You might, for instance, choose to get notified only when you’re mentioned in a comment, or whenever someone responds to something you commented on. The form is available to anybody with the hyperlink. It’ll be stored automatically. It can readily be changed to have other choices listed.

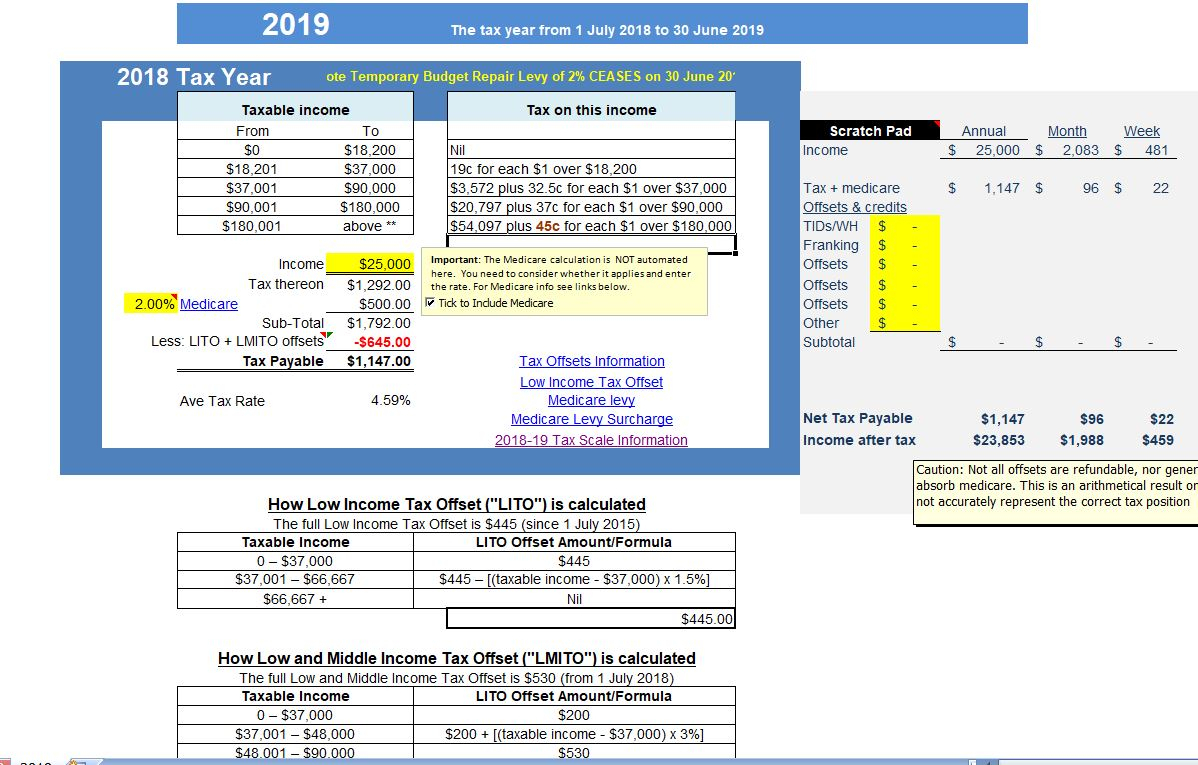

Capital Gains Tax Spreadsheet Australia For Ato Tax Calculator – Atotaxrates Uploaded by Adam A. Kline on Wednesday, January 23rd, 2019 in category 1 Update, Google.

See also Capital Gains Tax Spreadsheet Australia Pertaining To Tax Return Expenses Template Topgradeacai from 1 Update, Google Topic.

Here we have another image Capital Gains Tax Spreadsheet Australia With 006 Template Ideas Budget Planner Home Spreadsheet Free With featured under Capital Gains Tax Spreadsheet Australia For Ato Tax Calculator – Atotaxrates. We hope you enjoyed it and if you want to download the pictures in high quality, simply right click the image and choose "Save As". Thanks for reading Capital Gains Tax Spreadsheet Australia For Ato Tax Calculator – Atotaxrates.