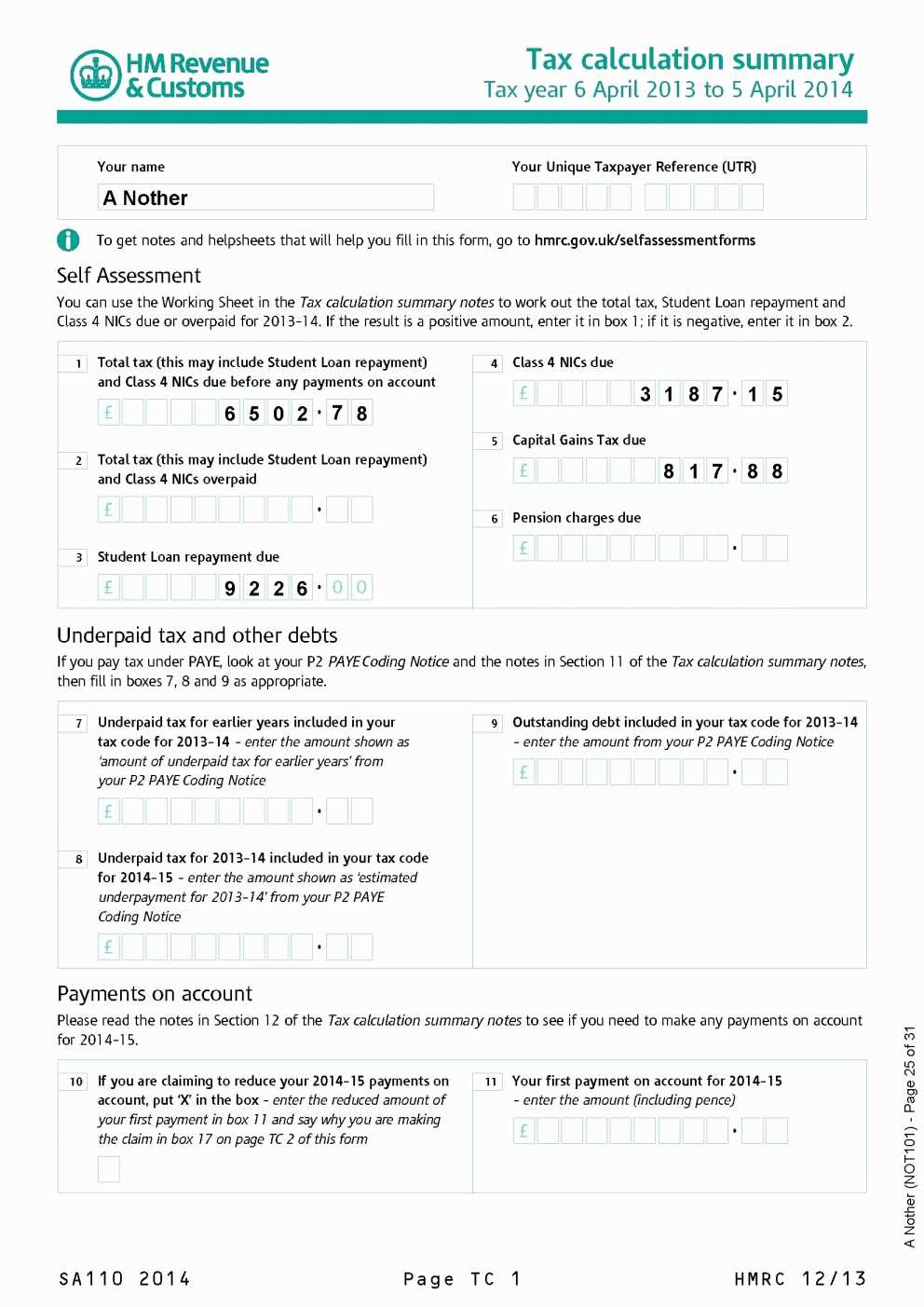

Capital Gains Tax Spreadsheet Shares Within 2013 Tax Worksheet Spreadsheet Template Computation Worksheet—Line Uploaded by Adam A. Kline on Friday, January 25th, 2019 in category 1 Update, Payment.

See also Capital Gains Tax Spreadsheet Shares Pertaining To An Awesome And Free Investment Tracking Spreadsheet from 1 Update, Payment Topic.

Here we have another image Capital Gains Tax Spreadsheet Shares Throughout Form Templates K Capital Gains Worksheet Printables Qualified featured under Capital Gains Tax Spreadsheet Shares Within 2013 Tax Worksheet Spreadsheet Template Computation Worksheet—Line. We hope you enjoyed it and if you want to download the pictures in high quality, simply right click the image and choose "Save As". Thanks for reading Capital Gains Tax Spreadsheet Shares Within 2013 Tax Worksheet Spreadsheet Template Computation Worksheet—Line.