Use Your Income Expense Spreadsheet to Manage Your Financial Statements Most of the small business owners are using a spreadsheet for their income expense. This spreadsheet is based on the most efficient method and the best way to determine the things that are the most important and most useful to…

Category: Business

Small Business Expense Template

A small business expense template is a great way to be organized. You can use this template as the foundation of your budget for your business. It helps you to set goals and to set spending limits for your company. It will also help you to find cost-effective ways to…

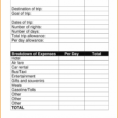

Business Travel Expense Template

Travel Expense Template A Business Travel Expense Template will give you the most practical budgeting approach to avoid the usual problems of long distance traveling. Think about your travel itinerary and see if it is still sensible after cutting costs. The Business Travel Expense Template will cost less than paying…

Business Expense Categories Spreadsheet

Business Expense Categories Spreadsheet Do you use a business expense categories spreadsheet to keep track of your business expenses? This can be a useful tool to help you manage your business expenses. In this article, we’ll look at some of the benefits that this type of spreadsheet can offer. Many…

Small Business Annual Budget Template

Using a Small Business Annual Budget Template The best way to start managing your small business budget is to use a small business annual budget template. These templates have the capabilities to automatically generate and assign jobs to different departments such as marketing, sales, office support, etc. If you want…

Spreadsheet For Small Business Expenses

What Are the Benefits of Using a Spreadsheet For Small Business Expenses? In the small business industry, there are many benefits of using a spreadsheet for small business expenses. These days, it is common practice to store your business information on a database. However, not all businesses use a database…

Business Startup Expenses Spreadsheet

Business Startup Expense Sheets – Track Your Expenses Better If you are looking for ways to save money on your business startup expenses, consider using a business startup expense spreadsheet. With this you can easily track your expenses and make sure that they are reasonable for your startup business. For…