Business Expense Policy Template – Creating Your Own Business Expense Policy

While a lot of small business owners may agree that having a business expense policy is an important component to running a successful business, it is also true that many do not know how to create their own business expense policy template. In this article I will explain how you can create your own business expense policy, the process by which it will be created and how it works. Once you have all of this information, you should have no problem creating one that is designed specifically for your business.

I am going to give you a quick overview of how a business expense policy works so that you are able to fully understand the process. This information should not take long to understand, but you may find it to be a bit confusing at first.

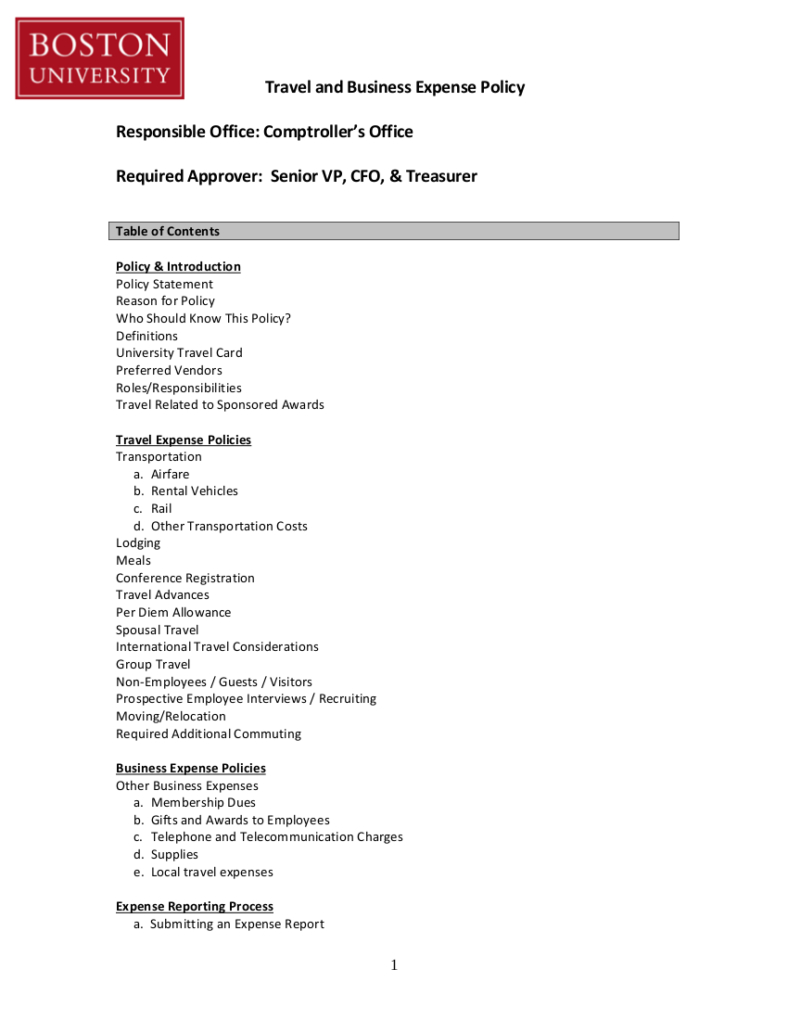

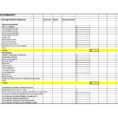

A business expense policy template is simply a document which is used by an accounting firm to create an expense reporting policy for your business. In other words, this policy is what determines how much money a business is responsible for paying in taxes on.

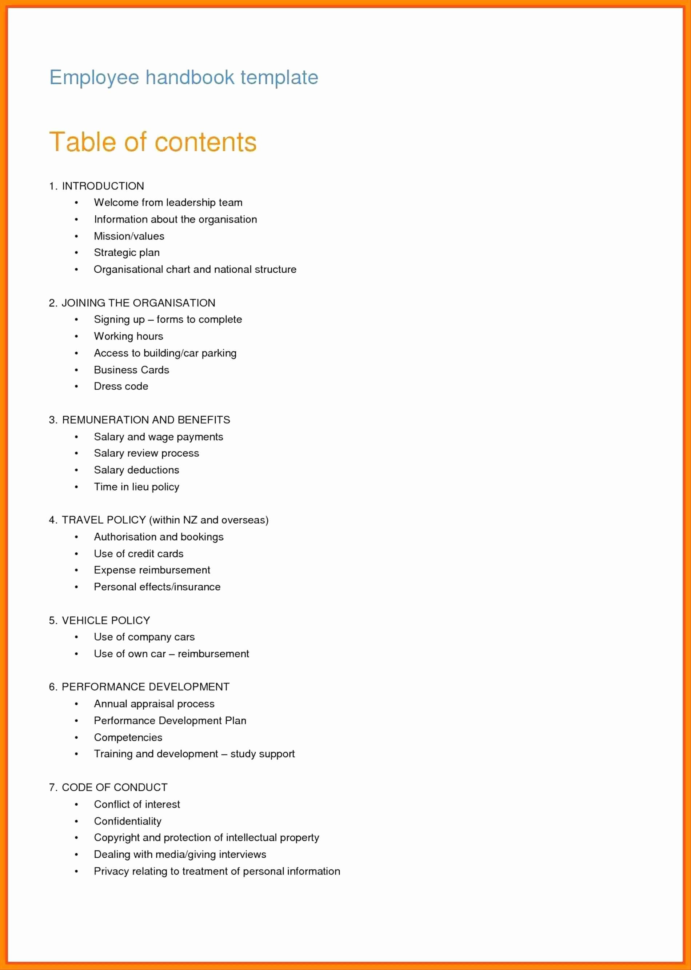

A business expense policy is really easy to create. All you need to do is choose a name for your new business expense policy, complete with a description and tax schedule. Then, depending on whether or not you plan to run your business as a sole proprietorship or a partnership, you will also need to create a form for both of these.

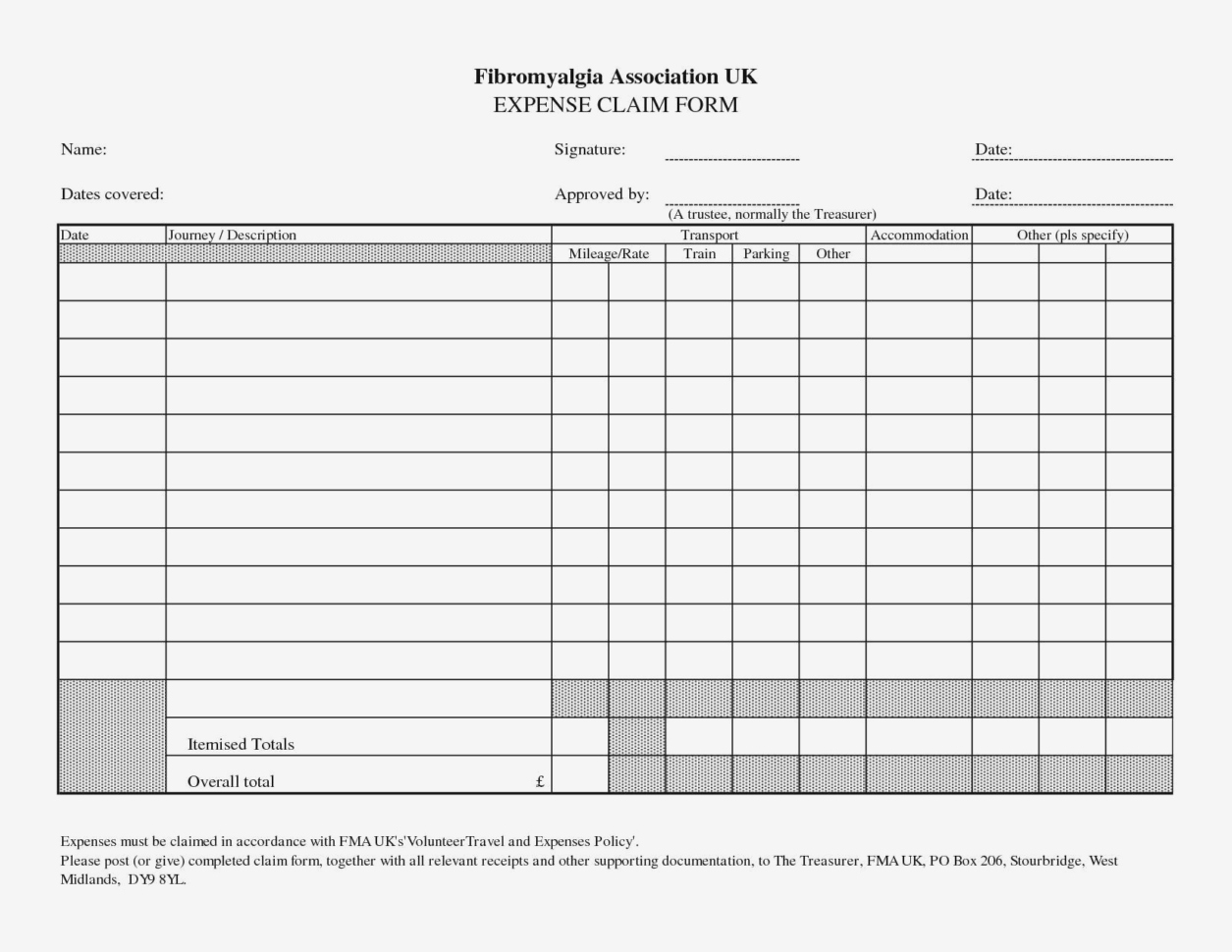

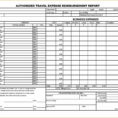

Once you have done this, you will have all of the basic paperwork needed to create your business expense policy. Your business expense policy will list all of the details of all of your business’s expenses, from food purchases to office supplies, and will also include what you will need to pay for as well as the dates.

If you do not wish to use your company’s name, you can also choose to use a nickname. You will need to list all of your employees’ names and contact information in the first line of your policy. After this, you will then need to add your business address and phone number.

All of the necessary information must be complete and accurate before the accountants can complete the entire form. After you have submitted your form to the accounting firm, they will make the necessary changes based on the information that you have provided.

For a sole proprietorship, your policy must clearly state that you are the owner of the business and that you have sole ownership of all of the assets of the business. However, for a partnership, your policy must state that you are the owner of the business and the partnership’s assets and that you and your partners share the profits of the business.

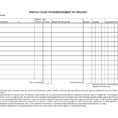

After you have filled out your business expense policy, the accounting firm will then issue a written receipt. The receipt will contain the date, time and amount of all of your business’s expenses, along with a description of each expenditure.

At this point, your business expense policy has been issued and it is now time to send your receipt to the IRS. The agency will expect to receive this receipt from the accounting firm within thirty days of your business’s initial tax filing.

As I mentioned at the beginning of this article, this process may seem complicated, but it is actually very simple. Once you get the basics down, it should not take you too long to get your business expense policy up and running. SEE ALSO : business expense log template

Sample for Business Expense Policy Template