Using a Business Expense Spreadsheet For Taxes

Using a business expenses spreadsheet for taxes is a good idea. The best part about using one of these is that the deductions and credits are usually listed on the right side of the sheet.

It’s important to use the right way to be able to get the correct deductions, credits, etc. If you are using the wrong way you could be missing important deductions, credits, etc. which could take your total deduction or credit lower than what you intended.

One thing to keep in mind is that when it comes to using a tax law spreadsheet, there are lots of things that you must consider. Some of the most common items that you need to consider are;

Take time off. It’s important to take time off from work every now and then to take care of yourself. Taking a vacation is great, but you don’t want to leave all of your business related work behind. Therefore you will need to consider time off from work when trying to figure out how much you should save by taking a vacation.

Consider taking a vacation in an exotic location. You may enjoy a holiday for the company when there is a special occasion and the holiday is in a location that will make your business trip even more memorable. You can also use a business expense spreadsheet for taxes to take care of getting your business expenses tax break.

Take a vacation when it’s your special occasion. If you want to go for a vacation, make sure that you are going on a trip that you enjoy and take some time off to enjoy it. For example, you can go on a cruise, golf, or get some company to come with you.

Make sure that your business trip includes a weekend. Even if you are going on a holiday or a conference that does not necessarily mean that you need to stay there overnight.

It’s also important to use a business expense spreadsheet for taxes so that you can make sure that you have the right amount of deductions, credits, etc. for your business. When using one, it’s important to make sure that you have the correct amounts on hand.

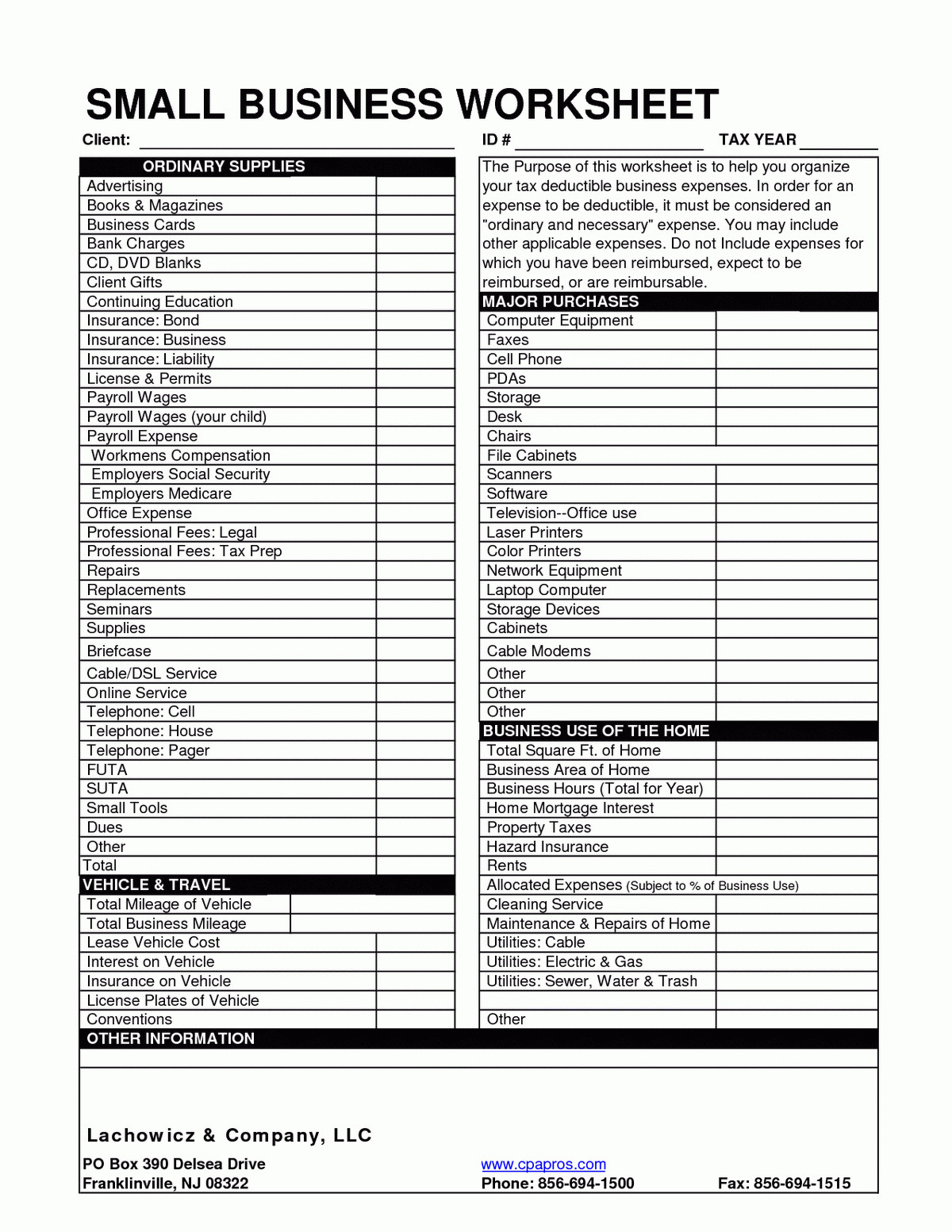

A business expense spreadsheet for taxes will help you figure out what types of deductions you should have. Most businesses don’t file their taxes on a daily basis and if they do they have a large error in their paper work. They also usually have a huge amount of accounting information on hand and this could be a problem when trying to figure out the right deductions and credits for the tax you are filing.

Also, most of these papers will contain details on every tax credit that you have. A business expense spreadsheet for taxes helps to eliminate the possibility of double filing. For any of the tax returns that you have filed recently it is a good idea to make sure that you have the correct amounts on hand so that you are able to get the correct deductions and credits for your business.

A business expense spreadsheet for taxes will help you figure out the right deductions and credits that you should have for your business. You will want to know how much you can save on taxes, but you will also want to know about tax credits and deductions for the business that you are involved with. If you do the math right, this could result in you saving a lot of money over the years. PLEASE SEE : business expenses spreadsheet excel

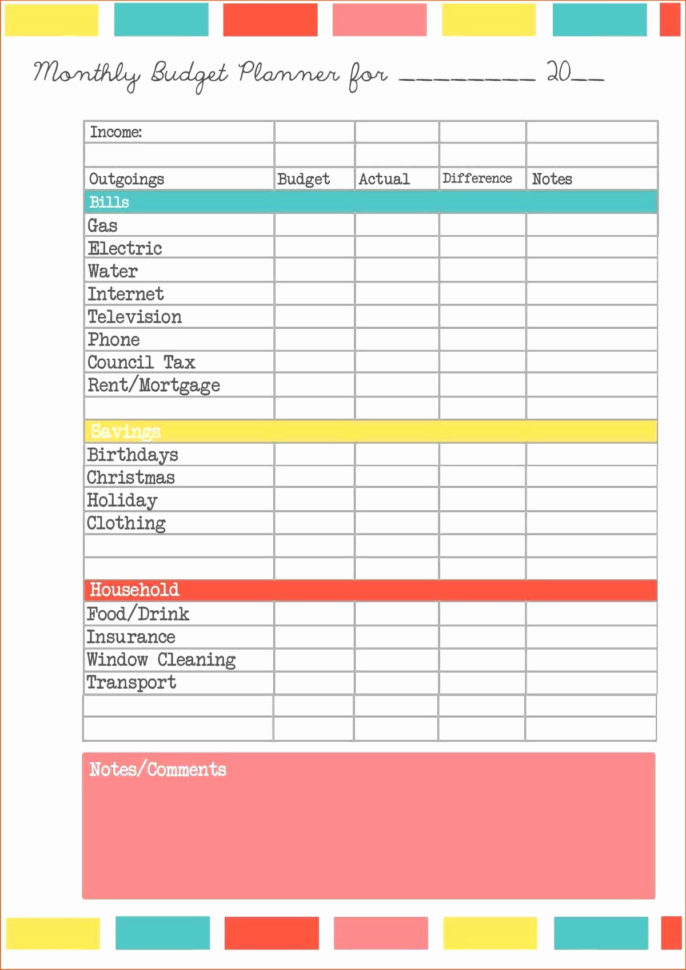

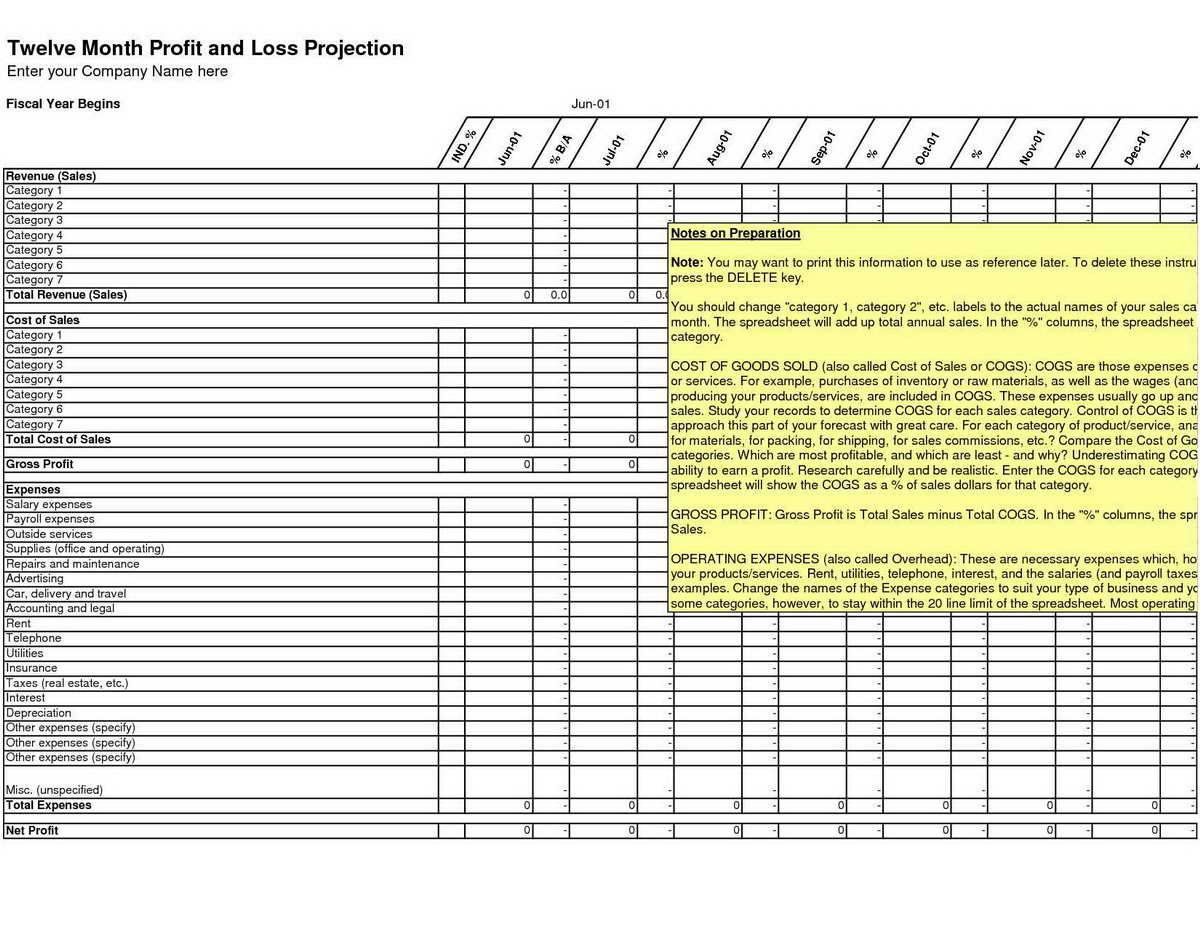

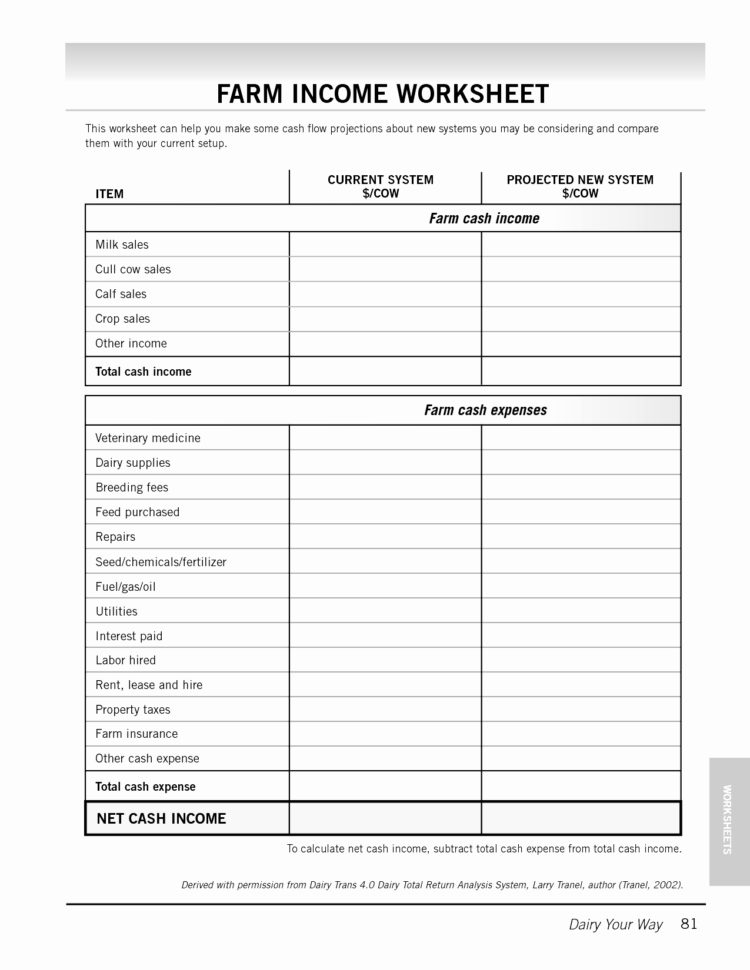

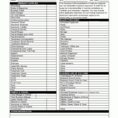

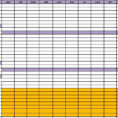

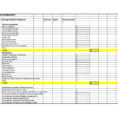

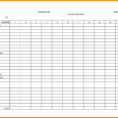

Sample for Business Expenses Spreadsheet For Taxes