Using Business Tax Sheets to Help You Plan Your Next Year’s Income

There are many different ways to put together a spreadsheet for your business, but it’s not enough just to get a bunch of business tax sheets. It helps to take out some time to do things properly, and business tax workbooks can really help you out with this part of the process.

For starters, make sure that you have a list of all the tax forms that you need to have on hand. This can be done in one of two ways. The first is if you’re working in the real world, you can take out a few pages of the government forms and then have it printed off and then photocopied for everyone.

The other way to go about this is to use big boxes and punch them out as you go. You can also do this if you’re just using pre-printed ones to get the job done quicker. Either way, you’ll need all of them lined up.

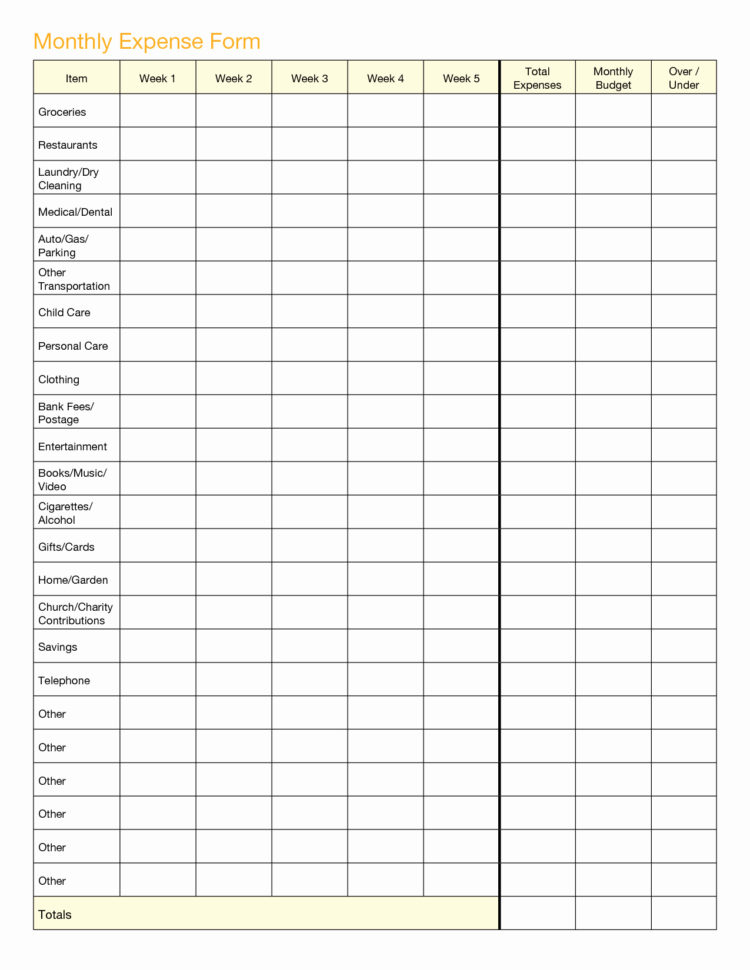

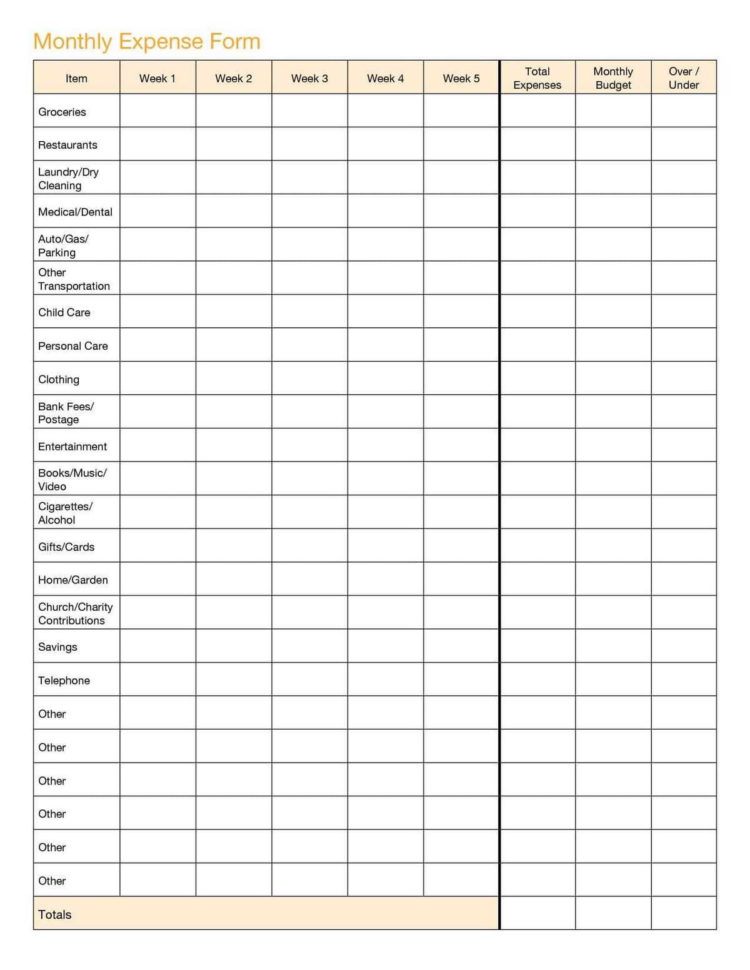

With individual workbooks, you need to go into each column and put in the information in the correct spot. Each sheet needs to include the information from a different form.

You should have a simple guide of what the different forms are, and then you’ll want to add each sheet on top of the others. If the end result is going to look like a giant paper weight, the guide is definitely needed.

There’s a couple of different ways to prepare complete payroll for your business. It depends on the size of your business, as well as what type of business you have.

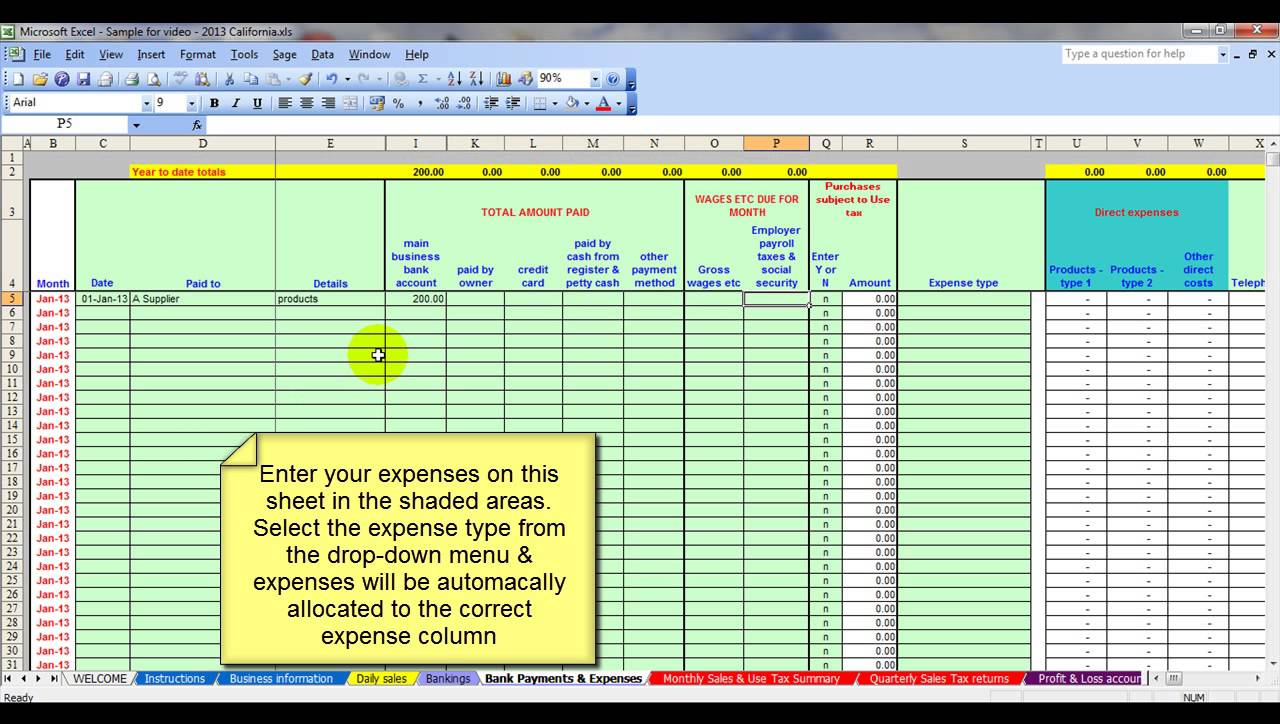

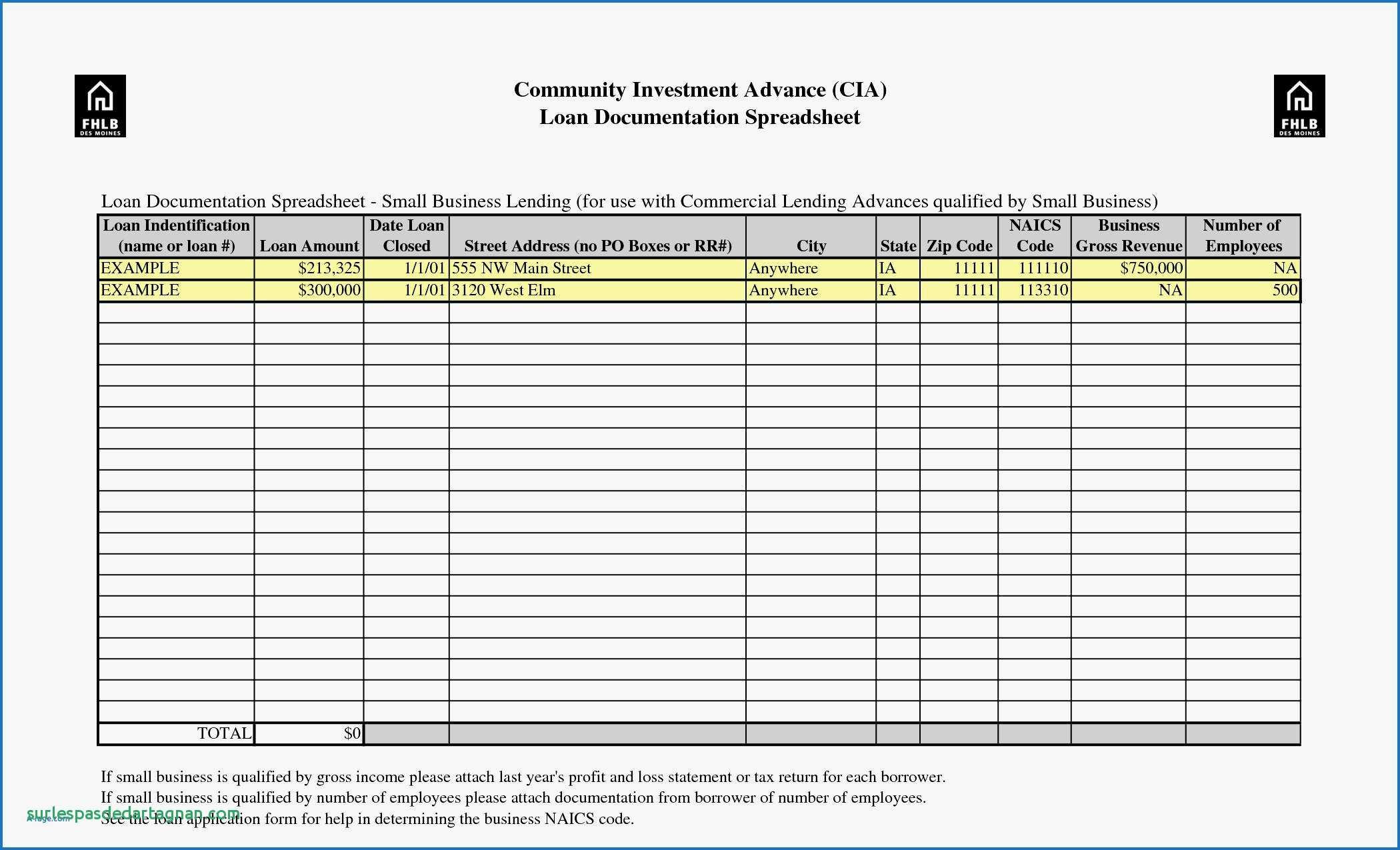

One example of what you can do with business tax sheets is to create a P/L with the total money you’ve earned for the previous year. This way, you’ll know exactly where your profit and loss are coming from.

When you’re finished with this process, it will allow you to plan for upcoming expenses and make sure that you have everything you need to hire an employee, or make any other purchases. You might also want to add a few more things to your business tax invoice that you’re going to need for whatever tax season is coming up.

Then again, it’s not necessary to use any of this information unless you have your own personal accounts set up for your business. But this will provide you with a good guideline and help you decide how much money you need to invest in your business.

If you don’t want to use these programs, you can certainly find a couple of different things online to help you. Just make sure that you’re comfortable with the software before you get started, so that you’re confident that it’s going to be accurate.

With all of the different software out there, there’s no reason that you shouldn’t be able to create your own business tax sheets. If you’re having trouble figuring out how to do this, try using business tax workbooks to help you out. PLEASE READ : business startup expenses spreadsheet

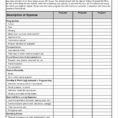

Sample for Business Tax Spreadsheet Templates