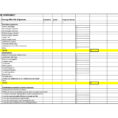

Using a Small Business Income and Expenses Spreadsheet Template to Keep Track of Your Expenses When you decide to write your own business plan, you can use a small business income and expenses spreadsheet template to help you keep track of all the expenses that you will incur throughout the…

Category: Business

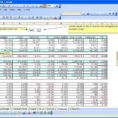

Monthly Business Budget Template Excel

Excel Business Budget Template Excel – Is Prepared For Every Budget Needed If you are considering doing an Excel business budget template, then I would like to explain the benefits of using Excel. After all, what would a budget be without figures? It’s easy to get overwhelmed by the large…

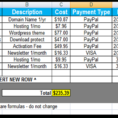

Business Expenses Spreadsheet Excel

Business Expenses Spreadsheet Excel With the growing economy, business owners have to make adjustments to their budget in order to ensure that their finances are in check. One of the best ways to be sure that you are properly managing your money is with a business expense spreadsheet. Using a…

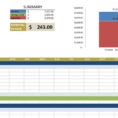

Business Operating Expense Template

Business Operating Expense Template A business operating expense (BOE) template is one of the many things that can help you to easily calculate and take care of your business expenses. They help you determine the different costs, which include the taxes, the business insurance, and the insurance administration fees, to…

Business Income And Expenses Spreadsheet

Business Income and Expenses Spreadsheet – Excel Instructions Starting a business is a wonderful thing and should be looked upon as a great thing but there are a business income and expenses spreadsheet which will be helpful for you to have. This spreadsheet will help you keep track of everything…

Business Expenses Spreadsheet For Taxes

Using a Business Expense Spreadsheet For Taxes Using a business expenses spreadsheet for taxes is a good idea. The best part about using one of these is that the deductions and credits are usually listed on the right side of the sheet. It’s important to use the right way to…

Businessballs Project Management Templates

All About Businessballs Project Management Templates Project management isn’t effortless. It is an easy way to complete assorted tasks that are required for the company to be productive. It is also an ongoing process throughout the entire project. Conclusion Project management might not be a terribly hard concept to understand,…