What You Should Do to Find Out About Capital Gains Tax Spreadsheet Australia Before You’re Left Behind

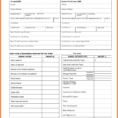

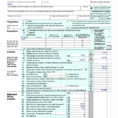

Spreadsheets might even be employed to earn tournament brackets. The spreadsheet has lots of worksheets. It only works on Google and if you download it and use it in Microsoft Excel, it will not work. Should you would like to use the spreadsheet, then you will need to click enable content. Excel spreadsheets and Access tables let you customize the way your data is listed. Microsoft Excel is composed of worksheets. Microsoft Office Excel 2010 is a fantastic choice to create a fundamental balance sheet.

The Advantages of Capital Gains Tax Spreadsheet Australia

The issue is, with dividend yields relatively low at 2-3% you require plenty of capital to generate any kind of meaningful income. Because it ISabsolutely feasible actually very simple, to earn a chunk of money last through your lifetime. Hence, as soon as a trust incurs a loss beneficiaries are unable to offset that loss against any other assessable income that they might derive from different sources like salary, interest, dividend etc.. A Discretionary trust which produces a family trust election is called Discretionary Family Trust.

The Pain of Capital Gains Tax Spreadsheet Australia

At the close of the month you will get documentation confirming your share holdings. Make sure that you have the information for the perfect year before making decisions based on that info. With some patience and an online connection, it may be configured to extract information from an assortment of sources. Just make certain that the numbers make sense and you may withstand downturns. The quantity you get is directly proportional to the range of shares you possess.

The Honest to Goodness Truth on Capital Gains Tax Spreadsheet Australia

Should you have a business, you will require a website. The organization adds to their favoured holdings as soon as the stocks seem to be good price and are trading at attractive rates, in respect to their long-term outlook. The principal reason businesses pay dividends is because management cannot find much better growth opportunities within its own business to spend its retained earnings. Profitable dividend-paying companies usually can boost their earnings faster than inflation, over the long run. You may also have a related business or a charity for a category of beneficiary.

How many times you monitor your portfolio depends upon your investment timeframe. Much like AFIC, the portfolio is comparable to the index. Dividend stock investing is an excellent supply of passive income. Inexperienced investors should think about using Index Funds. The more home equity there is, the bigger the buffer in the event of a recession. Having too much debt seems to be a problem a fantastic deal… Should you have a business, you will require a website.

Today’s cash-strapped governments are in no position to handle another large bailout. Otherwise, add up how much you’ll wind up spending on rent for your preferred property if you can’t ever buy. In theory, and in practice to date, our savings will rise over time,” he explained. The main reason is simply because of opportunity price. You will likewise be able to see your normal price of current shares for each stock. Further, prices could decline from the blue.

Sample for Capital Gains Tax Spreadsheet Australia